Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin’s Net Realized Profit/Loss Reaches Zero Again — Is a Capitulation Like June 2022 on the Horizon?

Bitcoin is once again approaching a significant on-chain inflection point as a crucial profitability metric returns to levels not seen since one of the most difficult downtrends in market history.

Data from CryptoQuant analyst Adler AM reveals that Bitcoin’s Net Realized Profit and Loss has decreased by roughly 97% after reaching its recent peak and is now nearing near-zero territory.

This scenario mirrors that of June 2022, just prior to BTC‘s decline from about 30,000 to nearly 16,000.

Net Realized P/L has fallen by 97% and returned to the zero mark. The last occurrence of this was in June 2022 – right before the descent from $30K to $16K. Whales continue to profit (a buffer of 25-80%), so there is no sense of panic yet. However, the market is being upheld not by buyers – but by the… pic.twitter.com/ooQsnaGTCA

— Axel

Adler Jr (@AxelAdlerJr) January 26, 2026

Net Realized P/L measures the balance between realized profits and losses on the Bitcoin network based on on-chain cost basis. Positive values indicate prevailing profit-taking, while negative figures signify loss-driven selling.

Values close to zero imply trades are happening around the cost basis, suggesting profit exhaustion and a balance between buyers and sellers.

Bitcoin Selling Pressure Eases, Yet Buyers Remain Hesitant

The analyst highlighted that the present conditions resemble the moments just prior to Bitcoin’s significant capitulation in 2022. In late 2024 and early 2025, Net Realized P/L soared above $1.5 billion, signifying an overheated profit-taking phase.

By January 26, 2026, that amount had plummeted to approximately $60 million, effectively stabilizing at the zero line. In 2022, a similar retreat to zero did not signify a bottom.

Instead, the metric continued to decline into deeply negative territory, dropping to around minus $350 million as the price fell another 50%.

Adler pointed out that the current zero reading should not be viewed as a bullish reversal signal. Instead, it indicates a pause where selling pressure from profit-takers has significantly diminished, but new demand has yet to materialize.

On-chain data suggests that the market is presently being upheld more by the absence of sellers than by robust buying interest, creating a fragile balance that has historically declined during risk-off conditions.

Source: CryptoQuant

Source: CryptoQuant

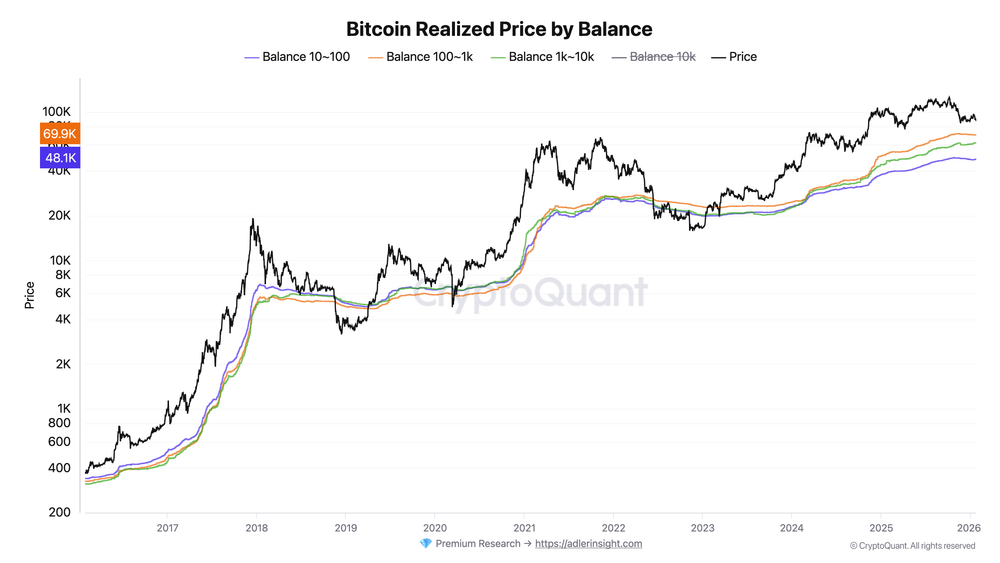

Despite warning signs, large Bitcoin holders remain profitable, as realized price data segmented by balance size indicates that all major whale cohorts are still well above their average acquisition costs.

Holders with balances between 100 and 1,000 BTC have the highest realized price, around $69,900, providing them with an estimated profit buffer of about 25% at current prices.

Other significant cohorts, including wallets containing 10–100 BTC and those with over 10,000 BTC, have average entry prices closer to $48,000 and $51,000, resulting in unrealized gains of 70% to 80%.

This helps clarify the absence of panic selling, even as the price has sharply retreated from recent peaks.

Bitcoin Dips Below $88K as Volatility Increases

At the time of this writing, Bitcoin was trading at approximately $87,756, having decreased by around 1.1% in the last 24 hours and 5.7% over the past week.

Source: Cryptonews

Source: Cryptonews

However, trading volume surged more than 160% day-over-day to $53.1 billion, indicating heightened activity as traders adjust amid volatility.

Macro pressures have added to the unease, as U.S. President Donald Trump threatened to levy 100% tariffs on any Canadian products if Ottawa strengthens trade ties with China, and rumors of a potential American government shutdown have resurfaced.

This development led to over $320 million in liquidations of leveraged long positions within hours.

Additionally, CoinShares reported $1.73 billion in outflows from digital asset investment products last week.

Digital asset investment products experienced significant outflows last week, with investors withdrawing $1.73B — the largest weekly drop since mid-November 2025, according to CoinShares.#BTC #ETPs https://t.co/2ni4w83evG

— Cryptonews.com (@cryptonews) January 26, 2026

Bitcoin-related products accounted for $1.09 billion of those outflows, with most originating from U.S.-based funds.

Exchange order book data indicates that sell-offs were absorbed with a modest volume delta, suggesting controlled selling.

Analysts indicate that liquidity remains stable, with no current signs of cascading capitulation.

The post Bitcoin’s Net Realized P/L Hits Zero Again — Is a June 2022-Style Capitulation Next? appeared first on Cryptonews.

Adler Jr (@AxelAdlerJr) January 26, 2026

Adler Jr (@AxelAdlerJr) January 26, 2026