Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Billionaire Michael Saylor’s Approach Acquires 13,627 Bitcoin for $1.25B

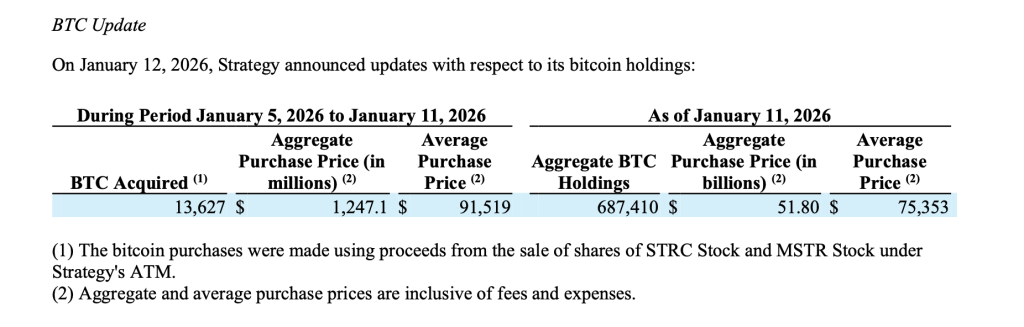

Strategy revealed in a regulatory document that it has acquired an additional 13,627 bitcoins between January 5 and January 11, investing around $1.25 billion at an average purchase price of $91,519 per BTC, inclusive of fees and expenses.

Strategy has purchased 13,627 BTC for approximately $1.25 billion at around $91,519 per bitcoin. As of 1/11/2026, we hold 687,410 $BTC acquired for about $51.80 billion at an average price of $75,353 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STRE https://t.co/bIbPbFAbTa

— Strategy (@Strategy) January 12, 2026

This acquisition further solidifies the firm’s status as the largest corporate holder of bitcoin worldwide and continues its established strategy of utilizing capital market activities to amass the digital asset.

Total Holdings Reach 687,410 BTC

As of January 11, Strategy reported total bitcoin holdings amounting to 687,410 BTC, obtained for an estimated total of approximately $51.80 billion. The company’s average purchase price across its entire portfolio is noted to be $75,353 per bitcoin, as detailed in the filing.

This latest acquisition occurs despite recent fluctuations in bitcoin prices and a broader retreat in digital asset investment products, indicating Strategy’s ongoing belief in bitcoin as a long-term treasury reserve asset.

Purchases Funded Through Equity and Preferred Stock Issuance

The filing indicates that the bitcoin acquisitions were financed through proceeds from the sale of shares under the company’s at-the-market (ATM) programs, which included both common and preferred equity.

During this timeframe, Strategy sold 1,192,262 shares of STRC, its Variable Rate Series A Perpetual Stretch Preferred Stock, generating $119.1 million in net proceeds. Additionally, the company sold 6,827,695 shares of MSTR Class A common stock, raising $1.13 billion in net proceeds.

No shares were sold during this period from its other preferred stock offerings, including STRF, STRK, and STRD, although considerable issuance capacity is still available across these instruments.

Capital Structure Supports Ongoing Bitcoin Accumulation

As of January 11, Strategy reported a significant remaining capacity for future issuance, including over $20.3 billion under STRK, $4.0 billion under STRD, $3.9 billion under STRC, and $1.6 billion under STRF. The company also has more than $10.2 billion of availability under its MSTR common stock program.

This structure enables Strategy to continue accessing capital opportunistically while distributing financing across common equity and multiple tiers of preferred stock with diverse dividend features.

A Long-Term Bitcoin Treasury Strategy

Strategy’s disclosure emphasizes its belief that bitcoin remains the central asset on its balance sheet. While the company’s average acquisition price is significantly below recent market peaks, the speed and volume of accumulation demonstrate its readiness to invest substantial capital irrespective of short-term price fluctuations.

With almost 700,000 BTC now in possession, Strategy’s balance sheet has evolved into one of the most concentrated institutional representations of long-term bitcoin exposure in global markets.

The post Billionaire Michael Saylor’s Strategy Scoops 13,627 Bitcoin for $1.25B appeared first on Cryptonews.