Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Billionaire Michael Saylor Suggests Additional Bitcoin Purchases in Midweek Update

“Considering the purchase of additional bitcoin,” Michael Saylor posted on Thursday morning, emphasizing Strategy’s standing as one of the most proactive corporate buyers of BTC.

Considering the purchase of additional bitcoin.

— Michael Saylor (@saylor) January 22, 2026

This X post follows the company’s recent announcement that it has increased its balance sheet by adding 22,305 bitcoin, investing around $2.13 billion as part of its continuous accumulation plan. The acquisition was made at an average cost of $95,284 per BTC, including fees and expenses.

Recent Acquisition Boosts Strategy’s Bitcoin Holdings

The acquisition revealed on January 20 was financed through proceeds from Strategy’s at-the-market equity and preferred stock offerings executed between January 12 and January 19.

This method reflects the company’s earlier capital-raising strategies, which have consistently transformed equity issuance into bitcoin investment during times of market consolidation.

As of January 19, Strategy possesses 709,715 bitcoin, obtained for roughly $53.92 billion at an average price of $75,979 per BTC.

Bitcoin Price Movement Indicates Consolidation

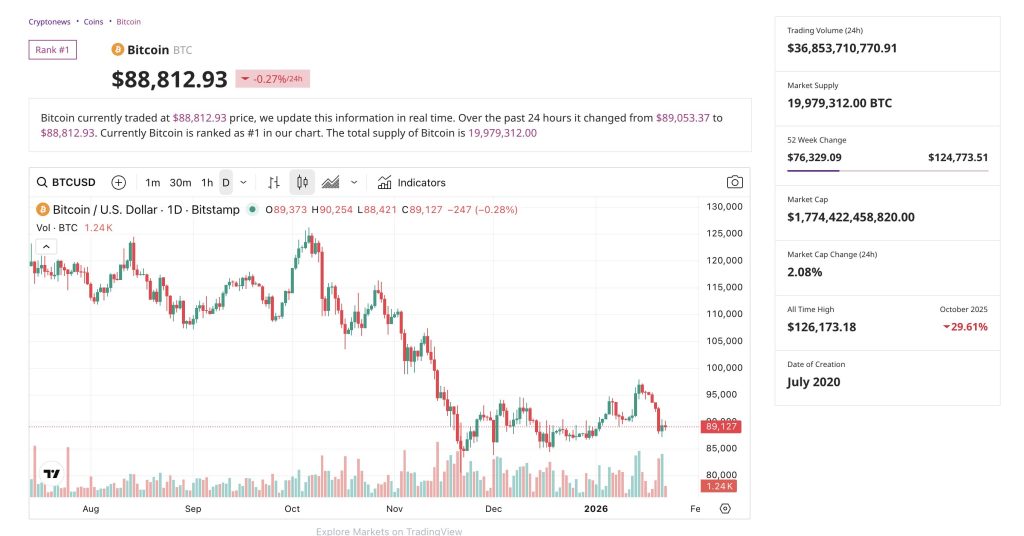

Bitcoin is priced around $88,800 on Thursday, representing a decline of approximately 0.3% over the last 24 hours, based on CryptoNews data. The asset has retreated from recent peaks above $95,000 and remains significantly below its all-time high near $126,000 recorded in October 2025.

Recent price trends indicate that bitcoin is operating within a broad consolidation range, with buyers emerging around the $85,000–$90,000 area while upward momentum has paused beneath $100,000.

Trading volumes have decreased, indicating that market participants are awaiting new catalysts amid tightening financial conditions and evolving macroeconomic expectations.

Despite the recent decline, bitcoin remains up year-over-year, with its market capitalization hovering around $1.77 trillion, showcasing its status as the dominant digital asset by a substantial margin.

Markets reacted sharply after President Donald Trump threatened significant tariffs on eight European countries unless Denmark relinquishes Greenland, with statements suggesting that the U.S. might take control of the territory by force, causing a global risk-off response on January 20.

Gold soared to unprecedented highs while Bitcoin fell into the low-$90K range, with some intraday transactions dipping as low as $87K.

Strategy’s Long-Term Belief Persists

Saylor has characterized bitcoin as a long-term treasury reserve asset rather than a short-term investment. Strategy’s accumulation rate has shown minimal sensitivity to short-term fluctuations, with purchases continuing in both rising and declining markets.

The latest X post and the acquisition made earlier this week illustrate the company’s perspective that periods of consolidation are viewed as accumulation opportunities rather than signs of weakness.

While the strategy has garnered both praise and criticism from market analysts, Saylor has consistently maintained that bitcoin’s long-term scarcity and monetary characteristics outweigh temporary downturns.

The post Billionaire Michael Saylor Hints at More Bitcoin Buying in Mid-Week Post appeared first on Cryptonews.