Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

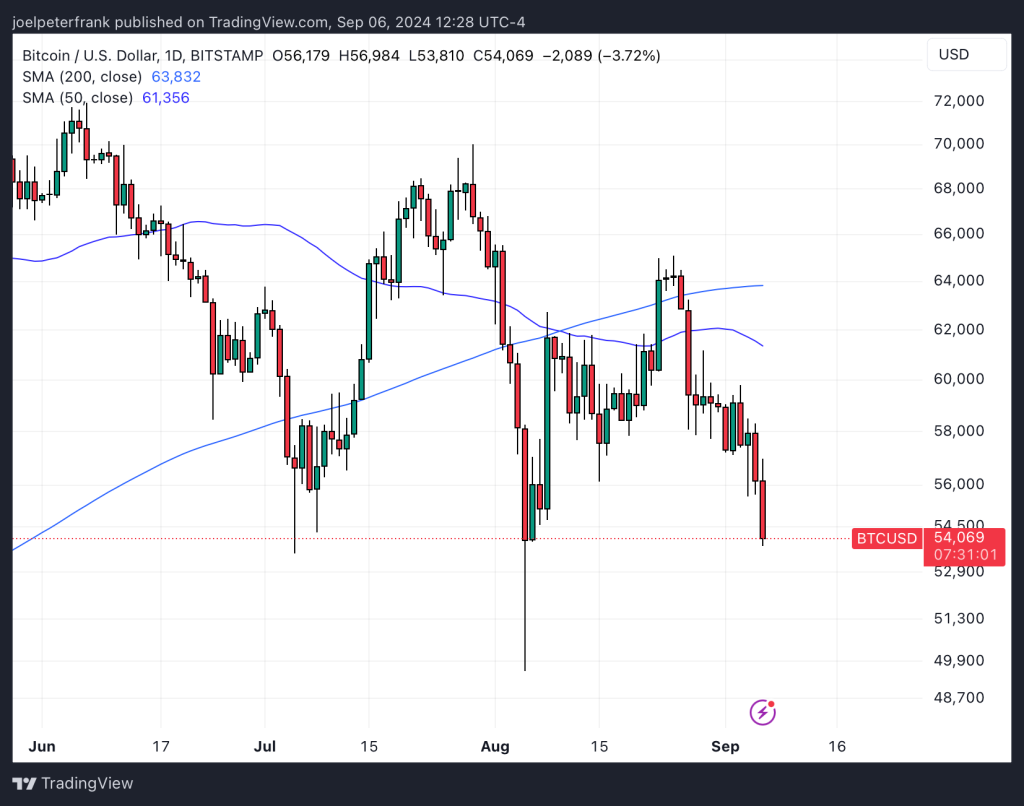

Bitcoin Price Approaches $54,000 Mark – Analysis of the Recent US Jobs Report’s Effect on the Market

The Bitcoin (BTC) price fell below $54,000, marking its lowest point since early August, following the publication of the August US jobs report, which seems to have intensified, rather than alleviated, concerns that the US may be heading towards a recession and that the Federal Reserve might be lagging in its efforts to prevent it.

The most recent non-farm payrolls data indicated that the US economy added 142,000 jobs in August, slightly below the anticipated figure of 160,000.

US Jobs Report (Aug.)

NFP: 142k (exp. 160k, prev. revised 89k)

Unemployment rate: 4.2% (exp. 4.2%, prev. 4.3%)

Earnings M/M: 0.4% (exp. 0.3%, prev. revised -0.1%)

Earnings Y/Y: 3.8% (exp. 3.7%, prev. 3.6%) pic.twitter.com/u0Ywer8hts— Newsquawk (@Newsquawk) September 6, 2024

While this figure is not particularly poor, the significant downward revisions to the June and July reports appeared to alarm the market—86,000 fewer jobs were reported for these months than previously estimated.

The unemployment rate decreased to 4.2% from 4.3% in July, yet this did not seem to alleviate investor concerns.

Currently down approximately 3.7% for the day, according to TradingView, the decline in Bitcoin’s price reflects bearish trading conditions across risk assets.

The S&P 500 dropped 1.5%, bringing its weekly losses to 4%, while the tech-heavy Nasdaq 100 index fell by 2.3%.

Additionally, the price of WTI futures reached its lowest point since June 2023.

US 10-year yields also fell to their lowest level since mid-2023 at 3.65%.

These macroeconomic trends strongly suggest that investors are increasingly anticipating a slowdown in US (and global) growth or a recession.

Some analysts contend that investors are interpreting the latest data in an excessively pessimistic way.

Alianza advisor and former Pimco CEO Mohamed El-Erian remarked that the recent figures still align with his view that the US economy will evade a recession.

Especially after the excitement of a month ago, when analysts and economists suddenly increased their probability of an economic recession, this morning’s (August) US jobs report comes as a relief… that is unless you were absolutely convinced that the Federal Reserve would cut…

— Mohamed A. El-Erian (@elerianm) September 6, 2024

LondonCryptoClub, on the other hand, described the recent sell-off as a “bear trap.”

Reading this and it ties in with our view

I think this just one big bear trap here

Transfer of wealth from bears to bulls

Happy to be your exit liquidityhttps://t.co/yR4pBfyZhI

— LondonCryptoClub (@LDNCryptoClub) September 6, 2024

If Recession is Coming, Where Next for Bitcoin (BTC)?

If the US economy shifts into recession by 2025 and the government/Fed response involves significant rate cuts, quantitative easing, and substantial spending, this could serve as a major boost for Bitcoin.

Historically, Bitcoin has been viewed as an effective hedge against the devaluation of government currencies.

The period of 2020/2021 exemplified this—Bitcoin surged to new all-time highs amid extensive fiscal and monetary stimulus, only to experience a sharp decline as this stimulus was withdrawn (i.e., when the Fed began increasing interest rates).

However, we are still far from that scenario. As the probability of a near-term recession increases due to weakening US economic data and market uncertainty regarding the government/Fed response, rising uncertainty may negatively impact risk assets, including Bitcoin.

Long-term investors are advised to continue purchasing Bitcoin during dips, anticipating that the price will surpass $100,000 in the coming years.

Nevertheless, the short-term outlook remains unclear. Fed rate cuts anticipated later this month are unlikely to provide significant support for Bitcoin until recession-related uncertainties are resolved.

Political factors also remain unpredictable. Market participants seem to favor the more pro-crypto US Presidential candidate Trump over his Democratic opponent Harris.

Trump’s odds continue to rise.

He’s now up by 7%. pic.twitter.com/z9Qz7JFMoQ— Polymarket (@Polymarket) September 4, 2024

A Trump victory could serve as a significant positive catalyst for Bitcoin’s price.

However, until that occurs, Bitcoin’s risks appear to be skewed to the downside. In the upcoming days or weeks, a retest of August lows below $50,000 is quite plausible.

The post Bitcoin Price Tests $54,000 Level – Here’s How the Latest US Jobs Report Impacted the Market appeared first on Cryptonews.

US Jobs Report (Aug.)

US Jobs Report (Aug.) https://t.co/yR4pBfyZhI

https://t.co/yR4pBfyZhI