Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Binance Holds 65% of Centralized Exchange Stablecoin Reserves – Implications for Liquidity

Following a challenging week, Binance continues to strengthen its hold on the cryptocurrency market. The exchange now commands 65% of all stablecoin reserves located on centralized platforms.

Currently, it possesses approximately $47.5 billion in USDT and USDC combined. This represents a significant portion of cryptocurrency liquidity concentrated in a single location.

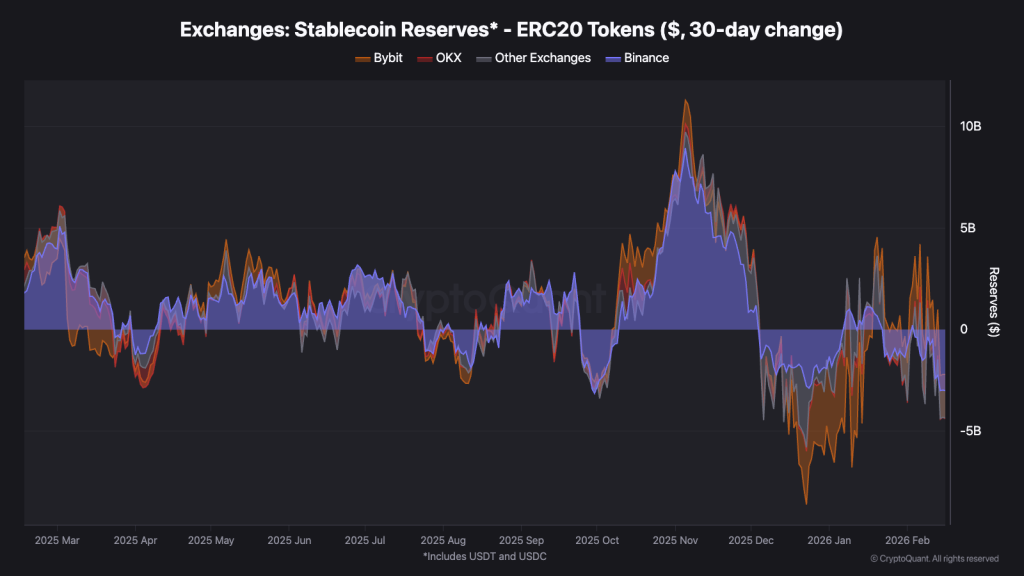

What adds to the intrigue is the current timing. Overall market outflows have decreased to about $2 billion. Thus, while capital is not entering the market aggressively, Binance is subtly reinforcing its control over the stablecoin supply.

In the cryptocurrency realm, liquidity equates to influence. Binance is accumulating a substantial amount of it.

Key Takeaways

- Dominant Market Share: Binance currently holds $47.5 billion in stablecoins, accounting for 65% of all centralized exchange liquidity.

- Outflows Stabilize: Monthly stablecoin outflows have slowed to $2 billion, a significant decline from the $8.4 billion recorded in late 2025.

- Competitors Trail: The closest competitor, OKX, controls only 13% of reserves, underscoring a growing disparity in exchange liquidity depth.

Why is Capital Consolidating?

Funds are not fleeing from cryptocurrency; they are relocating to perceived safer environments. During the peak of the late 2025 turmoil, redemptions reached $8.4 billion. Now, outflows have stabilized at around $2 billion this month. This change indicates a rotation rather than a complete withdrawal.

Source: Cryptoquant

Source: Cryptoquant

Rather than exiting the ecosystem, investors seem to be consolidating around platforms with deeper liquidity and quicker execution. In constrained conditions, traders prioritize slippage and reliability over distributing funds across smaller exchanges.

This is why capital is congregating on the largest platforms. When uncertainty increases, perceived safe havens draw the majority of the flow.

Binance Stablecoin Data Breakdown

The extent of Binance’s lead is difficult to overlook. Data indicates that the exchange now holds around $47.5 billion in stablecoins, an increase from $35.9 billion a year prior.

This marks a 31% rise over twelve months. The growth followed a distinct shift after the BUSD wind-down, with liquidity significantly moving into USDT and USDC.

Source: CryptoQuant

Source: CryptoQuant

In contrast, competitors lag far behind. OKX manages approximately $9.5 billion. Coinbase is close to $5.9 billion. Bybit follows with roughly $4 billion. The disparity is considerable and structural.

Recent reserve reports reveal Binance’s total reserves, including cryptocurrency assets, exceed $155 billion. When liquidity changes on Binance, it tends to have a ripple effect throughout the market. This illustrates the extent of its dominance.

The post Binance Controls 65% of CEX Stablecoin Reserves – What It Means for Liquidity appeared first on Cryptonews.