Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitget Study: 20% of Generation Z and Alpha Willing to Consider Crypto Retirement Funds

A recent survey conducted by Bitget Analysis indicates a transformation in how younger generations perceive their retirement.

20% of respondents from Gen Z (ages 11-27) and Alpha (10 years old and younger) showed a willingness to receive their pensions in cryptocurrencies, contrasting sharply with the traditional pension models preferred by older generations.

This finding points to a growing interest in exploring alternative retirement savings methods among younger individuals, reflecting their comfort and familiarity with digital assets and a desire for potentially higher returns, according to Bitget.

Younger Generations Distrust Traditional Pensions

Bitget surveyed nearly 17,000 individuals from Gen Z and Alpha.

A significant 78% of these younger respondents expressed greater confidence in alternative retirement savings methods compared to conventional pension funds. These alternatives include cryptocurrencies, real estate, and private pension plans.

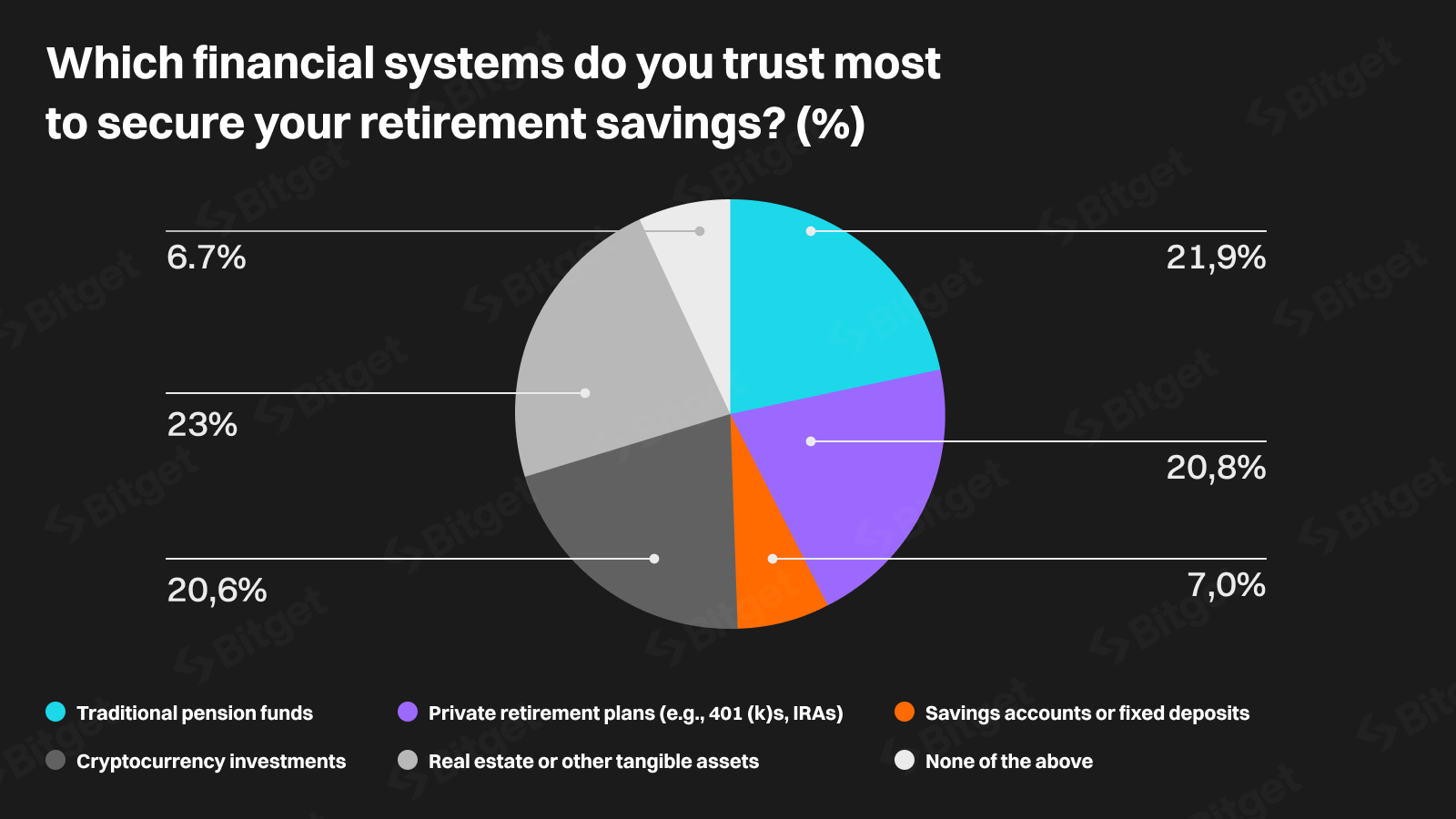

Younger respondents prefer alternatives (real estate, private plans, crypto) to traditional pensions. Source: Bitget Analysis

Younger respondents prefer alternatives (real estate, private plans, crypto) to traditional pensions. Source: Bitget Analysis

This change can be attributed to several factors, including a perceived lack of transparency within traditional pension systems. Nearly 73% of respondents acknowledged that they do not understand where or how their pension funds are actually invested, leading to feelings of uncertainty and distrust.

“This is a wake-up call for the financial industry,” stated Gracy Chen, CEO of Bitget, adding:

“Younger generations are no longer satisfied with rigid, traditional pension systems. They are seeking innovative solutions that provide more control, flexibility, and transparency.”

Younger Generations Lack Pension Knowledge

Additionally, the study highlighted a significant knowledge gap regarding pension systems in general.

Over 20% of respondents did not possess even a basic understanding of pensions, indicating a critical need for enhanced financial education among younger generations. This lack of knowledge impedes meaningful engagement with retirement planning and strengthens the appeal of alternative, more easily understood options like cryptocurrencies, according to the report.

