Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

As SOL ETFs Rise, Alchemy Enhances Solana’s Infrastructure for Institutional Capacity

Investors have invested over $280 million into newly launched U.S. Solana exchange-traded funds (ETFs) within just six trading days, with analysts now estimating potential inflows of up to $5 billion over the coming year.

As Solana becomes a focal point for institutional portfolios, concerns are rising regarding whether its infrastructure can support high-frequency operations across ETFs, wallets, and consumer applications.

Web3 infrastructure company Alchemy has stated that to address this increasing demand, it has entirely restructured its Solana stack. This redesign aims to provide near-zero downtime, quicker response times, and enhanced throughput, ensuring that both institutional and retail users enjoy a smooth network experience even during peak loads.

This week, Solana seems to have dismissed broader Fed-induced uncertainty, with policymakers reiterating that December rate reductions are “not a foregone conclusion” this week.

BSOL has unlocked $417 million in new capital for Solana’s ecosystem, serving as a new entry point for U.S. investors to access regulated SOL staking yields.

What a week for $BSOL, besides the big volume, it led all crypto ETPs by a country mile in weekly flows with +$417m ($IBIT had a rare off week, it’ll be back). It also ranked it 16th in overall flows for the week. Big time debut. pic.twitter.com/HpKUTdq1J5

— Eric Balchunas (@EricBalchunas) November 1, 2025

Engineered for Scale and Speed

Alchemy indicates that its Solana rebuild was the result of two years of collaboration with developers throughout the ecosystem. Partnering with teams from Bags.fm, Solflare, and Robinhood, the company examined the actual bottlenecks developers faced when accessing Solana data and processing transactions.

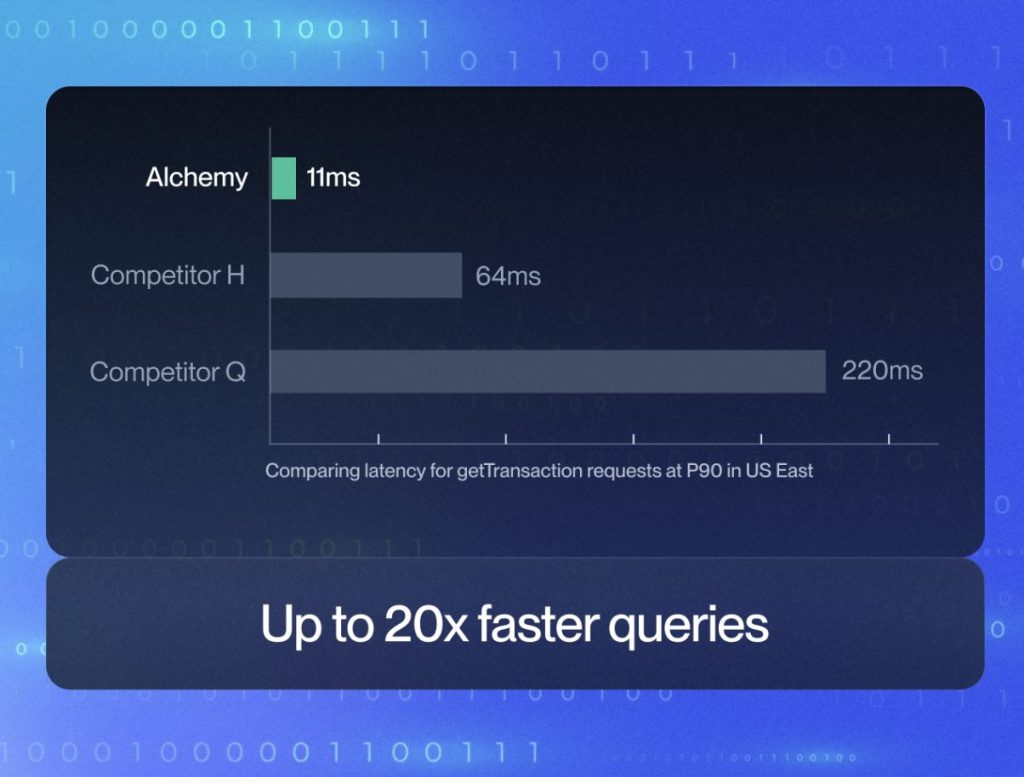

The outcome is a new generation of RPC and Streaming APIs specifically designed for Solana. The enhanced infrastructure provides 20 times faster archive calls, 99.95% uptime, and double the throughput compared to its previous iteration.

Alchemy’s engineering team has also optimized the system to manage large data sets with improved reliability, allowing for near-instant responses on transaction-intensive workloads. This results in quicker user experiences on exchanges, wallets, and analytics platforms that rely on continuous access to on-chain data.

Addressing the “Chewing Glass” Challenge

Solana developers have long described the network’s complexity as “chewing glass” — a metaphor for the challenging technical environment they have embraced to create next-generation financial products. While Solana’s core protocol has advanced, the surrounding tools and infrastructure have often struggled to keep up.

Alchemy’s research revealed that many developers faced recurring challenges when accessing historical data due to limitations in Bigtable-based RPC systems, leading to missing records, throttling, or incomplete data sets.

This compelled teams to devise intricate workarounds that hindered iteration and increased costs. The new Solana architecture removes those limitations, significantly speeding up heavy data operations such as getTransaction and getProgramAccounts while ensuring reliability at scale.

Infrastructure for the Institutional Era

With ETF adoption gaining momentum and Western Union set to introduce a stablecoin on Solana in 2026, the chain is entering an institutional phase where uptime and accuracy are as critical as speed.

By reconstructing Solana’s “plumbing” from the ground up, Alchemy has equipped the network to manage sustained institutional traffic and mass-market consumer applications without sacrificing performance.

As Solana’s ecosystem develops, Alchemy’s overhaul represents a significant turning point — one where the network transitions from “chewing glass” to facilitating finance at scale.

The post As SOL ETFs Surge Alchemy Rebuilds Solana’s Infrastructure for Institutional Scale appeared first on Cryptonews.