Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin Cash Futures Surge 24% Amidst Six-Year Low in Active Addresses – Is There a Risk?

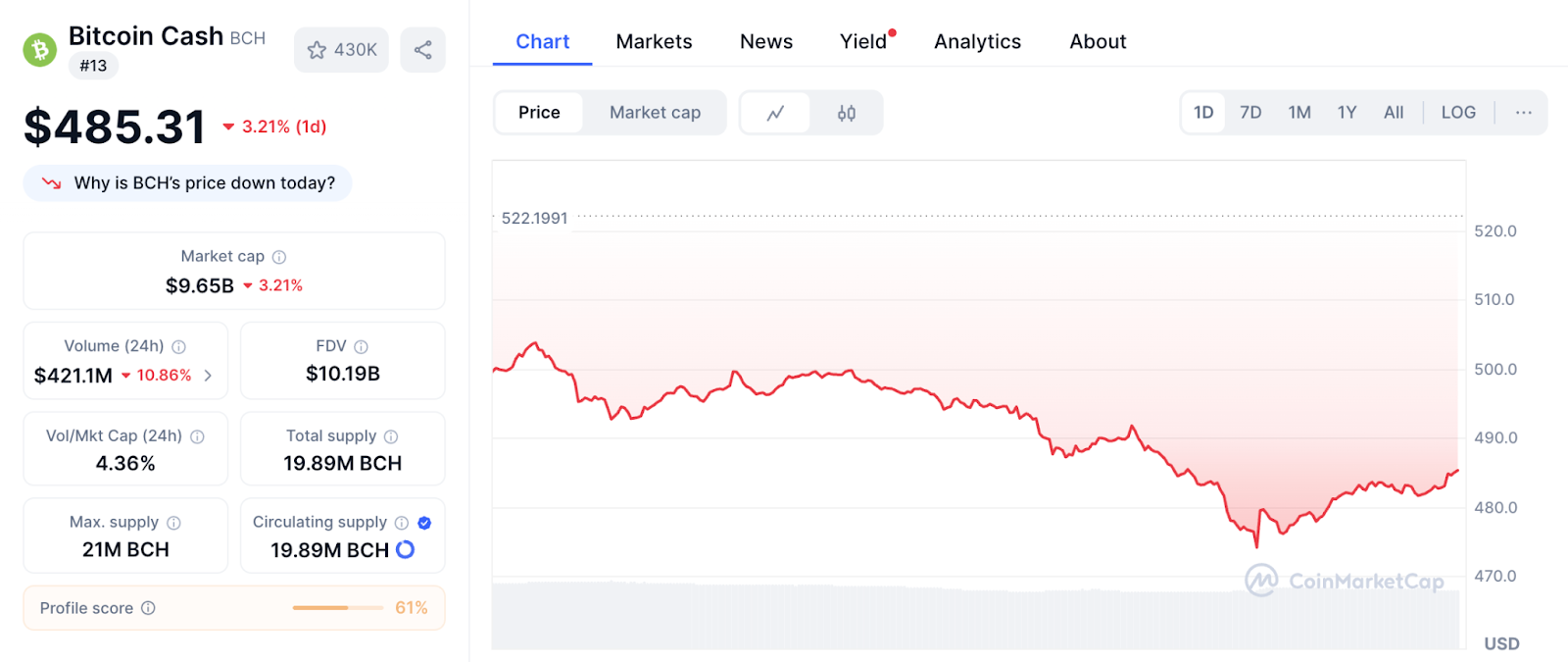

Bitcoin Cash (BCH) experienced a decline of 7.8% this week as it dropped below $485, coinciding with a 24% increase in futures open interest, revealing a concerning disparity between speculative investments and a six-year low in network activity.

The altcoin’s 20% surge in June now seems precarious. While derivatives traders increased their positions, daily active addresses plummeted to levels not seen since 2018. With the RSI indicating bearish divergences, BCH must maintain support at $400 to prevent losing all recent gains.

Source: CoinMarketCap

Source: CoinMarketCap

Can $BCH Maintain Its Speculative Rally Into a Genuine Bull Run?

Introduced in August 2017 as a fork of Bitcoin, Bitcoin Cash ($BCH) was created to enable quicker and more affordable transactions by expanding the block size limit from 1 MB to 8 MB.

BCH is a peer-to-peer electronic cash system.

BTC is not. pic.twitter.com/0L3xtKN1sX— Roger Ver (@rogerkver) September 16, 2018

The network, which operates on a proof-of-work consensus mechanism, currently has around 19.8 million $BCH in circulation, with a maximum supply capped at 21 million $BCH.

