Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin Price Forecast: Bitwise Survey Reveals 99% of Crypto Investors Intend to Hold or Increase Holdings by 2026

Bitwise Asset Management, managing over $15 billion in client assets, has published its 2026 Benchmark Survey, indicating that 99% of financial advisors who invested in crypto in 2025 intend to either increase or maintain their exposure in 2026.

If these advisors encourage clients to keep their investments, Bitcoin price forecasts imply that BTC could approach $120,000 before the fourth quarter of 2026.

65% of Advisors Anticipate Bitcoin Surpassing $110K Before End of 2026

The survey, carried out in collaboration with VettaFi, reveals that institutional demand and Bitcoin’s record highs led advisors to allocate to crypto at the highest rate ever recorded in the survey’s history.

99% of financial advisors who allocated to crypto in 2025 plan to increase or maintain their exposure in 2026. @EricBalchunas @JSeyff

(Data from the recently released 8th annual Bitwise/VettaFi Benchmark Survey of Financial Advisor Attitudes Towards Crypto Assets.) pic.twitter.com/ICANsniQ2Z— Matt Hougan (@Matt_Hougan) January 13, 2026

<papproximately 32% of advisors invested in crypto for client accounts 2025, an increase from 22% 2024.

“The future of crypto has always hinged on the perceptions of financial advisors,” stated Bitwise CIO Matt Hougan. “They serve as trusted advisors to millions of families and are responsible for managing trillions of dollars. In 2025, advisors have embraced crypto like never before.”

Hougan continued, “One statistic that took me by surprise is: 99% of advisors who owned crypto in 2025 intend to increase or maintain their exposure. There were questions about how advisors would respond if crypto experienced volatility. We now have our answer: They’re planning to buy more.”

The survey collected responses from 299 financial advisors regarding crypto assets in client portfolios, which included independent advisors, broker-dealer representatives, planners, and wirehouse representatives from across the United States.

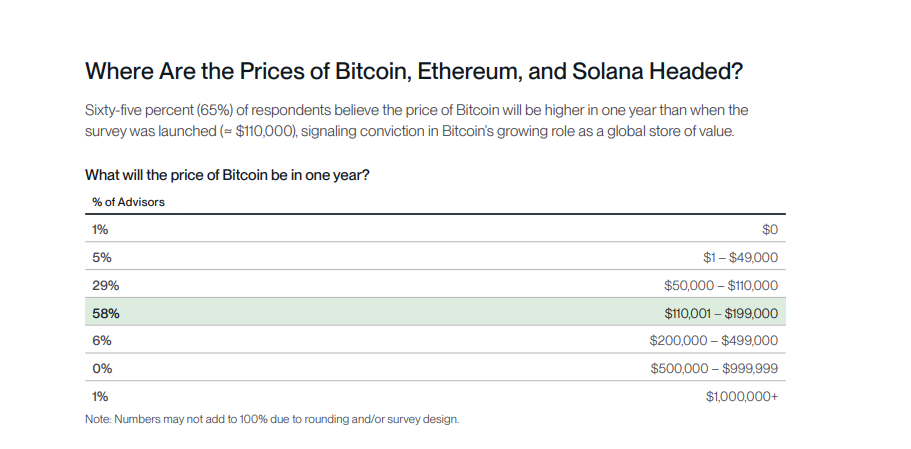

Sixty-five percent believe Bitcoin’s price will surpass $110,000 (its launch price) within one year, while 58% expect it to range between $110,000 and $199,000 before the end of 2026.

Source: Bitwise

Source: Bitwise

Crypto analyst Rektcapital noted that the $93,500 resistance is weakening due to shallower rejections, and a weekly close above this level could initiate a breakout into six figures.

Bitcoin Price Forecast: Weekly Chart Indicates Stabilization Around $90K

The 7-day Bitcoin chart illustrates the market stabilizing following a sharp correction, with the price trying to regain key structural levels.

Bitcoin is trading around the low $90,000s, lingering near the 9-week SMA, which has leveled off after serving as dynamic resistance.

The broader uptrend from 2023 remains intact, as the price continues to stay well above the significant weekly demand zone between $67,000 and $70,000, a level that marks the macro bull market floor.

The most crucial near-term zone is the $100,000–$103,000 range, which previously functioned as a distribution and rejection area.

Source: TradingView

Source: TradingView

A decisive weekly close above this zone would indicate that sellers have been absorbed and that Bitcoin is prepared to continue its trend.

Above this level, the previous range highs between $116,000 and $120,000 come back into view as the next target for upside movement.

Although momentum remains subdued, it is still constructive. The RSI is holding in the mid-40s, indicating consolidation rather than exhaustion.

Historically, Bitcoin tends to build bases in this RSI region prior to expanding higher.

In the near term, Bitcoin is likely to fluctuate between the high $80,000s and $100,000 while momentum rebuilds.

A significant breakout above $100,000 would confirm the resumption of the trend and open pathways toward $116,000–$120,000.

Failure to reclaim that level could prolong consolidation, although a deeper downside seems limited unless the price falls below the $67,000–$70,000 weekly support.

Bitcoin Hyper Presale Rides on 86% Odds of $100K+ in 2026

Polymarket traders are placing odds of over 86% on Bitcoin surpassing $100,000 in 2026, which could benefit BTC-beta projects like Bitcoin Hyper.

Bitcoin Hyper ($HYPER) is developing the first operational Bitcoin Layer 2 utilizing Solana-based technology for enhanced speed and scalability while maintaining Bitcoin’s security.

The project has raised over $30 million to enable Bitcoin-native dApps, offering BTC holders the chance to deploy their assets productively using on-chain tools designed for the Bitcoin ecosystem.

To acquire $HYPER before the next price increase, visit the official Bitcoin Hyper website and connect your wallet (such as Best Wallet).

You can swap USDT or SOL for tokens at $0.013575, or use a credit card.

Visit the Official Bitcoin Hyper Website Here

The post Bitcoin Price Prediction: Bitwise Survey Shows 99% Of Crypto Investors Plan to Hold or Add in 2026 appeared first on Cryptonews.