Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin Price Forecast: Major Firm Indicates BTC is Performing Like a Growth Stock – What Are the Implications?

Grayscale has just released a report that is prompting a reevaluation of ownership perceptions.

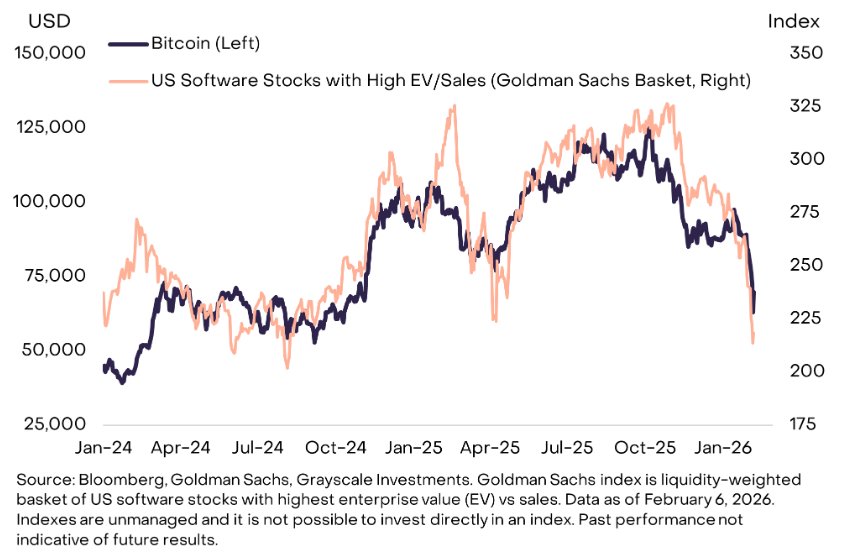

Recent fluctuations in Bitcoin’s price have mirrored those of software stocks rather than gold or other precious metals, particularly since the beginning of 2024.

As fears surrounding AI impacted the software industry, Bitcoin experienced a significant decline, dropping 50% from its October peaks while gold reached new highs.

Source: Grayscale

Source: Grayscale

This situation poses challenges for those who consider Bitcoin a “safe haven.”

Nonetheless, Grayscale’s Zach Pandl maintains that Bitcoin serves as a long-term store of value due to its limited supply and autonomy from central banks.

It is important to note that Bitcoin is only 15 years old, whereas gold has had thousands of years to establish its worth. During the COVID crash in 2020, Bitcoin initially fell but subsequently outperformed all other assets as central banks engaged in extensive money printing.

Following the collapse of Silicon Valley Bank in 2023, as confidence in traditional finance waned, Bitcoin surged while bank stocks plummeted. The correlation with growth stocks persists because Bitcoin is still undergoing price discovery as institutional investment increases.

The discussion surrounding narratives will persist. In the meantime, Bitcoin’s price movements are conveying their own narrative.

Bitcoin Price Prediction: Why Bitcoin Appears to Be Reaching a Bottom

Bitcoin has recently emerged from a narrow descending channel. It is currently fluctuating just above the $64K support level, seemingly deliberating its next significant move.

The breakdown structure has technically concluded, but the price must demonstrate its ability to maintain this higher low zone.

Source: BTCUSD / TradingView

Source: BTCUSD / TradingView

$64K represents a crucial support level. Should the BTC price fall below this, the $60K level may come back into consideration.

$71K serves as the initial significant target and resistance. If this level is cleared decisively, the pathway toward $80K may begin to open. If buyers continue to defend this range, a potential upward squeeze could become quite intriguing.

While Bitcoin’s price remains volatile and unexciting, many whales may already be shifting their focus to new opportunities such as Bitcoin Hyper, which is rapidly gaining popularity.

Bitcoin Hyper Enhances Bitcoin Utility: Whales Appreciate This

Bitcoin Hyper ($HYPER) is designed for traders seeking more than just waiting for correlations to shift.

This Bitcoin-centric Layer-2 solution utilizes Solana technology to enhance BTC’s speed, reduce costs, and facilitate its use for payments, applications, and staking, all while preserving Bitcoin’s core security.

It retains the Bitcoin brand’s strength while adding genuine functionality on top.

Momentum is already evident. The Bitcoin Hyper presale has generated over $31 million to date, with $HYPER priced at $0.0136751 before the next increase, in addition to staking rewards reaching as high as 37%.

If Bitcoin is still determining its future direction, Bitcoin Hyper is already positioning itself for what lies ahead.

Visit the Official Bitcoin Hyper Website Here

The post Bitcoin Price Prediction: Billion-Dollar Firm Says BTC is Acting Like a Growth Stock – Is That Good or Dangerous for You? appeared first on Cryptonews.