Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin ETFs Lose $1.62B in Four Days — Are Hedge Funds Selling BTC?

Bitcoin spot exchange-traded funds have experienced significant outflows over four trading days, totaling a loss of $1.62 billion.

This situation has prompted speculation about whether hedge funds are decreasing their Bitcoin exposure in response to shifting market conditions.

The withdrawals coincide with Bitcoin’s inability to regain traction around crucial price levels, as a previously favored institutional arbitrage strategy gradually loses its attractiveness.

BlackRock’s IBIT Leads Bitcoin ETF Outflows as BTC Dips Below $90K

As of January 22, 2026, US-listed spot Bitcoin ETFs recorded net daily outflows of $32.11 million, continuing a trend of redemptions that peaked at $708.71 million on January 21, following $483.38 million on January 20, according to Sosovalue data.

Over the past week, net outflows have reached 1.22 billion.

Trading activity remained robust on January 22, with Bitcoin spot ETFs registering $3.30 billion in volume, despite assets under management falling to $115.99 billion, approximately 6.49% of Bitcoin’s market capitalization.

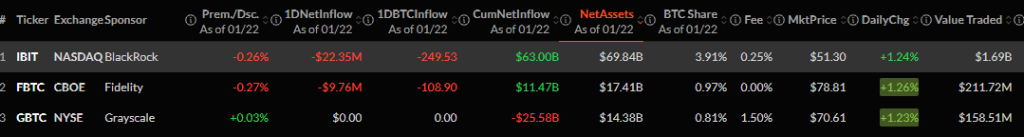

BlackRock’s iShares Bitcoin Trust led the daily outflows, redeeming $22.35 million, which is approximately 249.5 BTC.

Notwithstanding the withdrawals, IBIT continues to be the leading product, managing $69.84 billion in assets and nearly 4% of the Bitcoin supply represented in ETFs.

Bitcoin ETFs data Source: Sosovalue

Bitcoin ETFs data Source: Sosovalue

Fidelity’s FBTC followed with $9.76 million in outflows, while Grayscale’s GBTC reported stable daily flows but remains significantly negative overall, with cumulative net outflows of $25.58 billion as investors shift away from its higher 1.5% fee.

Other issuers, such as Bitwise, Ark and 21Shares, VanEck, Invesco, Valkyrie, Franklin, and WisdomTree, experienced largely stable flows, indicating a pause rather than widespread panic selling.

The ETF retreat has unfolded in conjunction with Bitcoin’s price weakness.

BTC was trading at approximately $89,982 on January 22, down 1.3% for the day and nearly 5% over the past week, after briefly dipping to $88,600.

Source: Cryptonews

Source: Cryptonews

Trading volume has also decreased, dropping nearly 28% to $37.77 billion, signaling that market participation is thinning as prices stabilize below $90,000.

Compressed Yields Trigger Hedge Fund Exit From Bitcoin ETFs

Market analysts indicate that hedge fund positioning is a significant factor driving the ETF outflows.

Amberdata reveals that yields on the Bitcoin basis trade, a strategy involving purchasing spot Bitcoin through ETFs while selling futures to exploit price spreads, have fallen below 5%, down from about 17% a year prior.

As returns diminish and approach the yield available on short-term US Treasuries, rapidly moving capital has less motivation to remain invested.

Analysts noted that while hedge funds likely represent only 10% to 20% of ETF holders, their actions can dominate flows in the short term when the trade ceases to be effective.

Bloomberg data indicates that the unwind is observable in derivatives markets as well.

Bitcoin futures open interest on the Chicago Mercantile Exchange (CME) has dropped below Binance’s for the first time since 2023, reflecting reduced participation in cash-and-carry trades by US institutions following the launch of ETFs there.

One-month annualized basis yields are currently around 4.7%, barely exceeding funding and execution costs, as spreads tighten and arbitrage opportunities diminish.

CryptoQuant indicators show evident demand turning negative, with whale and dolphin wallets transitioning from accumulation to distribution.

Furthermore, the Coinbase premium remained significantly negative, indicating a weaker appetite from US institutions.

Simultaneously, leverage in Bitcoin futures has risen to its highest level since November, heightening the market’s sensitivity to sudden movements in either direction.

Flows in other crypto ETFs emphasize that the sell-off is not uniform.

Ethereum spot ETFs also experienced substantial outflows this week, including $41.98 million on January 22, while XRP and Solana-linked products saw slight inflows, suggesting selective institutional repositioning rather than a comprehensive exit from digital assets.

The post Bitcoin ETFs Bleed $1.62B in Four Days — Are Hedge Funds Dumping BTC? appeared first on Cryptonews.