Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Can DeFAI Transform into the Core Cryptocurrency Advancement of 2025?

Key Takeaways:

- DeFAI initiatives utilize AI within DeFi to enhance user interfaces, assist in completing complex tasks with a single click, and analyze data.

- DeFAI tokens such as Griffain and Hey Anon have shown significant growth over a month: 733% and 1400%, respectively.

- If successful, DeFAI could address liquidity challenges and transform how users engage with decentralized protocols.

DeFAI, or Decentralized Finance (DeFi) combined with Artificial Intelligence (AI), has generated interest in the crypto market. Many view it as a pivotal narrative. But will it fulfill the expectations?

AI trading bots are currently among the most discussed topics. Projects like Virtuals Protocol (VIRTUAL), ai16z (AI16Z), and aixbt by Virtuals (AIXBT) have experienced growth fueled by this popularity.

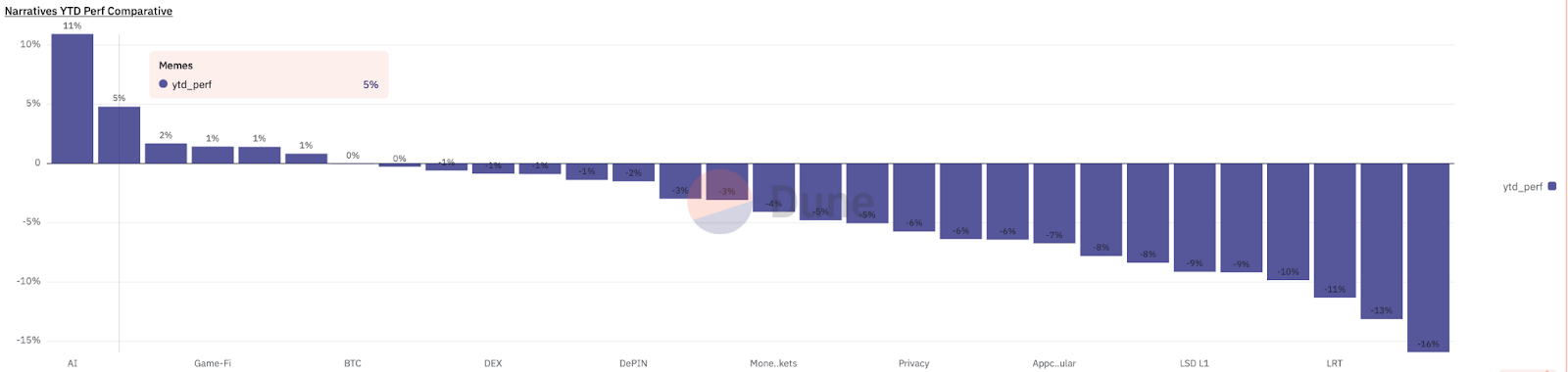

According to Dune, AI has emerged as the top-performing narrative of the year with an 11% increase, outpacing meme coins at 5%. In the crypto landscape, focus is now shifting towards DeFAI, which offers more practical applications of AI in decentralized finance.

Source: Dune

Source: Dune

DeFi + AI: Is It the New Trend of the Season?

DeFi is a crucial component of the crypto ecosystem, yet its tools can be challenging to navigate, requiring newcomers to adapt. This is particularly true for trading on decentralized exchanges (DEXs), which are significantly more complex than their centralized exchange (CEX) counterparts.

Consider scenario one. Company A has launched a bot that employs an AI agent to analyze meme coins on Solana (SOL), which typically debut on DEXs. The bot evaluates trading volume (sharp increases or decreases), liquidity levels, whale activity, price history, Fully Diluted Valuation (FDV), and other data.

It then categorizes these coins and provides estimated profit and loss expectations. The bot can also manage this task if a trader wishes to monitor changes in this data daily over a week.

For instance, you may want to acquire meme coins that were launched no more than 2–3 days ago with low market caps but high trading volumes. The AI agent processes this request and determines whether to purchase the meme coin based on its analysis.

Additionally, it can send a direct request to fund your DeFi wallet for acquiring the selected meme coin on a specific chain. This streamlines the process, as a single request suffices to complete the task.

This greatly simplifies the daily routine for traders attempting to seize new meme coins before their potential surge. Moreover, this market is highly volatile and often necessitates several hours of daily monitoring.

Now, let’s examine scenario two. You have recently begun trading in the crypto market and decided to earn passive income through staking but lack the necessary expertise. You discovered an AI agent that analyzes staking protocol data.

For example, it assesses the Annual Percentage Yield (APY), potential risks, differences between staking on Ethereum or Solana, requirements, the number of locked assets, and other factors. Based on your preferences, the agent makes a decision.