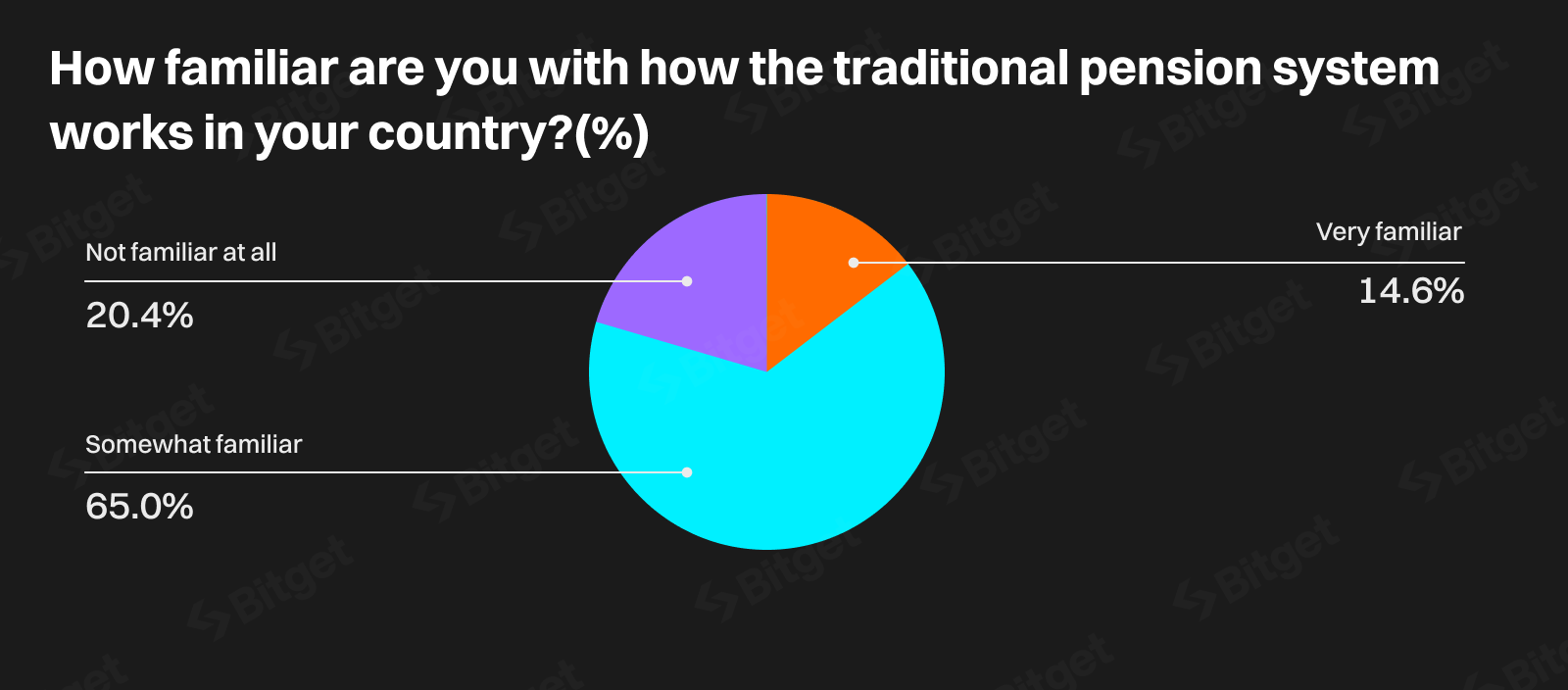

More than 20% of respondents are not familiar with the concept of pensions in general. Source: Bitget Analysis

More than 20% of respondents are not familiar with the concept of pensions in general. Source: Bitget Analysis

“Younger generations are transforming the way we think about money,” Chen added. “The emergence of crypto pensions is not merely a fleeting trend – it is part of a broader financial revolution. The industry must adapt to remain relevant.”

