Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

BitMEX’s Tom Lee Anticipates Ethereum May Surpass Bitcoin in Market Dynamics

BitMEX chairman Tom Lee posits that Ethereum may eventually exceed Bitcoin’s market dominance, likening it to the way U.S. equities surpassed gold following the abandonment of the gold standard by the United States in 1971.

In a discussion with ARK Invest CEO Cathie Wood on Thursday, Lee remarked, “Ethereum could surpass Bitcoin in a manner akin to how Wall Street and equities surpassed gold after ’71.”

As it stands, Bitcoin’s market capitalization is approximately $2.17 trillion, which is about 4.6 times greater than Ethereum’s $476.33 billion, as reported by CoinMarketCap.

However, Lee, who also manages BitMine’s strategy for accumulating Ethereum, contends that Ethereum’s long-term prospects resemble the ascent of the U.S. dollar post-1971, when it transitioned to a “fully synthetic” fiat currency.

Tom Lee Draws Parallels Between Ethereum’s Growth and Post-Gold-Standard Dollar Supremacy

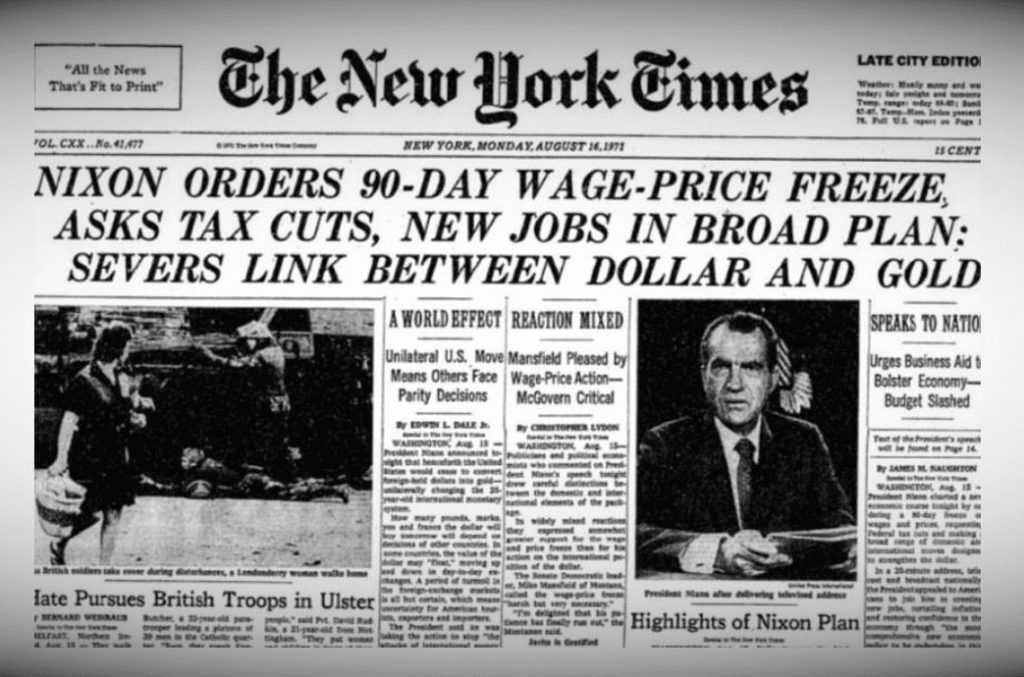

Lee’s perspective is rooted in historical comparisons. When President Richard Nixon terminated dollar-gold convertibility in 1971, gold initially surged, but over time, U.S. equities skyrocketed in value, with their market capitalization eclipsing that of gold.

Source: NY Times

Source: NY Times

Gold remained a finite and valuable asset, yet stocks, which symbolize innovation, productivity, and growth, became the driving force of the economy.

Lee’s argument implies that a similar trend could emerge in the cryptocurrency space. Bitcoin, akin to gold, is limited and dependable but fundamentally static.

In contrast, Ethereum operates as a dynamic digital ecosystem that facilitates smart contracts, decentralized finance (DeFi), tokenized assets, and digital identity infrastructure, described by Lee as “the blockchain backbone of a tokenized Wall Street.”

“When the U.S. exited the gold standard, gold was the immediate beneficiary,” Lee stated. “However, Wall Street developed products that established the dollar’s dominance. Presently, equities have a market cap of $40 trillion, while gold’s stands at $2 trillion.”

He further noted that Ethereum’s involvement in tokenizing real-world assets, fostering decentralized applications, and enabling on-chain finance could enable it to replicate that trajectory. “As everything becomes tokenized, Ethereum could serve as the financial foundation of the digital economy,” Lee remarked.

