Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Billionaire Investor Claims Ethereum Has Reached Its Lowest Point – Is This the Time for Strategic Investments?

Key opinion leader Tom Lee asserts that the wider market has misjudged the situation; savvy investors remain steadfast in their optimistic Ethereum price forecasts.

Prominent Ethereum supporter Tom Lee contends that the altcoin is at or close to its lowest point, suggesting that the downturn has exceeded expectations as price movements diverge from improving fundamentals.

In a CNBC interview on Monday, Lee remarked that the cryptocurrency sector had “suffered more than anticipated,” highlighting aggressive liquidity reductions that eliminated excess leverage and resulted in a broadly deleveraged market.

Tom Lee states that the cryptocurrency market has endured more than expected due to the absence of leverage at present.

The overall economy is in relatively good condition. pic.twitter.com/WrofY5iNzO— BMs (@bmsquantum) February 2, 2026

He framed the situation as a decline in risk appetite, with capital shifting from cryptocurrencies to traditional safe havens such as gold and silver, which are favored as hedges against the prevailing macroeconomic narrative.

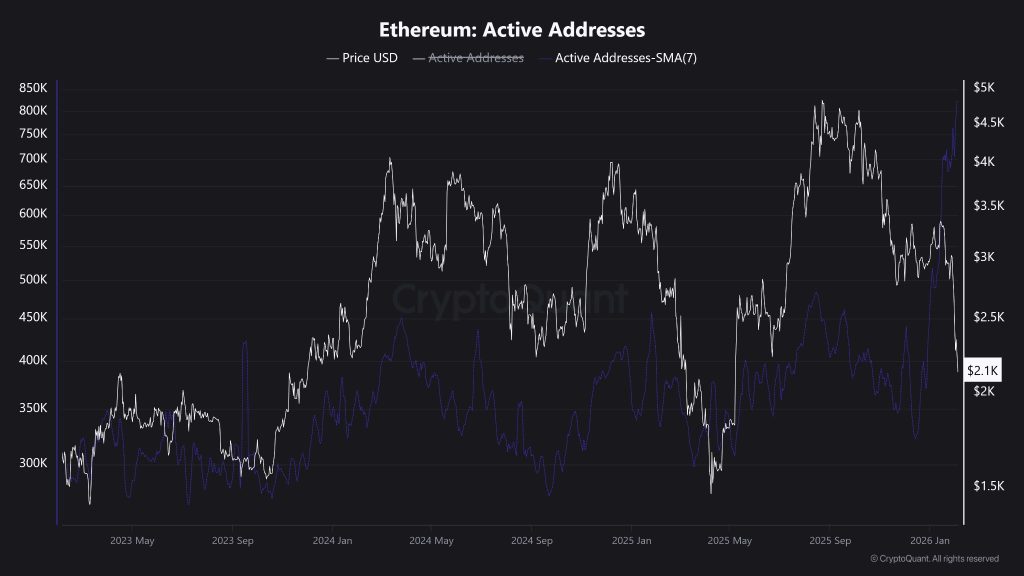

However, underlying network activity presents a contrasting narrative. Weekly active addresses have surged to new all-time highs, surpassing the peak participation recorded during the 2021 bull market at 825,000.

Ethereum Active Addresses 7-day SMA. Source: CryptoQuant.

Ethereum Active Addresses 7-day SMA. Source: CryptoQuant.

When fundamentals continue to improve while prices lag, Lee believes it is merely a matter of time before they realign and the market stabilizes.

His actions reflect his conviction. Tom Lee-led ETH treasury firm BitMine augmented its holdings by 20,000 ETH during trading on Tuesday, despite unrealized losses reaching $7 billion following the crash.

Ethereum Price Prediction: First a Bottom, Then a Boom

The assertion that Ethereum is nearing a bottom may have a technical foundation, as it approaches the lower support trendline of the ascending triangle that has influenced price movements throughout this cycle.

ETH USD 1-week chart, ascending triangle pattern. Source: TradingView.

ETH USD 1-week chart, ascending triangle pattern. Source: TradingView.

The RSI is nearing the 30 oversold threshold, indicating that capitulation may be occurring, which increases the likelihood that the pattern retains its historical significance.

While the liquidation event over the past week has pushed the MACD further from a golden cross above the signal line, it does not diminish the momentum it had built in the preceding months.

Ethereum approaches a potential pivot point. With a rebound, attention will quickly turn to a 130% increase towards the upper boundary of the pattern, exceeding all-time highs around $5000.

If stronger and more stable support is established here, Ethereum could enter a new phase of price discovery, with the next significant target being 365% higher at $10,000.

However, the pattern sets the stage for a multi-year rally. If fully realized, it could see gains extend 1,300% towards the $30,000 level, although that is more likely to occur in the next cycle.

Bitcoin Hyper Presale: Solana Technology is Coming to Bitcoin

Those who chose alternative layer-1s like Ethereum over the leading cryptocurrency may need to reassess as the Bitcoin ecosystem addresses its primary limitation: scalability.

Bitcoin Hyper ($HYPER) is merging Bitcoin’s security with Solana technology, creating a new Layer-2 network that enables faster, cheaper, and more versatile use cases that Bitcoin could not support independently.

This enhancement positions Bitcoin to re-enter high-growth narratives such as DeFi and real-world asset tokenization – where throughput and efficiency are essential.

The project has already secured nearly $31 million in presale, and after launch, even a small portion of Bitcoin’s substantial trading volume could significantly elevate its valuation.

By tackling slow settlement times, high fees, and limited programmability, Bitcoin Hyper eliminates longstanding obstacles for Bitcoin.

To purchase $HYPER at the presale price, visit the official Bitcoin Hyper website and connect a wallet (such as Best Wallet).

You can exchange existing cryptocurrency or use a bank card to finalize the transaction in just a few clicks.

Visit the Official Bitcoin Hyper Website Here

The post Ethereum Price Prediction: Billionaire Investor Says ETH Just Hit Bottom – Is This the Moment Smart Money Loads Up? appeared first on Cryptonews.