A significant upgrade on May 15, 2025, introduced targeted virtual-machine limits, high-precision arithmetic, and an adaptive block-size algorithm to enhance scalability and reliability.

While these improvements aim to support more sophisticated on-chain applications, adoption remains limited—daily active addresses have recently reached six-year lows, suggesting that recent price fluctuations may be more influenced by speculation than by actual utility.

Despite low on-chain activity, institutional interest has risen.

$BCH is defying gravity, up 5% in 24h and +20% vs $BTC in 4 weeks, just as the golden cross hits on the BCH/BTC pair.

Volume surged 3x, but here’s the catch: on-chain activity is at a 6-year low.

Speculators are celebrating, but the fundamentals? Still on vacation.

Bull trap? pic.twitter.com/PXsxog01rz— Joe Swanson (@Joe_Swanson057) July 1, 2025

Open interest in $BCH futures increased by over 24% in June, while trading volume more than doubled after $BCH surpassed $500 on June 27. This briefly elevated its market capitalization above $10 billion, placing it 12th, although it has since fallen to 13th with a valuation of $9 billion.

Analysts highlight $BCH’s scalability and stability above $400 as crucial bullish indicators but caution that bearish RSI divergences could limit further advances.

$BCH zoooomed out view, dates back to late 2022, weekly tf, the highlight of this chart is notice the wave counts, early stages of a macro 3rd wave, price currently early stage wave 1 of a larger 3rd degree wave…not familiar with elliot wave? Ask GPT or Grok about 3rd waves… pic.twitter.com/JWzHNcxfVR

— Disrupt Yourself (@EasychartsTrade) June 28, 2025

Bitcoin Cash’s DeFi ecosystem shows promise but faces challenges in gaining traction. Despite $BCH’s low fees and high throughput—benefits that attract niche developers—the chain’s total value locked (TVL) of $7.9 million and modest daily DEX volume of $13,841 indicate limited real-world application.

This disconnect becomes more pronounced when analyzing recent price movements. While $BCH surged 20% in June, on-chain activity reached six-year lows, confirming that the rally was driven by derivatives speculation rather than organic growth.

$BCH is defying gravity, up 5% in 24h and +20% vs $BTC in 4 weeks, just as the golden cross hits on the BCH/BTC pair.

Volume surged 3x, but here’s the catch: on-chain activity is at a 6-year low.

Speculators are celebrating, but the fundamentals? Still on vacation.

Bull trap? pic.twitter.com/PXsxog01rz— Joe Swanson (@Joe_Swanson057) July 1, 2025

BCH must translate its technical advantages (such as the scalability upgrades from May) into merchant adoption and developer incentives for sustainable growth. The 24% rise in futures open interest indicates that market confidence exists; now, the network must provide corresponding on-chain utility.

For $BCH to achieve long-term growth, it needs to enhance merchant adoption and developer incentives. While recent upgrades and increasing futures interest lay a foundation, broader acceptance will hinge on the network’s ability to convert technical advancements into practical usage.

BCH/USDT Chart Analysis: From Bullish Breakout to Bearish Retracement and Potential Reversal

The BCH/USDT chart illustrates a distinct transition through various market phases, starting in late June and extending into early July.

BCH price chart Source: TradingView

BCH price chart Source: TradingView

Initially, the price demonstrated a robust uptrend, marked by a sharp breakout and large green candles supported by significant volume. This swift rally propelled BCH from approximately $475 to just below $510.

This bullish momentum halted as the price entered a sideways consolidation phase, creating a range-bound pattern between roughly $500 and $510. During this time, volume decreased, and MACD flattened, signaling indecision and diminishing buying pressure.

As the consolidation broke to the downside, BCH entered a consistent downtrend, forming a series of lower highs and lower lows. The price declined steadily with minor relief bounces, ultimately breaking below the $480 support level. The downtrend was accompanied by increasing red volume bars, indicating rising selling pressure.

Recently, the chart indicates signs of a bullish bounce, with a sharp reversal from the $472–$474 range. This was confirmed by a bullish MACD crossover beneath the zero line, suggesting that bearish momentum has diminished and buyers are beginning to enter the market. Volume also increased slightly, supporting the short-term bullish reversal.

However, for this recovery to be sustainable, BCH must reclaim the $488–$490 resistance zone and maintain momentum above the MACD baseline. If rejected, the price risks retesting the $474 support.

The post Bitcoin Cash Futures Jump 24% as Active Addresses Hit Six-Year Low – Risk Ahead? appeared first on Cryptonews.