Indicators of an Ethereum Shift: Market Leaders Suggest Potential Flippening as ETH Surpasses Bitcoin

Ethereum’s fundamentals already bolster this thesis. In the last 24 hours, Ethereum’s price increased by 6.6% to $3,731.69, while Bitcoin saw a 5.1% rise to $104,737.

Source: Cryptonews

Source: Cryptonews

The two leading cryptocurrencies continue to dominate the market, yet the debate over whether Ethereum could eventually “flip” Bitcoin’s market capitalization—a concept commonly referred to as the “flippening”—has resurfaced among industry figures.

In August, Ethereum co-founder and ConsenSys CEO Joseph Lubin forecasted that Ethereum could soar “by 100 times” and surpass Bitcoin as the leading monetary base.

Lubin indicated that Wall Street’s increasing integration of decentralized technology could enhance Ethereum’s value as financial institutions adopt staking, validator nodes, and Layer-2 solutions to replace outdated systems.

Ethereum co-founder @ethereumjoseph predicts a 100x $ETH rally as Wall Street adopts DeFi with the potential to flip Bitcoin’s monetary base through institutional staking.#Ethereum #Bitcoinhttps://t.co/l6YqzBQGbL

— Cryptonews.com (@cryptonews) September 1, 2025

Lee echoed this sentiment during a separate appearance on CNBC, referring to Ethereum’s smart contracts as “the next layer of the internet.”

Importantly, the network consistently processes more transactions than Bitcoin, supports the majority of DeFi and NFT activities, and continues to draw institutional interest through tokenized bonds, funds, and corporate assets.

Additionally, “Rich Dad, Poor Dad” author Robert Kiyosaki reinforced Ethereum’s narrative, characterizing it as both a store of value and an industrial asset.

“Currently, I believe silver and Ethereum are the best options as they serve as stores of value, but more significantly, they are utilized in industry,” he stated, labeling both assets as “hot, hot, hot” for the upcoming cycle of wealth preservation.

Tom Lee predicts Ethereum rally to $5,500 soon, $12,000 by year-end as BitMine accumulates $7.65B treasury. #Ethereum #Rallyhttps://t.co/HV8oQB807D

— Cryptonews.com (@cryptonews) August 27, 2025

Lee recently anticipated that Ethereum could rise to $5,500 in the short term, with a target of $12,000 by the end of the year.

While Bitcoin maintains an advantage in market value and brand recognition, Ethereum’s growing utility and network activity are fueling speculation that a “flippening” could happen in the next cycle.

Lee’s comparison reframes the rivalry not as an ideological battle, but as a matter of functionality. “Gold will always hold value,” an analyst noted. “However, the future of finance was constructed on equities, and the future of blockchain may be established on Ethereum.”

Could Ethereum Ever Achieve Bitcoin’s Market Value? Here’s What It Would Require

To address the question, Ethereum would need to increase by approximately 4.6 times its current price to align with Bitcoin’s market capitalization, based on market data analyzed on October 17.

With 120.7 million ETH in circulation compared to 19.9 million BTC, Ethereum’s larger supply accounts for its lower per-unit price.

BTC-ETH Market Cap Dominance Source: glassnode

BTC-ETH Market Cap Dominance Source: glassnode

For Ethereum to match Bitcoin’s market cap, it would need to trade around $17,379 per ETH, a level that would represent one of the most significant price increases in its history.

Analysts often consider market capitalization a more equitable comparison than price alone. Bitcoin’s smaller supply supports its higher valuation per coin, while Ethereum’s strength lies in its varied ecosystem, which powers smart contracts, decentralized finance (DeFi), and tokenized assets that facilitate real-world applications.

Historically, Ethereum has occasionally outperformed Bitcoin. Data indicates that over certain five-year periods, Ethereum’s average annualized return reached 60.4%, slightly surpassing Bitcoin’s 59.1%.

ETH Overall Price Chart Source: Coingecko

ETH Overall Price Chart Source: Coingecko

For Ethereum to close the market-cap gap, it would require years of consistent outperformance.

At a 20% annual growth rate, achieving parity could take about 8.4 years; at 30%, roughly six years; and at 50%, under four years, assuming Bitcoin’s market value remains constant, which is an unlikely scenario.

Nearly a decade post-launch, Ethereum holds approximately 21% of Bitcoin’s market size.

Its ongoing growth and institutional adoption position it as the strongest contender to Bitcoin’s dominance, although the anticipated “flippening” remains a distant, theoretical goal.

The post Ethereum to Overtake Bitcoin? BitMEX’s Tom Lee Predicts Wall Street-Style Flip appeared first on Cryptonews.