Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin Price Forecast: RSI Signals a Potential Breakout – Will 2026 Begin with a Surge or a Decline?

Bitcoin is entering 2026 at a pivotal juncture. The price movement is becoming more constrained, the RSI is rising, and institutional investors keep accumulating, yet prediction markets express doubt about a swift surge to six figures.

Polymarket probabilities still indicate that $120,000 is the most probable scenario, even as Bitcoin hovers within a narrowing triangle around $89,000. The forthcoming movement could establish the sentiment for the upcoming year.

Polymarket: Reasons Traders Are Reluctant to Anticipate a Rapid $150K Bitcoin Surge

Bitcoin is launching 2026 with a blend of hope and pragmatism. While analysts continue to propose six-figure targets, Polymarket participants are exercising caution regarding how high they believe BTC can ascend before 2027.

Examining the market probabilities, the most likely scenario emerges at $120,000, with a 45% chance, despite this figure being below its all-time high from 2025.

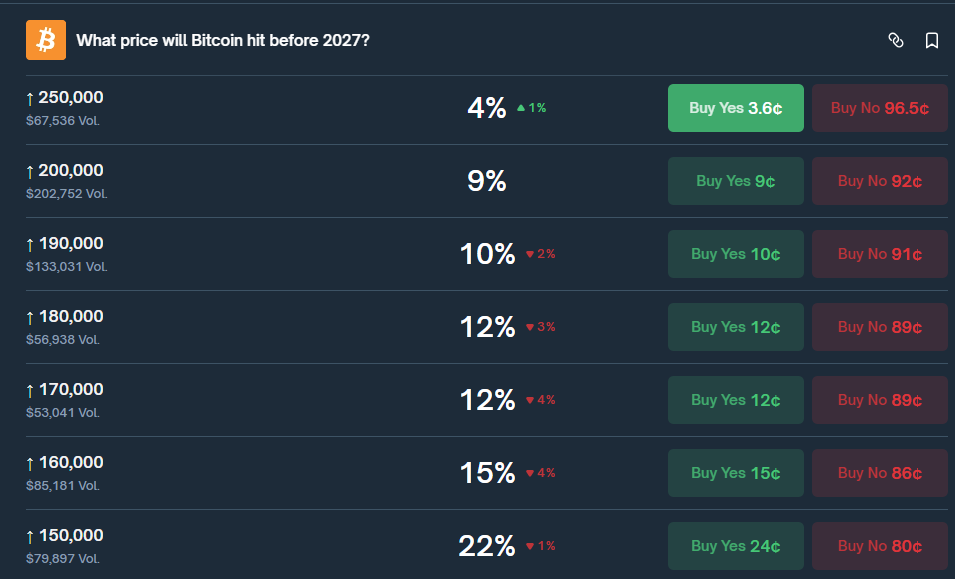

However, confidence in achieving higher targets is diminishing. Polymarket indicates:

- 35% of traders believe $130,000 is a possibility

- 28% of traders believe $140,000 is a possibility

- 21% of traders believe $150,000 is a possibility

Source: Polymarket

In comparison, the market suggests there’s likely an 80% probability that Bitcoin will either maintain or rebound in the $100,000 range, indicating traders foresee stability but are not expecting an immediate dramatic rise.

This caution may stem from cyclical dynamics – Bitcoin finished the previous year in the negative, and with the four-year halving cycle nearing its end, traders are likely becoming more selective about their investments.

Institutional Bitcoin Purchases Indicate Long-Term Commitment

Conversely, despite a softer outlook among retail traders, institutions continue to back their beliefs with capital. In the final quarter of 2025, Japan-based Metaplanet acquired 4,279 BTC, raising its total to 35,102 BTC, valued at approximately $3.1 billion at current prices.

Even though their stock performance has been underwhelming, they regard Bitcoin as a long-term store of value.

Tether has similarly acted. As BTC dropped below $88,000, the stablecoin issuer purchased 8,889 BTC, totaling around $778.7 million. While these acquisitions do not assure an immediate price increase, they demonstrate that major players are taking advantage of price dips to increase their exposure.

Bitcoin Technical Analysis: Will It Break Out or Break Down?

From a technical standpoint, Bitcoin price forecasts remain neutral, as BTC trades around $89,400, confined within a symmetrical triangle on the four-hour chart. This formation reflects tightening volatility rather than any indication of weakness. The price continues to establish higher lows, with the resistance line descending from $92,800 to $93,000.

BTC is fluctuating around a pivot area near $88,200-$89,000, where the 50-day and 100-day EMAs are converging. This convergence of the EMAs indicates a state of balance rather than an imminent breakout. Provided the price remains above the upward trendline from $84,400 and the 200-day EMA near $87,000, the overall structure stays positive.

Bitcoin Price Chart – Source: Tradingview

The candlestick patterns support this view as well. Recent trading sessions show spinning tops and small-bodied candles, signaling indecision rather than selling pressure. The RSI has broken its short-term downtrend and is now exceeding 55, indicating strengthening momentum.

If Bitcoin manages to close above $90,500, it would resolve the triangle positively and pave the way toward $92,800 and subsequently $95,000. Conversely, a drop below $87,000 would undermine the setup and introduce the potential for a decline to $85,800; at present, the structure more likely favors an upward movement.

Potential Catalysts for Bitcoin’s Next Major Movement in 2026

With institutions absorbing supply and price compressing towards a technical apex, the current setup suggests preparation rather than exhaustion. Whether the next move results in a deliberate breakout or merely another range expansion will influence how soon those $150,000 targets appear attainable. For the moment, traders are betting on endurance, and historical trends indicate that Bitcoin often rewards such patience.

Maxi Doge: A Community-Centric Meme Coin with Competitive Spirit

Maxi Doge is rapidly gaining momentum as one of the more prominent meme coin presales this year, merging bold branding with community-focused incentives. The project has already amassed over $4.39 million, positioning it among the stronger early performers in the meme token arena.

In contrast to typical dog-themed tokens that depend solely on social media buzz, Maxi Doge emphasizes engagement. The project hosts regular ROI competitions, community challenges, and events designed to maintain high participation levels throughout the presale period. Its mascot, inspired by leverage, and fitness-oriented branding have contributed to its distinction in a saturated meme market.

The $MAXI token also features a staking mechanism that allows holders to earn daily rewards from smart contracts. Stakers gain access to exclusive competitions and partner events, adding a passive earning component while promoting long-term involvement rather than short-term speculation.

Currently priced at $0.000276, $MAXI is nearing its next scheduled presale increase. With momentum building and community engagement remaining robust, Maxi Doge is establishing itself as a meme coin focused on sustained interaction rather than fleeting excitement.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: RSI Screaming for a Breakout – Is 2026 About to Start With a Bang or a Breakdown? appeared first on Cryptonews.