Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin Drops Under $95K, Yet ETF Interest Reaches Statistical Highs – Are Whales Accumulating Once More?

This week, Bitcoin has dropped below $95,000 after pulling back from recent peaks close to $98,000. However, indicators of institutional demand are showing their strongest signals in months, as U.S. spot ETF inflows surge past statistical norms.

Even with the price decline, on-chain analytics reveal tightening sell-side pressure and renewed accumulation, indicating that whales might be accumulating during this consolidation phase.

Glassnode’s most recent market analysis verifies that Bitcoin remains in a consolidation phase rather than experiencing a trend decline, with the 14-day RSI decreasing from 63.6 to 61.0 while staying above neutral levels.

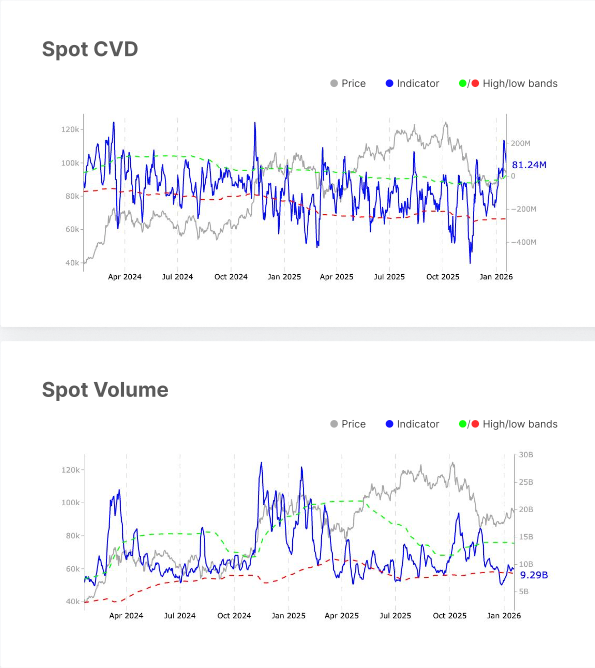

Spot trading volume increased slightly from $8.8 billion to $9.3 billion, along with a significant shift in the net buy-sell imbalance that broke above its upper statistical band, skyrocketing from -$4.6 million to $81.2 million, a remarkable 1,877% rise signifying a robust decrease in sell-side pressure.

Source: Glassnode

Source: Glassnode

ETF Demand Hits Statistical Extremes

U.S. spot Bitcoin ETF flows witnessed a sharp reversal last week, changing from $1.3 billion in outflows to $1.7 billion in inflows, pushing activity far beyond statistical averages.

This extreme reading suggests renewed institutional accumulation, with weekly ETF trading volume increasing from $16.8 billion to $21.8 billion, both metrics exceeding their historical averages.

Source: Glassnode

Source: Glassnode

BlackRock’s IBIT was the primary driver of the inflow surge, capturing $1.035 billion during the trading week of January 12–16, accounting for nearly three-quarters of total Bitcoin ETF demand.

CryptoQuant CEO Ki Young Ju confirmed the trend of institutional accumulation, stating, “Institutional demand for Bitcoin remains strong.”

Institutional demand for Bitcoin remains strong.

US custody wallets typically hold 100-1,000 BTC each. Excluding exchanges and miners, this gives a rough read on institutional demand. ETF holdings included.

577K BTC ($53B) added over the past year, and still flowing in. pic.twitter.com/kG1c8dTvlq— Ki Young Ju (@ki_young_ju) January 19, 2026

He remarked that U.S. custody wallets (generally holding between 100 and 1,000 BTC each) added 577,000 BTC valued at $53 billion over the past year, with flows continuing into January despite price consolidation.

The ETF MVRV ratio rose to 1.71, sitting just above its upper statistical threshold, indicating that ETF holders remain comfortably in profit.

Glassnode analysts noted this heightened profitability as introducing a mild short-term profit-taking risk, although overall sentiment remains positive as institutions continue to increase their positions.

Mixed Derivatives Positioning Amid Decreased Leverage

Futures markets presented mixed signals as open interest grew from $31.0 billion to $31.5 billion, reflecting what Glassnode analysts describe as a “cautious” rebuilding of speculative interest.

Funding rates plummeted by 60.6%, from $1.5 million to $0.6 million daily, indicating a sharp decline in long-side urgency and a more balanced positioning following recent enthusiasm.

The perpetual cumulative volume delta improved from -$437.7 million to -$6.2 million, rising above its upper statistical band.

Options markets continued to reflect heightened uncertainty, with open interest increasing from $29.96 billion to $32.89 billion, while the volatility spread widened from 42.8% to 44.6%, approaching the upper limits of its historical range.

On-Chain Activity Stabilizes With Cautious Improvement

Key blockchain metrics demonstrated tentative recovery across various indicators.

Active addresses rose by 3.8% to 656,294, remaining below the lower statistical band but indicating improved network engagement without excessive speculation.

Entity-adjusted transfer volume increased by 3.9% to $8.6 billion, maintaining a balanced level of on-chain activity.

Bitcoin fee volume grew by 13.2% to $241,100, surpassing the lower statistical band.

The short-term-to-long-term holder supply ratio also rose from 16.7% to 17.0%, moving above its upper statistical threshold amid increased trading activity and potentially higher volatility.

Realized cap change also improved from -0.3% to -0.1%, indicating stabilizing capital flows and a reduction in sell-side pressure.

The percentage of supply in profit increased from 70.6% to 75.1%, while net unrealized profit/loss improved from -8.1% to -3.8%, with both metrics suggesting reduced market stress and recovering investor sentiment.

Ethereum ETFs showcased notable strength in December, with Fidelity’s FETH attracting $59.25 million and Grayscale’s Ethereum Mini Trust adding $39.21 million, ranking among the top 10 U.S. ETPs by net inflows.

January flows accelerated further, with spot Ethereum ETFs capturing $479 million during the week of January 12–16, led by BlackRock’s ETHA at $219 million.

The post Bitcoin Falls Below $95K, But ETF Demand Just Hit Statistical Extremes – Are Whales Loading Up Again? appeared first on Cryptonews.