Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Analysts Suggest Ethereum’s Increasing Inflation May Not Be Detrimental

Key takeaways:

- Experts suggest that the increasing inflation rate of Ethereum is not necessarily detrimental and may actually enhance network utility.

- They indicate that the short-term effects of Ethereum’s inflation are likely to negatively influence market expectations and investor sentiment.

- Ethereum’s inflationary framework differs from Bitcoin’s deflationary approach, yet it presents unique benefits in terms of network sustainability and flexibility.

According to three analysts and founders interviewed by Cryptonews, Ethereum’s shift to an inflationary model may not be a negative development.

This follows the second-largest cryptocurrency, after Bitcoin, experiencing a consistent rise in its average daily supply over recent months. The annual supply of Ethereum is projected to increase by approximately $1.5 billion by the end of the year, partly due to a reduction in ETH gas fees—the fees incurred to execute transactions on the Ethereum blockchain.

Data from Ultra Sound Money reveals that the Ethereum supply has grown by over 262,008 ETH since early April, reaching 120,326,493 ETH as of September 6. During this same timeframe, gas fees decreased by nearly 90%.

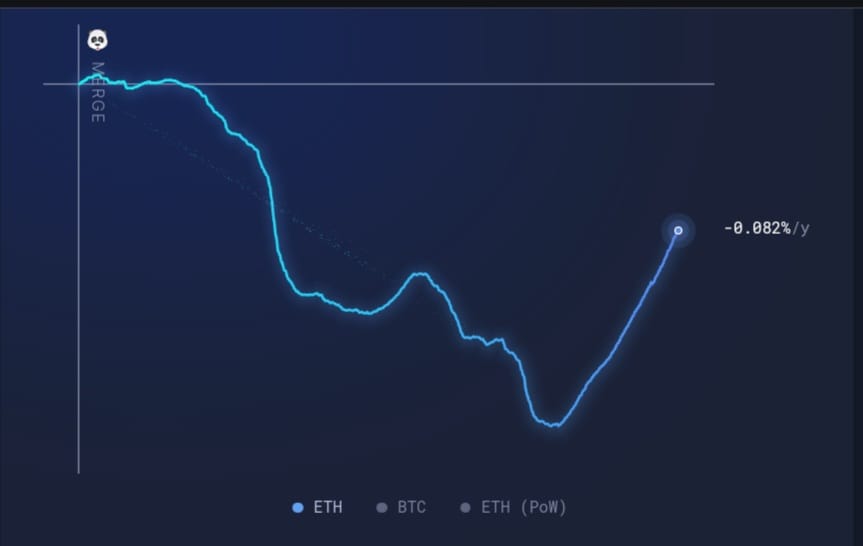

ETH supply since the Merge. Source: Ultra Sound Money

ETH supply since the Merge. Source: Ultra Sound Money

As the supply increased, many began to question the long-term stability and worth of Ethereum, referencing its previous deflationary traits as an initial attraction.

Nevertheless, analysts who spoke with Cryptonews concurred that ETH inflation is not intrinsically “harmful,” at least in the medium term. This is attributed to the fact that Ethereum’s emission model—or the rate at which new coins are introduced into circulation—differs fundamentally from Bitcoin’s.

“Ethereum has a carefully designed emission model that is based on the perception of ETH as a utility token fueling the Ethereum DeFi ecosystem,” stated Sasha Ivanov, founder of the decentralized open-source platform Waves.

“Consequently, it does not prioritize token scarcity in the same manner as Bitcoin, which has a capped total supply of 21 million. Instead, it emphasizes long-term network sustainability and guarantees that network validators will consistently receive rewards.”

Inflation Encourages Users to Spend Ethereum

Ethereum has not always been inflationary. In 2022, it transitioned to a more energy-efficient operating system in a process known as “The Merge,” and by the end of March 2024, the number of tokens entering circulation had decreased by over 452,000 ETH, according to Ultra Sound Money.

However, an update to the ETH network referred to as “Dencun” in March 2024 led to reduced gas fees, which somewhat contributed to Ethereum’s inflationary cycle.

