Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

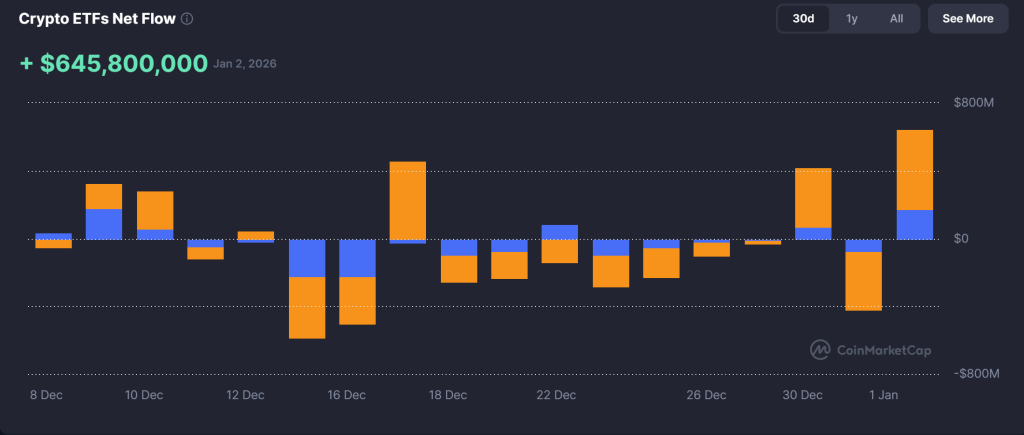

Bitcoin Price Forecast: BTC Rises to $91K as $645M ETF Inflows Indicate Bullish Surge

Bitcoin has regained attention following $645.8 million in cryptocurrency ETF inflows on January 2, which has rekindled hope throughout the digital asset sector. Meanwhile, the overall cryptocurrency market capitalization has reached $3.12 trillion, with a daily trading volume nearing $75 billion, indicative of increasing institutional participation.

The Fear and Greed Index currently stands at 40 (neutral), a significant improvement from the fear levels observed in December. Additionally, the Altcoin Season Index at 25 confirms that the market is firmly in a Bitcoin-dominant phase. Analysts suggest that the demand for ETFs is tightening supply at a time when liquidity is limited, establishing favorable conditions for rising prices.

Bitcoin Technical Setup: Triangle Breakout Points to $94K

From a technical standpoint, Bitcoin’s price forecast appears to have shifted to a bullish outlook following a confirmed breakout from a triangle pattern after a month-long period of consolidation. The breakout above $89,500 signifies a definitive conclusion to December’s sideways movement and suggests the onset of a new bullish trend.

The 4-hour chart indicates that Bitcoin is trading around $91,260, establishing a pattern of higher lows and consistently increasing volume. A crossover of the 50-EMA above the 100-EMA indicates strengthening momentum, while the RSI near 69 implies controlled bullish activity without entering overbought conditions.

Candlestick patterns further support the bullish sentiment; a bullish engulfing candle breached resistance, followed by a spinning top at $92,000, indicating short-term consolidation before a potential upward continuation.

Bitcoin (BTC/USD) Market Outlook: Eyes on $94K and Beyond

If Bitcoin can maintain its position above $89,000, we could see the next upward targets between $93,500 and $94,600—the trajectory looks promising for a potential advance towards $98,000 in the upcoming weeks. However, if it closes below $88,400, we might witness a significant decline, inviting some short-term selling pressure.

Currently, the outlook is optimistic, with increased ETF investments and regular traders re-entering the market—additionally, the lagging performance of altcoins suggests a more mature bull run rather than mere speculation.

Should this momentum persist, Bitcoin might soon be targeting $100K in Q1 of ’26, propelled by the influx of new ETF capital, coupled with significant macro trends starting to favor digital assets.

Maxi Doge: A Meme Coin Built Around Community and Competition

Maxi Doge is gaining momentum as one of the more dynamic meme coin presales this year, merging striking branding with community-driven incentives. The initiative has already amassed over $4.4 million, positioning it among the leading early performers within the meme token segment.

In contrast to typical dog-themed tokens that depend solely on social media buzz, Maxi Doge emphasizes engagement. The project conducts regular ROI competitions, community challenges, and events designed to sustain high participation levels throughout the presale period. Its leverage-inspired mascot and fitness-themed branding have helped it distinguish itself in a saturated meme market.

The $MAXI token also incorporates a staking feature that enables holders to earn daily smart-contract rewards. Stakers gain entry to exclusive competitions and partner events, adding a passive earning element while fostering long-term engagement rather than short-term speculation.

Currently priced at $0.0002765, $MAXI is nearing its next planned presale increase. With momentum building and community involvement remaining robust, Maxi Doge is establishing itself as a meme coin oriented towards sustained engagement rather than transient hype.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: BTC Climbs to $91K as $645M ETF Inflows Signal Bullish Breakout appeared first on Cryptonews.