Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin Price Forecast: Worldwide Bond Markets Are Declining – Is $150K BTC Inevitable?

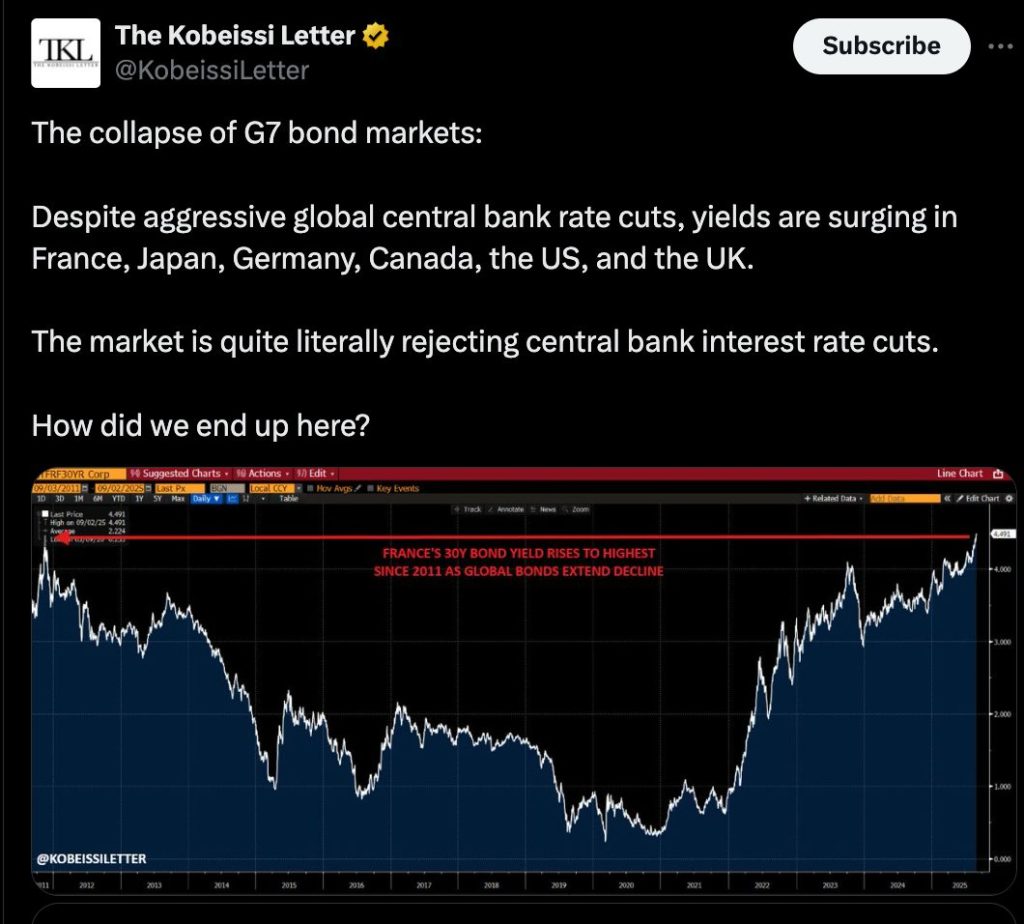

The Bitcoin price is currently trading around $111,000 after finding support close to the $109,500 level. On the fundamental side, global government bond markets are facing pressure, with yields increasing across the US, Europe, Japan, and the UK. The US 30-year Treasury yield is approaching 5%, French long bonds have surpassed 4% for the first time since 2011, and UK gilts have reached 27-year highs.

In Japan, the 30-year yield has hit unprecedented levels, prompting warnings of a potential “collapse in G7 bond markets,” as noted by The Kobeissi Letter.

Source: The Kobeissi Letter

Source: The Kobeissi Letter

This significant increase in yields is indicative of a combination of inflationary worries, escalating debt levels, and supply constraints. For Bitcoin, the consequences are extensive. Historically, BTC has functioned as both a risk asset and a hedge, depending on the factors driving yield increases.

