Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Cathie Wood Changes Strategy, Acquires $6.9M in Coinbase Shares – Is ARK Anticipating a Recovery?

Cathie Wood is back in the market. ARK Invest has acquired 41,453 shares of Coinbase stock, valued at approximately $6.9 million.

The timing of this move is noteworthy. Just a few weeks prior, ARK was reducing its exposure. Now, they are re-entering as COIN attempts to stabilize.

Key Takeaways

- The Buy: ARK acquired 41,453 shares totaling $6.9 million across three ETFs on Feb. 18.

- The Split: The majority was allocated to the flagship Innovation ETF (ARKK), which received 29,689 shares ($4.9 million).

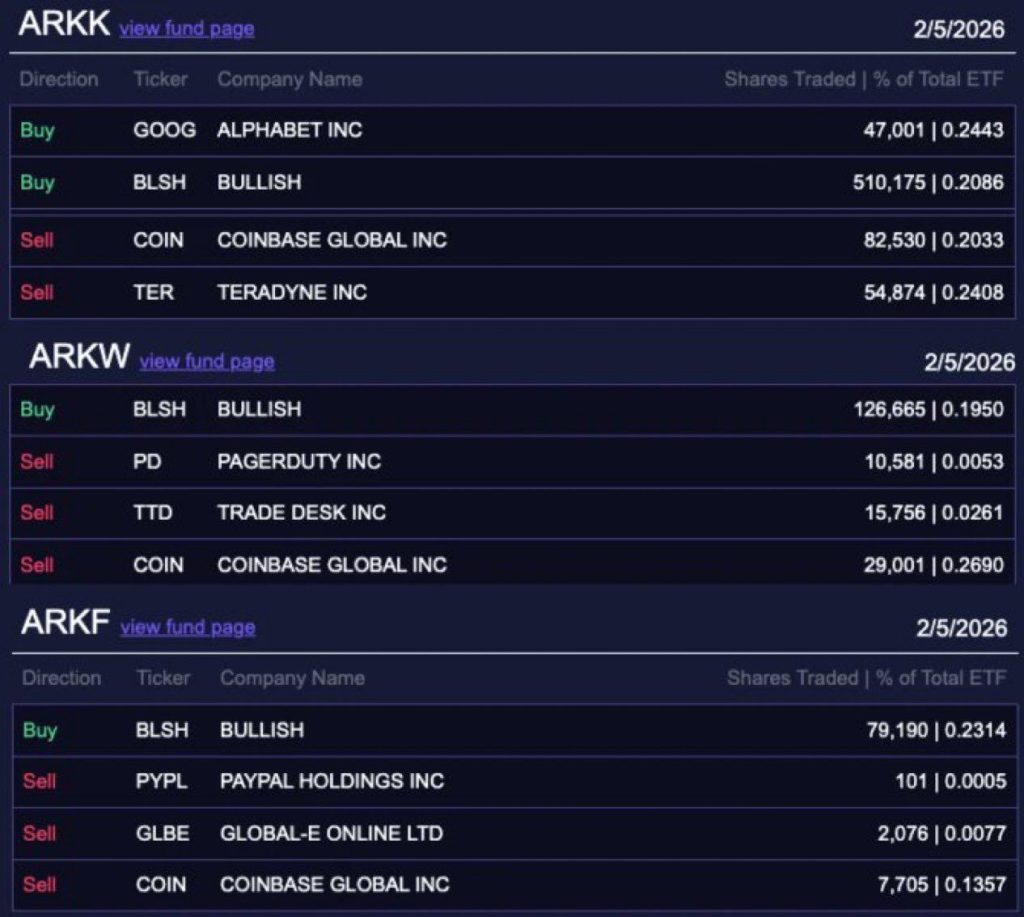

- The Pivot: This marks a reversal from a selling trend in early February when ARK divested $17.4 million in COIN.

Is This a Tactical Pivot?

A few weeks ago, ARK was taking a different approach. The firm sold approximately $17.4 million worth of COIN on Feb. 5 and Feb. 6 while the overall market was declining. Concurrently, it redirected capital into the crypto exchange Bullish.

Now, the situation has changed. This new $6.9 million purchase indicates that ARK perceives value at these price points. It resembles the typical buy-the-dip strategy they are recognized for.

For traders monitoring ETF flows, this development is significant. ARK typically limits positions to around 10% of a fund. The previous selling and recent acquisition likely reflect portfolio rebalancing rather than panic. It appears more like weight management than a shift in long-term belief.

Why ARK Just Bought $6.9M in Coinbase Stock

The acquisition was distributed among three primary funds. The leading ARK Innovation ETF (ARKK) spearheaded the effort with a $4.9 million investment. The Next Generation Internet ETF (ARKW) contributed $1.2 million, while the Fintech Innovation ETF (ARKF) added $704,000.

This buying activity coincided with a rebound in COIN. Shares rose 1% on Tuesday to $166.02 and have increased by 8.4% over the past five trading days. Technically, the stock is attempting to establish support after a 28% decline year-to-date.

Source: Ark Invest Tracker

Source: Ark Invest Tracker

Market analysts observe that such buying often precedes potential rallies. Similar technical indicators are appearing elsewhere in the market, with some experts cautioning about extreme funding rates that could lead to squeeze scenarios.

According to the firm’s disclosures, COIN continues to be a significant component of the portfolio. It ranks as the seventh-largest holding in ARKK (4% weighting) and the third-largest in ARKF (5.6% weighting).

What Does This Signal for COIN Stock?

ARK’s return to purchasing suggests confidence despite Coinbase’s mixed earnings report. The company recently announced a $667 million net loss for Q4, primarily due to unrealized crypto losses.

Nevertheless, analysts remain optimistic. Bernstein has maintained an outperform rating with a $440 price target—indicating over 200% potential upside. This positive outlook is partly driven by expectations that historical capital inflows could enhance retail trading volume in the upcoming months.

Regulatory clarity is also a significant factor. With discussions intensifying in Washington, particularly regarding forthcoming market structure bills, the fundamental outlook for Coinbase could change swiftly. For the moment, Cathie Wood is wagering that the current price represents a bargain, not a distress signal.

Discover: Here are the crypto likely to explode!

The post Cathie Wood Reverses Course, Buys $6.9M in Coinbase Stock – Is ARK Betting on a Rebound? appeared first on Cryptonews.