Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin Faces Key Support Level as Downward Pressure Increases and Long-Term Investors Sell 815K BTC: CryptoQuant

The momentum of Bitcoin has significantly diminished, and the market has entered one of its most bearish periods of the year, as indicated by the latest weekly report from CryptoQuant.

Market sentiment has rapidly declined as Bitcoin hovers perilously close to the $100,000 mark. This shift commenced following the “Big Liquidation” event on October 10, which depleted upward momentum and drove several key indicators into bearish territory.

Long-term holders are selling aggressively.

Approximately 815K BTC were sold in the last 30 days, the highest amount since January 2024.

With demand decreasing, this selling pressure is impacting the price pic.twitter.com/jFODp4ZA1p— CryptoQuant.com (@cryptoquant_com) November 13, 2025

Spot demand began to decline earlier in October, while the growth of stablecoin liquidity—a vital factor for market inflows—has slowed considerably. These elements have combined to create a precarious environment where Bitcoin’s price struggles to maintain significant support.

A Market Losing Its Grip on Momentum

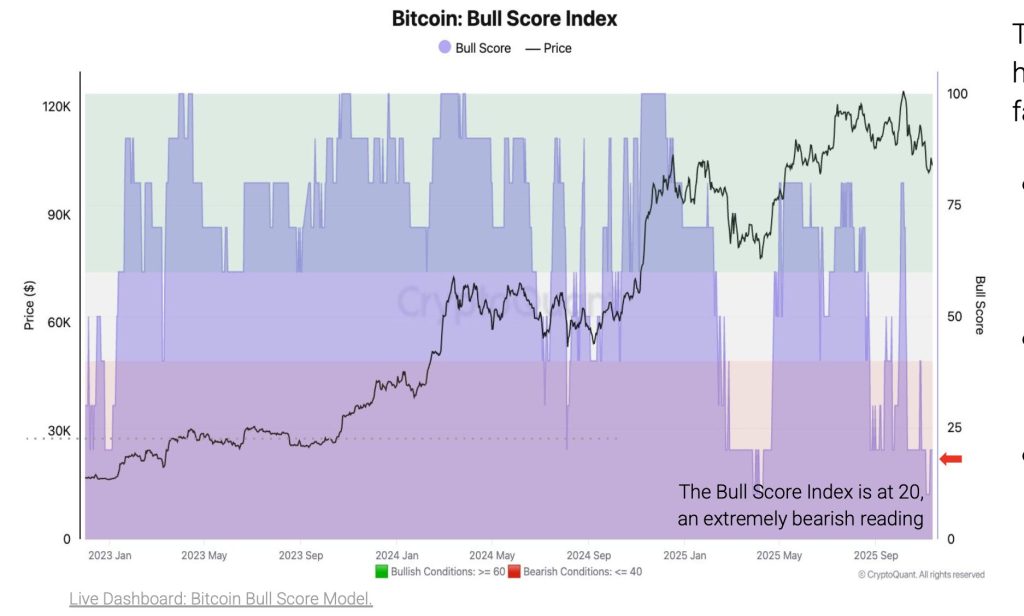

The Bull Score Index from CryptoQuant illustrates the severity of the downturn. Earlier in October, when Bitcoin achieved its all-time high of $126,000, the index recorded a strongly positive reading of 80. That optimism dissipated swiftly as Bitcoin fell below $100,000 for the first time since June.

The index has now dropped to 20, signifying an extremely bearish atmosphere. The rapid decline demonstrates how quickly the market has transitioned from vigorous buying to uncertainty and caution, with diminished new inflows and weaker spot demand contributing to the downward pressure.

Long-Term Holders Unload at Rare Levels

One of the most alarming indicators in the report is the activity of long-term holders. In the past month, they have sold around 815,000 BTC, representing their largest distribution since January 2024. This selling occurred as Bitcoin moved into the $118,000 to $121,000 range, a period when spot demand had already started to decline.

In earlier stages of the cycle, robust demand from ETFs, institutional investors, and retail buyers was adequate to absorb significant selling from long-term holders. That support is now lacking. Instead, the combination of consistent supply from long-term holders and diminishing demand is exerting clear downward pressure on the market, increasing the risk of further price declines.

Profit-Taking Remains Strong, but Capitulation Is Absent

Profit realization continues to be high. On November 7, investors secured approximately $3 billion in net profits, reflecting the aggressive selling witnessed throughout October. Despite the substantial profit-taking, the market has yet to exhibit signs of capitulation.

Realized losses remain exceptionally low, indicating that holders are not engaging in panic selling even as price support weakens. This situation—strong profits coupled with minimal losses—suggests that the market has not yet established a bottom. Historically, price floors develop only after losses increase and weaker hands exit the market, a trend that has not yet manifested.

The Battle at the 365-Day Moving Average

Bitcoin’s current challenge revolves around the 365-day moving average, which is positioned near $102,000. This line has acted as the ultimate support level throughout the ongoing bull cycle and was one of the last significant indicators to turn bearish during the transition into a prolonged downturn in 2021–2022.

Bitcoin has now fallen below this level multiple times—a warning sign not previously observed in this cycle. If the price continues to close beneath the 365-day average, the likelihood of a more profound correction increases significantly.

CryptoQuant observes that the next significant support levels are considerably lower, implying that failure to reclaim this moving average could hasten a broader market decline.

Bitcoin currently finds itself at a pivotal point. With momentum waning, long-term holders selling heavily, and spot demand failing to keep up, the market’s capacity to stabilize heavily relies on whether Bitcoin can regain its 365-day moving average. The upcoming weeks may determine if this is merely a temporary setback or the onset of a more substantial correction.

The post Bitcoin Tests Critical Support as Bearish Momentum Deepens and Long-Term Holders Unload 815K BTC: CryptoQuant appeared first on Cryptonews.