These are precisely the types of challenges AI brokers aim to address in decentralized finance. As crypto researcher hitesh.eth pointed out, the DeFAI concept is based on Large Language Models (LLM) for Web3.

In simple terms, they facilitate user interaction with protocols.

In this model, the user does not interact directly with the protocol but through AI. The agent analyzes the data and decides to take action based on the specified parameters.

What you’re witnessing at the early stage of DeFAI projects like @griffaindotcom, Heyanon, and Neur are merely interfaces with LLM-powered web3 intents, now rebranded as abstraction layers for DeFAI.

— hitesh.eth (@hmalviya9) January 7, 2025

What Are the Prospects for DeFAI?

DeFAI is a relatively new narrative in the crypto space. However, with the growing interest in AI brokers, it is gaining momentum by providing practical and valuable use cases.

For instance, the AI brokers introduced by Virtuals Protocols lean more towards entertainment and content creation than tools for on-chain data analysis. This does not prevent the platform from being utilized to deploy bots for other tasks.

As DeFAI remains in its nascent stages, the number of initiatives in this area is still limited. Messari researcher Sam Ruskin has identified several examples, including Griffain (GRIFFAIN), Neur (NEUR), Wayfinder, and Hey Anon (ANON).

DeFAI’s market cap is under $1 billion, but I anticipate it could reach $25–$50 billion by the end of 2025. Here’s why:

In his DeFAI manifesto, @danielesesta highlighted how AI can drive a DeFi renaissance by addressing challenges like cross-chain fragmentation, liquidity, and… pic.twitter.com/hagzcchMLp— Sam Ruskin (@CryptoSam01) January 7, 2025

Griffain is among the most prominent projects in the DeFAI sector, holding the largest market capitalization among its peers at $375.2 million.

The token has also garnered attention due to its rapid growth. According to CoinGecko, GRIFFAIN began trading at $0.06 in early December and reached an all-time high (ATH) of $0.50 on January 6, marking a 733% increase.

Source: CoinGecko

Source: CoinGecko

Griffain enables users to create their own AI brokers or utilize existing templates on its platform. One of these brokers facilitates the creation of meme coins and conducting airdrops. However, access to the platform is currently by invitation only.

Two Brokers One Chat

Create memecoins with Agent Dev

Airdrop the supply with Agent Airdrop

Only @ griffain dot com pic.twitter.com/AXi4gItDlO— griffain (@griffaindotcom) January 4, 2025

The second-largest DeFAI token by market capitalization is Hey Anon (market cap: $175.4 million). The project currently operates via a Telegram bot.

Here’s a step-by-step explanation of what I had to do:

1. Swap $ETH to $USDT on @arbitrum :

• Swapped 0.02 $ETH to $USDT on the Arbitrum network using an Aggregator.

2. Bridge $USDT to @KAVA_CHAIN

• Bridged all my $USDT from the Arbitrum network to the Kava network.

3.… https://t.co/W8TjHcUWzE pic.twitter.com/RaOmRbOheM— Hey Anon (@HeyAnonai) January 4, 2025

Hey Anon is following a trajectory similar to Griffain. According to CoinGecko, its token price surged from $0.90 to $14 in just 10 days, reflecting a growth of approximately 1400%.

Source: CoinGecko

Source: CoinGecko

DeFAI: Is It As Promising As It Appears?

If DeFAI protocols carve out a niche in decentralized finance, they could bring about significant changes. First, DeFi would become more accessible for newcomers. Second, an influx of new users could address liquidity issues, a major concern for decentralized protocols. Third, increased adoption of decentralized products, including staking, restaking, games, and NFTs, could further accelerate development within these sectors.

However, DeFAI also raises certain concerns. One major issue is that AI brokers operate without human oversight. While this can be beneficial, it also introduces risks. For instance, how can a project ensure its bot won’t malfunction and make erroneous decisions? If an AI agent manages your wallet for meme coin purchases, it could misallocate funds or sell assets at a loss.

Security is another unresolved concern, as utilizing an AI agent necessitates connecting your wallet and granting it permission to execute transactions.

Furthermore, questions remain regarding how effectively AI brokers can process data across multiple chains simultaneously and make decisions based on this analysis.

The biggest challenge I see here, or the missing element, is the risk factor. The abstraction of complex DeFi is beneficial, but that complexity has served an important purpose: risk education.

There’s a learning curve for DeFi for newcomers, but in that process, newcomers learn about the…— Abdul (@0x_Abdul) January 6, 2025

It will take time to observe how DeFAI is adopted on a larger scale and what challenges it may encounter.

The post Can DeFAI Become the Main Crypto Trend of 2025? appeared first on Cryptonews.