Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

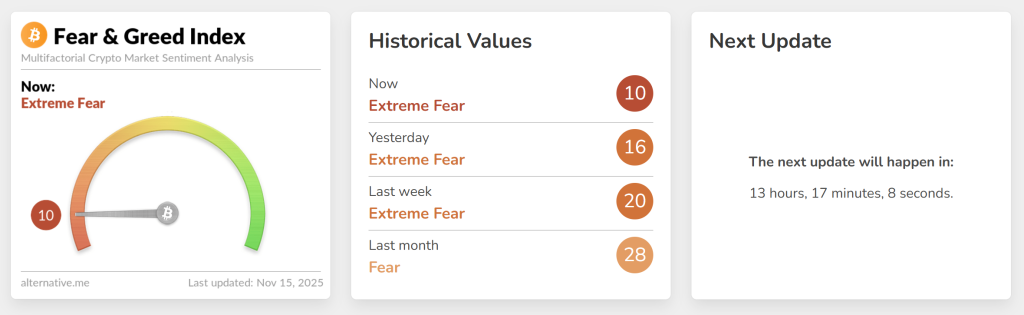

Bitcoin Price Forecast: Extreme Fear Index Reaches 10 – Could This Signal the Accumulation Low Traders Anticipated?

Bitcoin is currently priced at approximately $95,775, reflecting a decline of nearly 7% this week, as the overall cryptocurrency market enters one of its most delicate sentiment periods of the year. The Crypto Fear & Greed Index has plummeted to 10, indicating “Extreme Fear” and aligning with levels last observed in early March.

This shift alone is sufficient to cause even seasoned traders to hesitate, particularly as the market capitalization has fallen to $1.91 trillion and momentum indicators continue to weaken.

Historically, extreme fear has often served as a contrarian indicator, frequently appearing near significant accumulation zones; however, this time the technical framework does not provide a definitive conclusion.

Bitcoin has dipped below its long-term upward trendline for the first time since spring, indicating a disruption in the pattern that supported the market throughout much of 2024 and 2025.

Bitcoin (BTC/USD) Technical Outlook at a Crossroads

The outlook for Bitcoin appears bearish, even as BTC stabilizes following a steep drop that brought the market into the $94,500–$92,000 support range, an area that acted as a pivot during April and May. The long lower wick observed on Thursday suggests that buyers have entered the market, but the subsequent activity has been lackluster.

The 20-EMA has turned downwards, functioning as dynamic resistance, while the RSI is positioned near 33, remaining above oversold levels without establishing a clear bullish divergence.

Bitcoin Price Chart – Source: Tradingview

Bitcoin Price Chart – Source: Tradingview

The candlestick patterns reinforce the prevailing uncertainty. This week’s formation resembles a smaller iteration of a three black crows pattern, followed by a single rejection candle, which is insufficient to indicate capitulation but enough to decelerate the decline. The price is currently constrained between the breached trendline above and a mid-range support below, a zone where markets typically make swift decisions.

Key Levels to Monitor

A change in momentum necessitates substantiation. Traders are observing:

- $99,000 – Initial indication that buyers are regaining dominance

- $103,700 – The breached trendline; reclaiming this level would reset momentum

- $92,000 – Breakdown level that reveals deeper support

- $83,000 – Significant liquidity zone and next major downside target

A daily close above $99,000 would validate a short-term reversal, particularly if accompanied by a bullish engulfing candle and an RSI exceeding 40.

Is This an Accumulation Bottom?

Extreme fear can present opportunities, but it may also precede another selling wave. With Bitcoin caught between conflicting signals – oversold momentum versus broken structure – traders are approaching this area with caution. If buyers can defend $92,000, this could develop into a classic accumulation zone. If not, the market may need to revisit deeper supports before stability is restored.

Bitcoin Hyper: The Next Evolution of BTC on Solana?

Bitcoin Hyper ($HYPER) is introducing a new phase to the Bitcoin ecosystem. While BTC remains the benchmark for security, Bitcoin Hyper incorporates what it has traditionally lacked: Solana-level speed. The outcome is rapid, low-cost smart contracts, decentralized applications, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project prioritizes trust and scalability as adoption increases. Momentum is already robust, with the presale exceeding $27 million, and tokens priced at just $0.013265 before the next increase.

As Bitcoin activity rises and the demand for efficient BTC-based applications grows, Bitcoin Hyper distinguishes itself as the connector between two of crypto’s largest ecosystems. If Bitcoin laid the groundwork, Bitcoin Hyper could enhance it, making it fast, adaptable, and enjoyable once more.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Extreme Fear Index Hits 10 – Is This the Accumulation Bottom Traders Waited For? appeared first on Cryptonews.