Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin Falls into Bear Market as Institutional Interest Declines: CryptoQuant

Bitcoin might be entering a renewed bear market phase, as indicated by recent research from CryptoQuant, which highlights on-chain indicators, declining institutional flows, and tightening liquidity conditions that suggest significant structural downside risk.

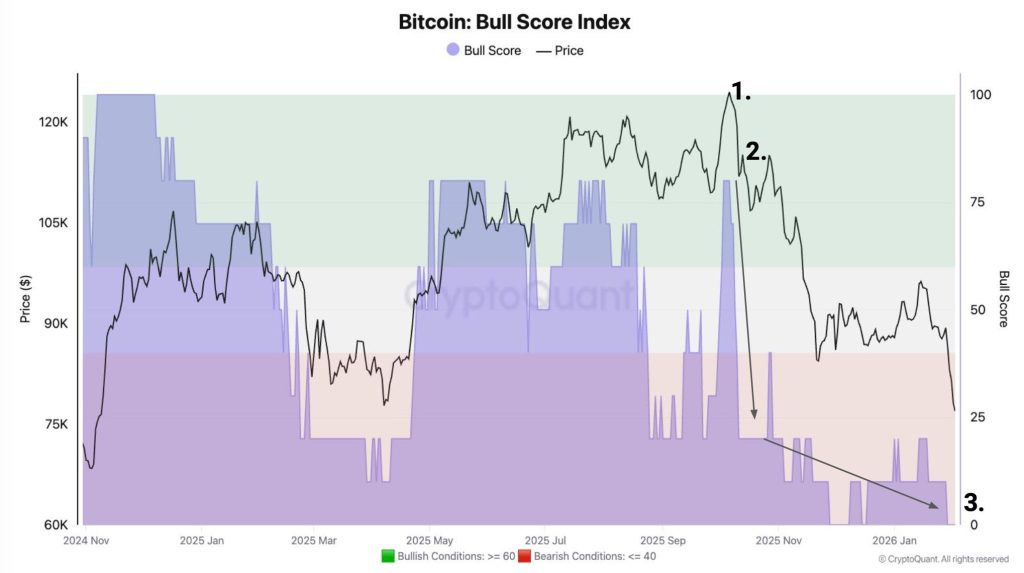

In its most recent Crypto Weekly Report, CryptoQuant stated that various on-chain metrics now affirm a bear market regime. The firm observed that Bitcoin reached a peak of approximately $126,000 in early October, when its Bull Score Index was at 80, indicating a robust bullish environment.

Bitcoin’s bear market is commencing with a weaker performance compared to 2022.

Since dropping below the 365-day MA on November 12, 2025, $BTC has decreased by 23% over 83 days, in contrast to just 6% during the same timeframe in early 2022.

Momentum is declining more rapidly this cycle. pic.twitter.com/t4xD2vljVI— CryptoQuant.com (@cryptoquant_com) February 4, 2026

However, after the liquidation event on October 10, the index turned bearish and has since dropped to zero, while BTC is trading closer to $75,000. “This indicates widespread structural weakness,” CryptoQuant noted.

ETF Flows Shift from Tailwind to Headwind

CryptoQuant emphasized a significant reversal in institutional demand, particularly through U.S. spot Bitcoin ETFs. At the same time last year, ETFs had acquired approximately 46,000 BTC, but in 2026, they have instead become net sellers, offloading around 10,600 BTC.

This change represents a 56,000 BTC demand gap compared to 2025, contributing to ongoing selling pressure throughout the market.

U.S. Spot Demand Remains Low

Despite the lower prices, CryptoQuant reported that U.S. investor engagement remains weak. The Coinbase Premium — often utilized as an indicator of American spot demand — has remained negative since mid-October.

Historically, prolonged bull markets have been associated with a positive Coinbase Premium driven by strong U.S. buying. CryptoQuant pointed out that this trend has not re-emerged, indicating that retail and institutional dip-buying remains limited.

Stablecoin Liquidity Experiences First Contraction Since 2023

Liquidity conditions are also tightening, as noted in the report. CryptoQuant highlighted that USDT’s 60-day market cap growth has turned negative by $133 million, marking the first contraction since October 2023.

Stablecoin expansion peaked at $15.9 billion in late October 2025, and this reversal aligns with liquidity drawdowns typically observed in bear markets.

The firm added that one-year apparent spot demand growth has plummeted by 93%, decreasing from 1.1 million BTC to just 77,000 BTC, reinforcing the slowdown in new capital entering the market.

Technical Breakdown Increases Downside Risk

CryptoQuant also cautioned that Bitcoin has fallen below its 365-day moving average for the first time since March 2022. BTC has already dropped 23% in the 83 days following that breakdown — a sharper decline than the initial phases of the 2022 bear market.

With crucial on-chain support levels now breached, CryptoQuant suggests that Bitcoin may encounter further downside toward the $70,000–$60,000 range unless a new catalyst emerges to restore demand and liquidity.

The post Bitcoin Enters Bear Market Territory as Institutional Demand Reverses: CryptoQuant appeared first on Cryptonews.