The collapse of G7 bond markets:

Despite aggressive rate cuts by global central banks, yields are rising in France, Japan, Germany, Canada, the US, and the UK.

The market is essentially rejecting the interest rate reductions by central banks.

How did we arrive at this point? https://t.co/cA7UCGuokD pic.twitter.com/0CndO3fQ5l— The Kobeissi Letter (@KobeissiLetter) September 2, 2025

Bitcoin’s Historical Playbook

Previous yield spikes provide insights. During the 2013 taper tantrum, Bitcoin’s price surged from below $100 to over $1,000 as investors moved away from government bonds. A similar trend was observed in 2021, when rising yields due to inflation concerns coincided with Bitcoin reaching $65,000.

However, the scenario changes when central banks increase yields through aggressive tightening measures. In 2018, rising real bond yields diverted capital from Bitcoin, leading to a decline of over 80% in its value.

The current cycle seems more aligned with the events of 2013 and 2021. U.S. debt has surged by more than $1 trillion in just two months, now totaling $37.3 trillion. Concurrently, data from Glassnode indicates an increase in Bitcoin’s holder retention rate, suggesting confidence in BTC as a safeguard against currency devaluation.

- U.S. debt reached $37.3 trillion in September, rising from $36.2 trillion in July.

- Bitcoin has increased by 4.2% over the past three days, reflecting the recent bond market surge.

- Holder retention rates indicate a stronger “HODL” trend among long-term investors.

Bitcoin (BTC/USD) Short-Term Technical Analysis

Bitcoin has escaped its descending channel, gaining momentum after several weeks of sideways movement. Currently priced near $110,819, BTC is consolidating above its pivot point at $110,181. The 50-EMA now acts as support, while the 200-EMA at $112,663 serves as the immediate resistance level to monitor.

Bitcoin Price Chart – Source: Tradingview

Bitcoin Price Chart – Source: Tradingview

Momentum is improving, with the RSI at 56, indicating renewed demand without signs of overextension. A decisive move above $112,600 could trigger rallies toward $115,600 and $117,500. On the downside, support levels are established at $107,407 and $105,215, providing traders with defined risk parameters.

Bitcoin (BTC/USD) Long-Term Technical Outlook

The broader perspective remains bullish within Bitcoin’s ascending channel from the 2022 lows. The price is consolidating at $110,587, with the 50-week SMA at $95,922 serving as strong support.

The RSI is at 62, indicating potential for further upward movement. If BTC surpasses $134,487, Fibonacci extensions suggest targets of $171,055 and $231,241, with an aspirational goal of $290,000.

Key long-term support levels are at $104,379, $89,096, and $74,732. As long as Bitcoin remains above $95,000, the supercycle structure stays intact, allowing for the possibility of six-figure milestones.

Presale Bitcoin Hyper ($HYPER) Combines Bitcoin Security With Solana Speed

Bitcoin Hyper ($HYPER) aims to be the first Bitcoin-native Layer 2 solution powered by the Solana Virtual Machine (SVM). Its objective is to enhance the Bitcoin ecosystem by facilitating rapid, low-cost smart contracts, decentralized applications, and even meme coin creation.

By merging Bitcoin’s unparalleled security with Solana’s high-performance infrastructure, the project paves the way for entirely new applications, including seamless BTC bridging and scalable dApp development.

The team has placed a strong emphasis on trust and scalability, with the project undergoing audits by Consult to instill confidence in its foundations among investors.

Momentum is rapidly building. The presale has already surpassed $13.7 million, with only a limited allocation remaining. At this stage, HYPER tokens are priced at just $0.012855—but this price will increase as the presale advances.

HYPER tokens can be purchased on the official Bitcoin Hyper website using cryptocurrency or a bank card.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Global Bond Markets Are Collapsing – Is $150K BTC Now a Matter of When, Not If? appeared first on Cryptonews.