Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

BitMine and Mystery Whale Acquire $882 Million in Ethereum Amid Retail Sell-Off

BitMine Immersion Technologies has acquired an additional 106,485 ETH valued at $470.51 million in the last 10 hours, raising its total holdings to 1.297 million ETH worth $5.75 billion, while an unidentified whale withdrew 92,899 ETH valued at $412 million from Kraken over a span of four days.

This substantial $882 million accumulation, verified by LookOnChain, took place as retail traders reacted with panic and sold during recent downturns.

Notably, BlackRock has accelerated its ETH accumulation at a rate 15 times faster than Bitcoin over the past month, with ETH holdings increasing by 65% compared to a mere 4% growth in BTC, while Trump is also reported to have purchased an additional $8.6 million in ETH along with $10 million in Bitcoin.

At the time of writing, Ethereum is trading 10.22% below its all-time high of $4,891 reached in November 2021, with global search interest peaking at levels not seen since 2021.

The sentiment analysis platform Santiment confirmed that negative social media commentary currently outweighs positive remarks regarding Ethereum, despite its remarkable rally.

The firm observed “FUD and disbelief” among retail traders as ETH prices rise, while “key stakeholders are accumulating loose coins that small ETH traders are willing to sell at this moment.”

Ethereum is now just 6.4% away from its $4,891 all-time high from November 16, 2021. There have been ongoing sell-offs from retail traders as the second-largest cryptocurrency by market cap has experienced this historic rally.

Prices typically move in the opposite direction of retail traders’ expectations.… pic.twitter.com/241va9Jc5L— Santiment (@santimentfeed) August 12, 2025

Corporate Ethereum Race Reaches Fever Pitch

BitMine has filed for an additional $20 billion at-the-market equity offering expansion, increasing its total stock sale capacity to $24.5 billion, with proceeds aimed at further ETH acquisitions.

The company intends to acquire and stake 5% of the total Ether supply, which amounts to approximately six million ETH valued at $22 billion at current market prices.

SharpLink Gaming also reported holding 728,804 ETH as of June 30, with nearly all of it staked to generate yield through its evolution into an Ethereum treasury vehicle.

The firm raised $400 million through a registered direct offering at $21.76 per share, anticipating that its ETH holdings will surpass $3 billion in value.

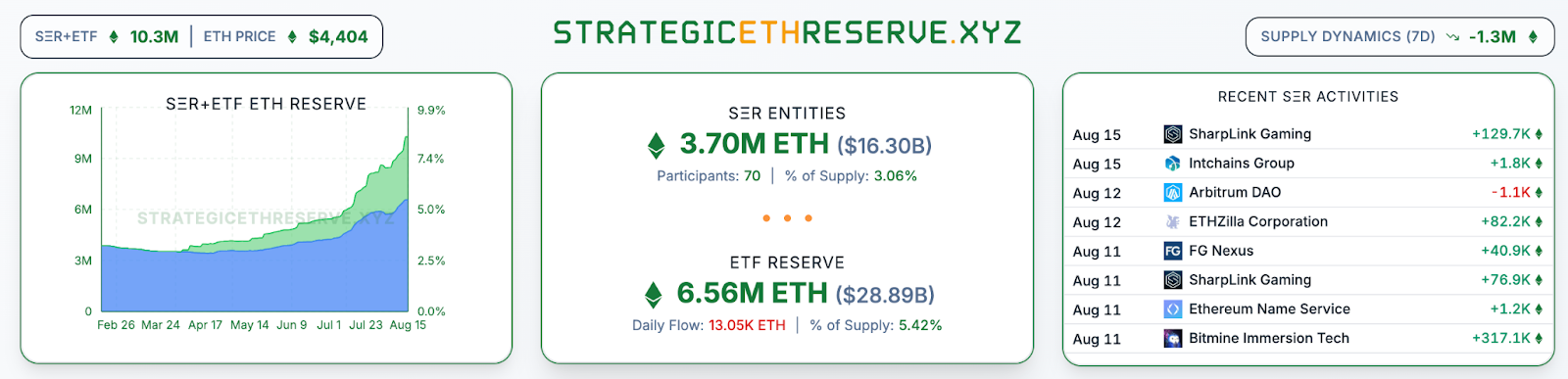

Corporate Ethereum holdings experienced the largest monthly increase on record in July, rising 127% to 2.7 million ETH valued at $11.6 billion.

In just this week, twenty-four new entities joined the ranks of corporate treasuries, bringing the total to 70 companies holding substantial ETH positions across various industries.

Source: Strategic ETH Reserve

Source: Strategic ETH Reserve

Chairman Thomas Lee characterized BitMine’s strategy as pursuing the “alchemy of 5%,” distinguishing the company from its crypto treasury counterparts through both the size of its holdings and stock liquidity.

The company’s five-day average daily dollar volume reached $1.6 billion, placing it 42nd among 5,704 US-listed stocks.

Retail Capitulation Creates Perfect Storm for Short Squeeze

As of August 13, short-term ETH holders realized approximately $553 million in daily gains according to Glassnode data, significantly outpacing long-term holders who remained relatively inactive.

Source: Glassnode

Source: Glassnode

Despite ETH’s 43% monthly increase, current profit-taking levels are still 39% below last month’s peak when prices were near $3,500.

Recently, the “7 Siblings” whale group sold 19,461 ETH valued at $88.2 million this week at an average price of $4,532, marking their first significant liquidation since accumulating 1.21 million ETH.

However, despite mixed market reactions, Ethereum is beginning to appear bullish to many.

Arthur Hayes has reversed his previous bearish outlook with an $8.4 million crypto buying spree, acquiring 1,500 ETH along with DeFi tokens after earlier predicting ETH would decline to $3,000.

This contrarian action aligns with broader institutional accumulation trends during periods of retail weakness.

Technical Analysis Points to Imminent Breakout

Ethereum is consolidating around $4,439 after successfully surpassing previous cycle highs near $4,800.

The crucial support level is at $4,367, representing the former resistance that must hold as new support to confirm the breakout above all-time highs.

Liquidation heatmap analysis indicates a significant concentration of liquidity positioned above current prices, particularly in the $4,800-$5,200 range, where short positions and stop losses could fuel a potential squeeze.

The visualization reveals that the majority of liquidity is situated above rather than below current levels, creating a characteristically bullish setup.

The institutional accumulation serves as a fundamental catalyst to initiate a technical short squeeze setup, which creates conditions for explosive upward movement.

Retail panic selling during institutional buying results in a classic transfer from weak hands to strong hands, typically preceding major advances.

The current price position below significant liquidity clusters suggests considerable upside potential if buying pressure propels ETH into squeeze zones.

The three-day timeframe perspective confirms that liquidity accumulation has been building over multiple sessions rather than being a temporary occurrence.

Ethereum appears poised for a substantial upward move toward the $5,200-$5,400 range, contingent on maintaining the $4,225 critical support level during any pullbacks.

The post BitMine and Mystery Whale Buy $882M in Ethereum While Retail Panic Sell appeared first on Cryptonews.