Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin Value May Reach $170K — Importance of Strategy ‘Resilience’ Stressed by JPMorgan

According to analysts at JPMorgan, the short-term trajectory of Bitcoin’s price is now less influenced by miner activities and more by the financial stability of Strategy, the largest corporate holder of Bitcoin globally, despite ongoing mining challenges and market fluctuations.

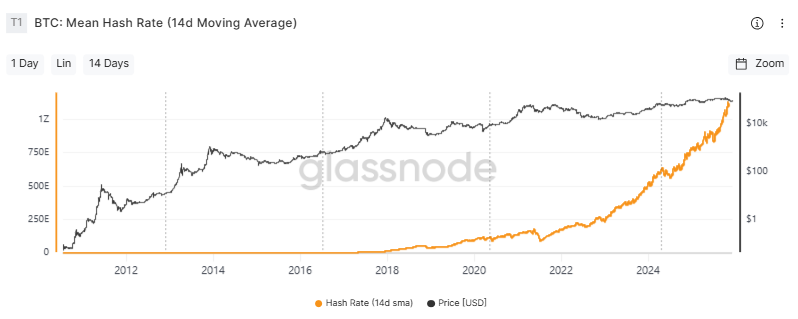

A report authored by managing director Nikolaos Panigirtzoglou highlighted two key factors currently impacting Bitcoin. The first is a recent drop in Bitcoin’s network hashrate and mining difficulty.

The second factor is the increasing market scrutiny of Strategy’s balance sheet and its capacity to refrain from liquidating its Bitcoin assets during the current market slump.

High-Cost Bitcoin Miners Withdraw as Hashrate Declines and Margins Dwindle

The reduction in hashrate is attributed to a combination of China reaffirming its ban on private mining operations and high-cost miners outside the nation withdrawing as declining Bitcoin prices and rising electricity expenses diminish profitability.

JPMorgan now estimates the production cost of Bitcoin at $90,000, a decrease from $94,000 the previous month. This estimate is based on electricity priced at $0.05 per kilowatt hour, with each $0.01 increase adding approximately $18,000 to the production costs for higher-cost miners.

Source: Glassnode

Source: Glassnode

With Bitcoin trading around $92,000, JPMorgan indicated that the asset remains close to its estimated production cost, creating ongoing selling pressure from miners.

As profit margins tighten, several high-cost producers have been compelled to sell off Bitcoin holdings in recent weeks to maintain solvency.

Despite these challenges, JPMorgan noted that miners are no longer the primary influence on Bitcoin’s next significant movement. Instead, focus has shifted to Strategy’s capacity to sustain its Bitcoin holdings without being compelled to sell.

Strategy’s enterprise-value-to-Bitcoin-holdings ratio currently sits at 1.13. This figure reflects the combined market value of its debt, preferred stock, and equity in relation to the market value of its Bitcoin reserves.

Source: BitcoinTreasuries.NET

JPMorgan stated that the fact this ratio remains above 1.0 is “encouraging” as it indicates that Strategy is unlikely to experience pressure to sell Bitcoin in order to meet interest or dividend obligations.

The company recently strengthened this position by establishing a $1.44 billion U.S. dollar reserve through ongoing at-the-market equity sales.

This reserve is intended to cover dividend payments and interest expenses for a minimum of 12 months, with the aim of extending coverage to 24 months.

JPMorgan asserted that this reserve significantly mitigates the risk of forced Bitcoin sales in the near future.

JPMorgan Projects $170K Bitcoin Scenario Despite Strategy’s MSCI Index Concerns

Strategy’s Bitcoin accumulation has markedly slowed in recent months, although it remains highly sensitive to price fluctuations.

In November, it acquired 8,178 BTC, marking its largest purchase since July, bringing total holdings to approximately 650,000 BTC. Its basic market capitalization is around $54 billion, with an enterprise value of roughly $69 billion.

Market participants are also monitoring an impending decision by MSCI regarding whether to exclude Strategy and other digital-asset treasury firms from its equity indices. JPMorgan suggested that the potential downside risk from exclusion is largely reflected in current pricing.

Since MSCI initiated its review in October, Strategy’s share price has decreased by about 40%, underperforming Bitcoin by approximately $18 billion in market capitalization.

JPMorgan estimates that an MSCI exclusion could lead to $2.8 billion in passive outflows, with up to $8.8 billion at risk if other index providers follow suit.

Nevertheless, the bank indicated that further downside is likely to be limited. Conversely, if MSCI retains Strategy in significant indices, JPMorgan believes both Strategy and Bitcoin could experience a significant rebound toward pre-October levels.

Beyond corporate balance sheets, JPMorgan continues to highlight the broader crypto market structure for potential long-term gains. The bank noted that the deleveraging of perpetual futures appears to be largely completed following unprecedented liquidations in October.

Simultaneously, Bitcoin’s volatility ratio relative to gold has improved, enhancing its risk-adjusted attractiveness to investors.

Based on these indicators, JPMorgan reiterated its volatility-adjusted comparison of Bitcoin to gold, suggesting a theoretical Bitcoin price nearing $170,000 over the next six to twelve months if market conditions stabilize.

Significantly, Bitcoin is currently trading about $68,000 below that mark.

The post Bitcoin Price Could Hit $170K — But Strategy ‘Resilience’ Is Vital: JPMorgan appeared first on Cryptonews.