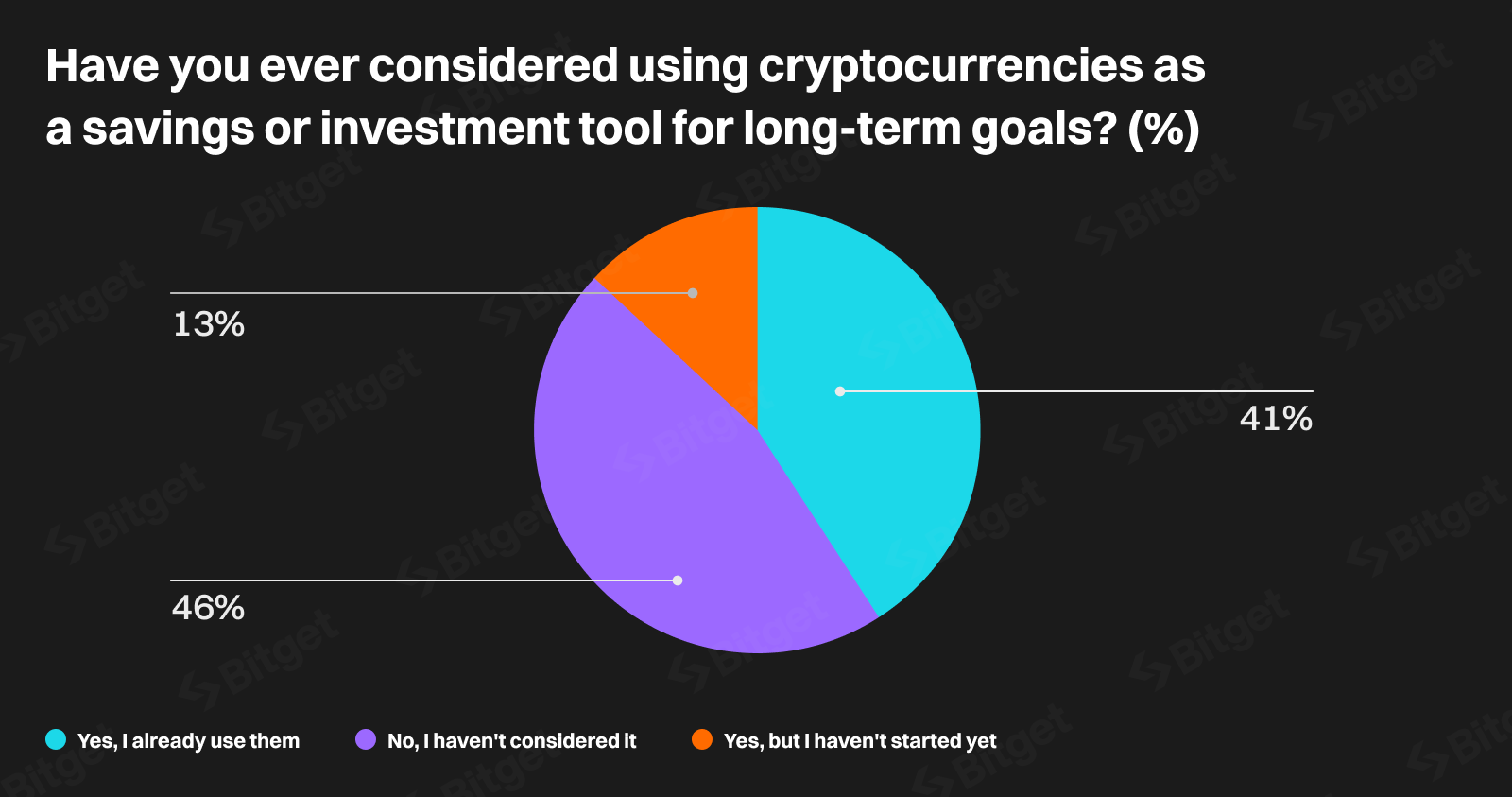

The survey results also indicate that nearly 87% of younger respondents are considering using cryptocurrencies as a savings or investment tool to achieve long-term objectives. Among them, about 41% expressed “strong interest,” stating that they are actively investigating cryptocurrency options for future investments.

87% of respondents are considering using crypto as a savings or investment tool. Source: Bitget Analysis

87% of respondents are considering using crypto as a savings or investment tool. Source: Bitget Analysis

A “Hybrid Approach” Required

While the potential of cryptocurrencies in retirement planning is significant, the study also recognizes the challenges.

Volatility remains a major concern for many, as the cryptocurrency market experiences considerable price fluctuations.

Furthermore, the regulatory landscape surrounding cryptocurrencies continues to evolve, creating uncertainty for both investors and regulators.

Despite these challenges, the study reveals the increasing influence of cryptocurrencies on the financial future of younger generations.

As Gen Z and Alpha enter the workforce and build wealth, their demand for innovative and transparent financial solutions will continue to reshape the industry. The future of retirement may involve a “hybrid approach,” the report concludes, integrating elements of traditional pension systems with the innovative potential of blockchain technology.

State Pension Funds Adopt Crypto

In 2024, numerous local and federal governments began increasingly exploring the integration of cryptocurrencies into their pension funds.

In the UK, Legal & General, a pension and investment firm managing $1.5 trillion in assets, announced in October that it would consider offering tokenized funds.

In August 2024, South Korea’s National Pension Service (NPS), the third-largest public pension fund globally, reported a $34 million exposure to MicroStrategy, a company known for its significant Bitcoin investments.

In the United States, the State of Michigan Retirement System demonstrated a proactive approach by holding approximately $18 million in shares of Bitcoin (BTC) and Ether (ETH) exchange-traded products (ETPs) as of September 30.

The post Bitget Survey: 20% of Gen Z, Alpha Open to Crypto Pensions appeared first on Cryptonews.