Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

$83 Trillion Fortune of Baby Boomers Could Shift to Crypto, According to Galaxy

Zac Prince of Galaxy Digital asserts that demographic changes and wealth transitions could direct substantial capital toward cryptocurrency markets over the next two decades as younger generations inherit from Baby Boomers.

During an appearance on The Milk Road Show, Prince highlighted demographic patterns as a significant advantage for cryptocurrency adoption.

“Older individuals will pass away, transferring their wealth to younger generations,” he stated, noting that younger investors exhibit distinctly different inclinations compared to their parents’ generation.

Prince remarked that these investors are “far more accustomed to platforms like our GalaxyOne, which is designed as an app first. It offers various products in one location, featuring a highly intuitive user interface, unlike the traditional method where one has to call their broker.”

Enormous Wealth Transfer on the Horizon

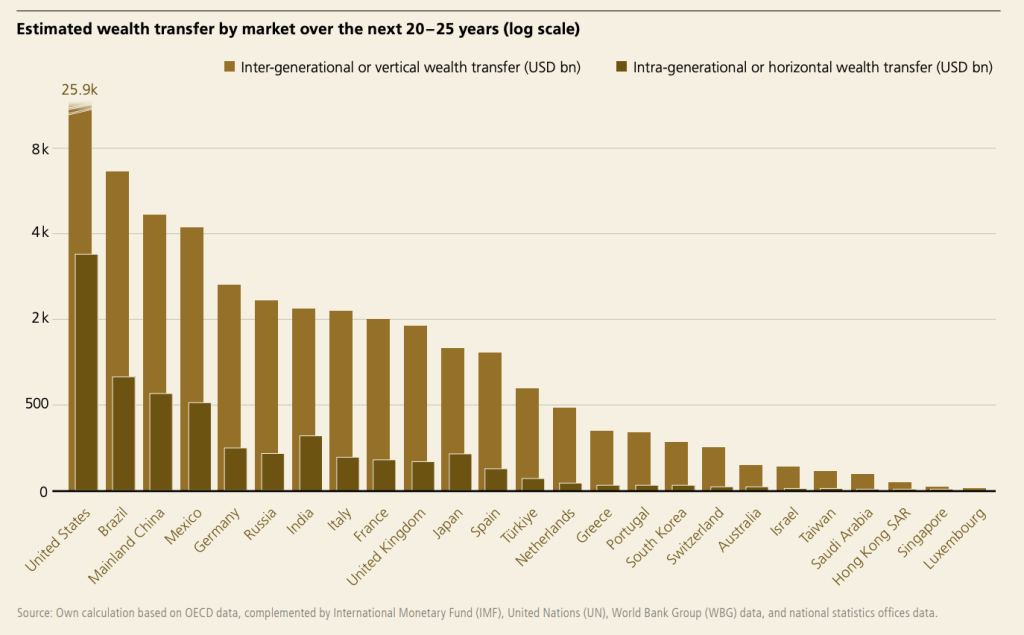

According to the UBS Global Wealth Report, an estimated $83 trillion will be transferred across generations in the next 20 to 25 years, with $9 trillion shifting between spouses and $74 trillion passing to heirs.

The United States is responsible for more than $29 trillion of this transfer, followed by Brazil at $9 trillion and mainland China at $5.6 trillion.

Source: UBS Report

Source: UBS Report

Prince stressed that patterns of wealth transfer do not necessarily align with population size or GDP.

Italy, despite having only half Japan’s population and 60% of its GDP, is expected to experience greater inter-generational wealth transfers due to higher savings rates and increased home ownership among its elderly population.

GalaxyOne is positioning itself to take advantage of this transition by focusing on mass-affluent investors (approximately 20% of US households) who meet the criteria of $200,000 in annual income or $1 million in net worth.

“We believe this demographic has some unique requirements that the likes of Robin Hood and Coinbase do not adequately address,” Prince remarked, emphasizing the importance of personalized customer service and tailored product offerings as distinguishing factors.

Retail Sentiment Contrasts with Institutions

While Prince recognized the bearish sentiment among retail investors at the end of 2024, with Bitcoin declining around 10% despite strong performances from gold, silver, and stocks, he perceives this as potentially positive.

“Whenever you start observing that sentiment, the patterns I’ve noticed throughout my years in the industry suggest it could signal the onset of a significant rise,” he stated.

The gap in sentiment between retail and institutional investors has expanded significantly.

Data from the FINRA Foundation indicates that consideration of cryptocurrency among US investors fell from 33% to 26% between 2021 and 2024, with 66% now viewing digital assets as highly or very risky, an increase from 58%.

Interest in crypto purchases among US investors drops to 26% from 33% in 2021 as risk appetite decreases sharply, according to FINRA research.#US #Cryptohttps://t.co/4mTMJ49hLC

— Cryptonews.com (@cryptonews) December 5, 2025

In contrast, institutional adoption has surged, with Morgan Stanley introducing Bitcoin ETFs and traditional financial platforms broadening access to cryptocurrencies.

Prince attributed this divergence to the slow opening of distribution channels.

“Many of those channels remain closed and progress slowly. The ETFs were only introduced last year. Some warehouses and other firms enforce a one-year lockdown on new ETFs being accessible to their clients,” he explained.

He anticipates that institutional products will continue to expand throughout 2025.

Young Investors Propel Adoption

Research from Coinbase has found that 45% of younger US investors currently own cryptocurrencies, compared to merely 18% of older generations, with younger investors allocating 25% of their portfolios to non-traditional assets (three times the 8% allocation among older investors).

Four out of five younger adults believe that cryptocurrencies will assume a significantly larger role in future financial systems.

Data from South Korea reflects these trends, with over half of citizens aged 20-59 having experience in crypto trading and 27% holding digital assets at present.

More than 10,000 Koreans hold $750K+ in crypto, primarily driven by young investors, despite being the smallest demographic.#Korean #Cryptohttps://t.co/uA561EaY8O

— Cryptonews.com (@cryptonews) August 25, 2025

Current holders have an average of 13 million won ($9,547) in cryptocurrencies, which represents 14% of their overall financial assets.

GalaxyOne is set to launch products aimed at this demographic shift, including corporate treasury solutions, crypto portfolio lines of credit, and staking services.

Prince disclosed plans to merge cryptocurrencies with traditional asset classes “in a manner that I believe other platforms have not accomplished before” in the latter half of 2025.

Looking ahead, Prince concluded that “the adoption of stablecoins is rapidly increasing” and that it could facilitate the largest wealth transfer in history, coinciding with a generation already committed to digital assets.

The post $83 Trillion Baby Boomer Fortune May Flow Into Crypto, Says Galaxy appeared first on Cryptonews.

Interest in crypto purchases among US investors drops to 26% from 33% in 2021 as risk appetite decreases sharply, according to FINRA research.#US #Cryptohttps://t.co/4mTMJ49hLC

Interest in crypto purchases among US investors drops to 26% from 33% in 2021 as risk appetite decreases sharply, according to FINRA research.#US #Cryptohttps://t.co/4mTMJ49hLC