Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Abu Dhabi Government Funds Acquire $1 Billion in Bitcoin – Insights Behind the Move?

Abu Dhabi has quietly made a significant investment in Bitcoin.

Investors linked to sovereign entities revealed over $1.04 billion in U.S. spot Bitcoin ETFs by the end of 2025. Mubadala Investment Company alone reported more than 12.7 million shares of the BlackRock spot Bitcoin ETF, valued at approximately $630.7 million.

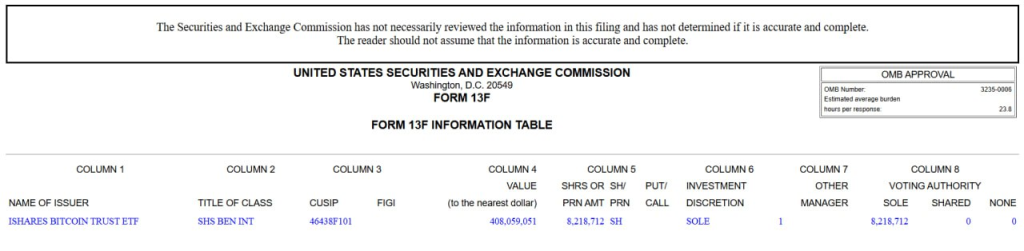

Source: SEC

Source: SEC

Al Warda Investments contributed an additional 8.2 million shares, estimated at around $408.1 million. In total, this amounts to roughly 20.9 million shares associated with one of the largest Bitcoin ETF providers globally.

This activity is not driven by retail speculation. It represents state-backed capital investing on a large scale.

The disclosures arrive as Bitcoin ETFs experienced $104.87 million in daily net outflows, with short-term selling pressure reemerging. Spot Bitcoin has been fluctuating around the mid $60,000 range, while overall sentiment remains delicate.

Source: Coinglass

Source: Coinglass

However, these positions reflect holdings as of December 31. This indicates a long-term allocation strategy rather than short-term trading.

Bitcoin Price Prediction: Are Governments Maintaining Price Levels to Accumulate?

Bitcoin continues to consolidate between distinct levels.

On the chart, the price rebounded sharply from the $60K–$64K demand zone and is currently ranging just below the $70K–$71K resistance area.

This zone continues to limit upward movement. A clear break and sustained hold above $71K would alter the short-term structure and pave the way toward $80K, then $90K.

The downside is straightforward. $64K serves as the critical support level. If it is breached, $60K could quickly come back into focus.

Now, considering the ETF narrative, while the price is fluctuating and sentiment appears fragile, large sovereign allocations are quietly accumulating in the background.

If the structure continues to improve and $71K eventually becomes support, the price may begin to align with that long-term positioning. For the moment, it is a contest between range resistance and a base attempting to establish itself above $64K.

While Governments Accumulate, Bitcoin Hyper Could Activate Capital

State-backed funds can afford to be patient. They allocate. They wait. They endure volatility.

Retail investors do not always operate in the same manner.

Bitcoin Hyper ($HYPER) is designed for participants seeking more than gradual range compression. This Bitcoin-centric Layer-2, utilizing Solana technology, enhances speed, reduces fees, and provides genuine on-chain utility while maintaining Bitcoin’s fundamental security.

It retains the brand strength of Bitcoin while facilitating actual activity on top of it. Payments. Staking. Scalable execution.

Momentum is already apparent. The Bitcoin Hyper presale has raised over $31 million to date, with $HYPER priced at $0.0136751 before the next increase. Staking rewards currently reach up to 37%.

If Bitcoin eventually surpasses $71K, that would be beneficial. If it continues to fluctuate while institutions accumulate, Bitcoin Hyper could be well-positioned to advance regardless.

Visit the Official Bitcoin Hyper Website Here

The post Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know? appeared first on Cryptonews.