A specific amount of ETH is destroyed—or “burned”—from the Ethereum network daily to decrease supply. This so-called “burn rate” is currently quite low, resulting in more Ethereum being issued than “burned.” This low burn rate is attributed to the decreased network fees following the Dencun update.

For instance, 7,380 ETH, valued at $17.7 million, were “burned” in the last 30 days. This contrasts with a total of 77,632 ETH, worth $186.3 million, issued during the same timeframe. Ethereum co-founder Vitalik Buterin commended the Dencun upgrade for saving users up to $100 million in fees.

ETH 30-day burn rate, supply and issuance. Source: Ultra Sound Money

ETH 30-day burn rate, supply and issuance. Source: Ultra Sound Money

Since the upgrade, however, Ethereum’s supply has been increasing at an average rate of 1,652 ETH per day. Based on this data and current Ethereum network activity, the annual inflation is projected to be around 600,000 ETH, valued at $1.44 billion at the current price, with an inflation rate of 0.7%.

In comparison, Bitcoin’s inflation rate is currently hovering around 0.8%, equating to $20 billion annually at current rates, as noted by Shubh Varma, CEO of New York City-based Hyblock Capital. He mentioned that Bitcoin, often praised for its deflationary model, remains technically inflationary until it reaches its maximum supply of 21 million in 115 years.

Solana’s inflation rate is at 8.9%, significantly higher than Bitcoin’s. This elevated rate reflects Solana’s strategy to rapidly grow its ecosystem.

In a conversation with Cryptonews, Varma stated:

“Contrary to popular belief, a low and stable [Ethereum] inflation rate isn’t necessarily detrimental; it can actually enhance utility. The premise is that a certain level of inflation motivates users to spend or utilize ETH instead of merely holding it (as holding could lead to value depreciation), thereby fostering economic activity within the network.”

Varma observed that low transaction fees resulting from the Dencun upgrade might introduce some inflation, “but they also enhance the network’s appeal by supporting increased demand and growth.” He added:

“If network activity and growth surpass the inflation rate, Ethereum’s value can still appreciate.”

Ryan Lee, chief analyst at Bitget Research, indicated that the rising inflation of ETH reflects a decline in on-chain activity and a drop in network adoption. He noted that the immediate effect would be on market expectations and investor sentiment.

“An increase in ETH circulation prompts investors to reconsider its long-term value, potentially resulting in negative market sentiment,” Lee stated.

However, he remained hopeful regarding the long-term effects, suggesting that historically, low gas fees have often indicated a price floor for ETH, leading to significant rebounds in the medium term.

Ethereum is Not Bitcoin

The alteration in Ethereum’s monetary policy is crucial for the network. It challenges the conventional narrative of ETH as a store of value. Instead, Ethereum’s value proposition is rooted in its utility as a token supporting an active DeFi ecosystem. This implies that the success of Ethereum is closely linked to the expansion and adoption of its network rather than its scarcity.

As Bitget’s Lee points out, “Ethereum must scale effectively through L2 solutions while preserving its core value on the mainnet. Relying solely on L2s without sufficient incentives for mainnet interaction may not represent the best strategy.”

Ivanov, the Waves founder, remarked that during periods of high network activity, Ethereum can become deflationary due to its fee-burning mechanism.

“Conversely, this leads to heightened inflationary pressure during times when the network is underutilized. If Ethereum’s utility does not expand, it may result in persistent price pressure, which could trigger further underutilization,” he explained.

Ivanov emphasized that Ethereum was never intended to serve as a store of value like Bitcoin, stating:

“Its [ETH] future relies entirely on its utility as a token supporting a vibrant DeFi ecosystem existing in Ethereum Layer 1 and Layer 2 chains built upon it. If Ethereum DeFi thrives, its inflation mechanics will only bolster its success.”

While Bitcoin pioneered the concept of peer-to-peer (P2P) cryptographic transactions, Ethereum ushered in the next evolution in crypto with its smart contracts—decentralized applications (dApps) that enabled innovative financial products, including NFTs, lending, and borrowing.

