Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Arthur Hayes Outlines Two Possibilities for Bitcoin Valuation, Anticipating a Significant Cryptocurrency Surge

Arthur Hayes has recently changed his outlook. The co-founder of BitMEX is now predicting a significant cryptocurrency rally, linking it to a $572 billion liquidity influx originating from Washington.

The catalyst? A Treasury adjustment involving the TGA and increased buybacks. In straightforward terms, this means more cash is re-entering the system.

Hayes refers to this as monetary morphine. In his opinion, this liquidity boost indicates that the most challenging phase of the downturn is already behind us.

Key Takeaways

- The Thesis: A coordinated reduction of the Treasury General Account and debt buybacks will inundate markets with cash.

- The Numbers: Hayes estimates approximately $572 billion in net liquidity will enter the financial system by the end of the year.

- The Timeline: This influx creates a high-probability scenario for a Bitcoin rally commencing now.

Why Is Hayes Referring to This as a Liquidity Event?

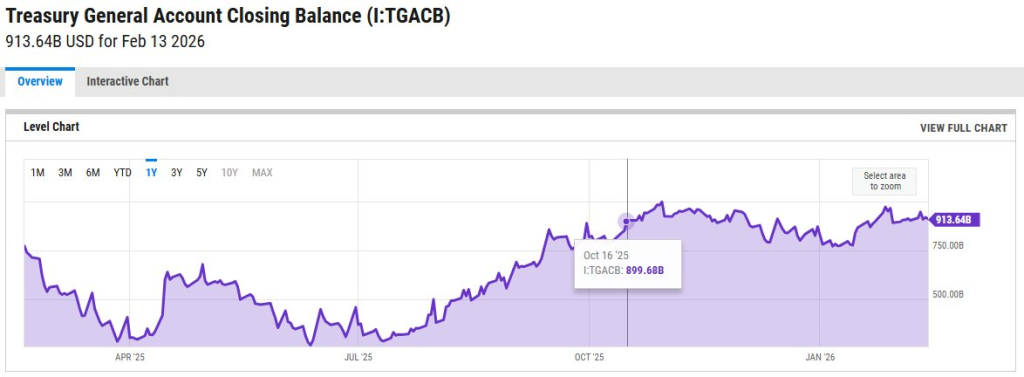

To understand Hayes’ perspective, one must examine the workings of the Treasury. The Treasury General Account functions as the government’s checking account at the Federal Reserve. When the balance is elevated, cash remains idle. As it is spent down, that money circulates into the banking system, enhancing overall liquidity.

Source: Treasury Gov

Source: Treasury Gov

Hayes describes this as stealth stimulus. While the Federal Reserve continues to emphasize tightening measures, the Treasury is discreetly reintroducing cash into circulation to stabilize the debt market. This discrepancy between rhetoric and action is where he identifies potential.

In essence, liquidity is being infused even if it is not explicitly labeled as easing. In flow-driven markets, this distinction is more significant than headlines. If the flow is active, risk assets like Bitcoin typically respond positively.

Analyzing the Figures: The $1 Trillion Inquiry

Hayes is clear about the magnitude. The TGA balance is currently around $750 billion, while Treasury guidance suggests a target closer to $450 billion. This variance alone indicates approximately $301 billion returning to the system as the balance decreases.

Source: MacroMico

Source: MacroMico

Additionally, consider the buybacks. The Treasury has begun repurchasing older bonds to ensure market functionality. Hayes estimates that this program could inject another $271 billion annually at the current rate. Combined, this results in about $572 billion in liquidity.

From his viewpoint, this level of flow counteracts much of the Federal Reserve’s quantitative tightening. Although it is not classified as easing, the impact can be similar. When liquidity increases, risk assets typically do not remain stagnant for long.

What Does This Imply for Bitcoin Price?

Hayes states it plainly. He believes the difficult period for crypto is over. Bitcoin has historically correlated with global liquidity, and if the supply of dollars is increasing again, that shifts the dynamics in favor of BTC.

An increased supply of USD often results in stronger upward pressure on limited assets.

Bitcoin (BTC)24h7d30d1yAll time

The current setup appears bullish. Funding rates have reached extremes, suggesting a crowded short position. If new Treasury liquidity begins to flow while shorts are positioned incorrectly, this scenario could lead to a rapid squeeze. Hayes anticipates that this could pave the way for a return toward all-time highs, potentially reaching $100,000.

He is not alone in this viewpoint. Major players are discreetly re-entering the market, increasing their exposure during downturns. Hayes’ message is straightforward. When liquidity shifts, markets react. This time, he believes the reaction will be upward, not downward.

Discover: Here are the crypto likely to explode!

The post Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally appeared first on Cryptonews.