Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Binance, OKX, Bybit, and Bitget Lead Q2 Amid Decrease in Exchange Activity: TokenInsight

The cryptocurrency sector exhibited initial recovery signs in Q2 2025, primarily fueled by a resurgence of interest in spot Bitcoin exchange-traded funds (ETFs) alongside a significant price increase in Bitcoin itself.

As per TokenInsight’s most recent Exchange Report, the overall crypto market capitalization rose to $3.46 trillion by the end of the quarter, marking a 28.2% increase from Q1.

Nonetheless, trading activity did not align with the broader market recovery, as cautious market sentiment, limited participation from altcoins, and macroeconomic challenges contributed to a decline in trading volumes.

Trading Volume Declines Despite Bitcoin’s Ascendancy

According to TokenInsight, the total trading volume across the leading 10 crypto exchanges reached $21.6 trillion in Q2, reflecting a 6.16% decrease from the preceding quarter.

1/ The Top 10 exchanges total $21.58T in volume, a decrease of 6.16% compared to the previous quarter. pic.twitter.com/Ue57kdpUP0

— TokenInsight (@TokenInsight) July 16, 2025

While Bitcoin surged from $83,000 to over $111,000 before settling around $106,000, the remainder of the market displayed mixed results.

Liquidity remained focused on a select few large-cap assets, with numerous altcoins experiencing minimal activity and significant declines in interest.

The spot market, in particular, saw a notable decline: average daily spot trading volume fell from $51 billion in Q1 to $40 billion in Q2. The total spot volume across major exchanges was $3.63 trillion, indicating a 21.7% decrease quarter-on-quarter.

Derivatives trading performed slightly better, reaching $20.2 trillion, which is down 3.6% from Q1. This sector proved to be more resilient as traders aimed to hedge against volatility and manage risks in the face of ongoing geopolitical conflicts and sluggish global growth.

The average daily derivatives trading volume dipped to $226 billion, compared to $233 billion in Q1, highlighting a general market caution.

Binance Maintains Leadership, But Market Share is Evolving

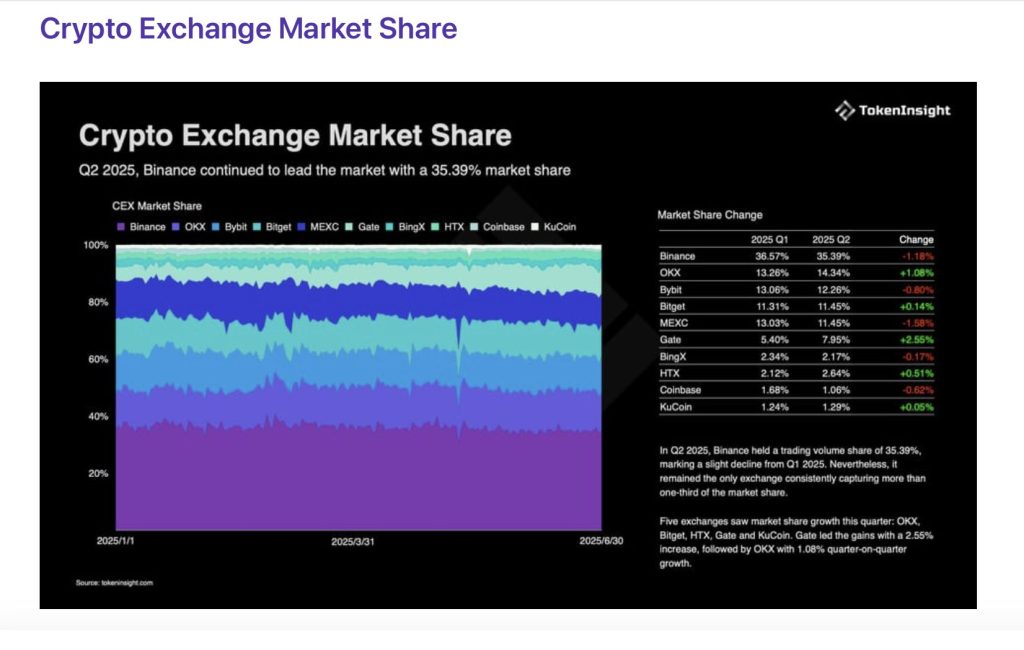

Binance continues to lead in total trading volume with a 35.39% share, although this reflects a slight decline from Q1. Other exchanges gained traction: OKX, Bitget, HTX, Gate, and KuCoin all increased their market shares during the quarter. Gate achieved the largest gain with a 2.55% rise, followed by OKX with a 1.08% increase.

In the open interest market, Binance bolstered its position with a 0.36% rise, attaining a 23.83% share. Bitget, OKX, and HTX also recorded modest increases.

The data indicates a gradual diversification in user behavior, as smaller platforms continue to draw more trading volume despite the overall market activity slowdown.

Exchange Tokens Underperform in Comparison to Bitcoin Surge

While Bitcoin experienced a 31.62% increase in Q2, tokens associated with exchanges lagged behind. BNB led the group with an 8.91% gain, followed by slight increases in OKB, BGB, and KCS.

Most other exchange tokens saw declines, reflecting decreasing interest in altcoin markets. As noted by TokenInsight, exchange tokens remain closely linked to altcoin activity, which faced diminished liquidity and volume during the quarter.

With ongoing macroeconomic uncertainties and inconsistent regulatory developments, Q3 is anticipated to pose challenges for the performance of exchange tokens.

TokenInsight expects continued divergence in this segment as market participants concentrate on high-cap assets and proceed with caution in allocating capital across the exchange sector.

The post Binance, OKX, Bybit, and Bitget Dominate Q2 as Exchange Activity Slows: TokenInsight appeared first on Cryptonews.