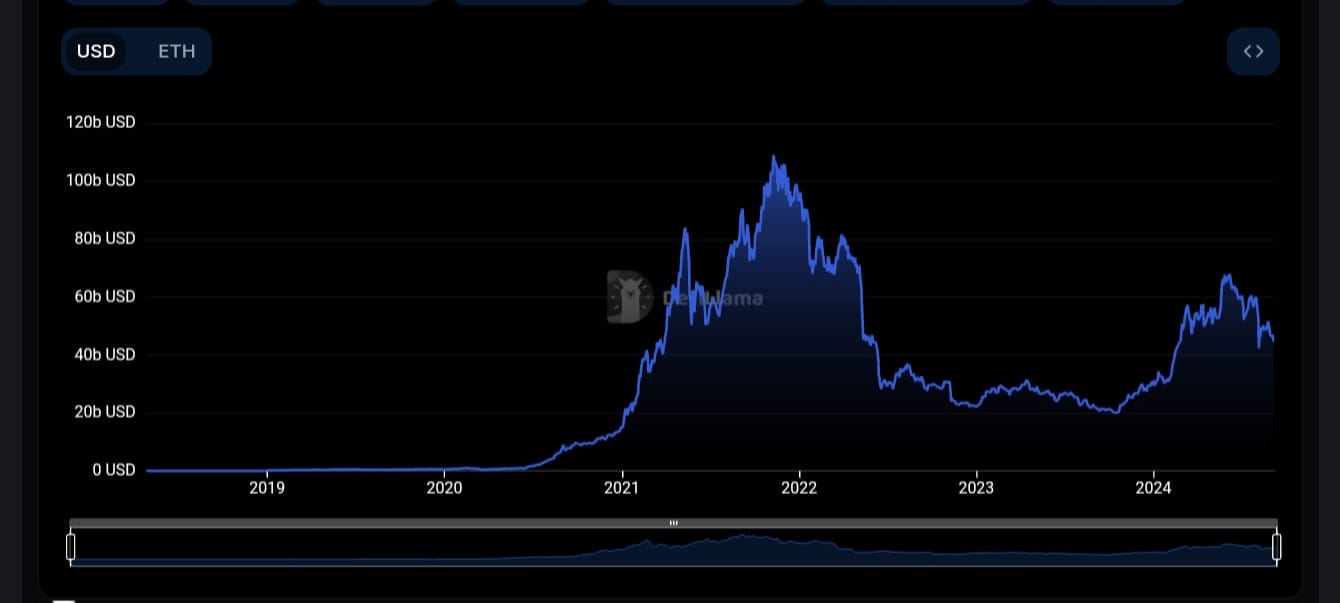

Within just a year leading up to November 2021, the total value locked in Ethereum-based protocols surged by 1,200% to approximately $109 billion. That figure has since decreased to $44.6 billion, according to data from Defillama. However, progress can be a double-edged sword.

Ethereum’s total value locked (TVL). Source: Defillama

Ethereum’s total value locked (TVL). Source: Defillama

Ethereum struggled to process the increased volume of transactions quickly enough, resulting in a sharp rise in fees. Similarly, Ethereum’s energy consumption soared. For the blockchain to become the primary vehicle for widespread cryptocurrency adoption, it required a system capable of handling substantial transaction volumes per second with minimal energy usage.

The Merge, which reportedly reduced energy consumption by 99%, along with the Dencun upgrade, which lowered network fees, are integral components of Vitalik Buterin’s overarching plan to enhance Ethereum’s efficiency.

“Bitcoin’s rigidity raises concerns about long-term security as block rewards diminish,” remarked Lee, the research analyst. He added:

“Ethereum, in contrast, provides a more flexible monetary policy that can adapt to the network’s requirements, balancing security and usability through its inflationary mechanisms. However, this very adaptability introduces uncertainty, which may deter some investors who favor a clear, capped supply.”

The post Ethereum’s Rising Inflation ‘Not Necessarily a Bad Thing,’ Analysts Say appeared first on Cryptonews.