Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

65 Million Revolut Customers Can Now Exchange Stablecoins Without Fees

Revolut has removed all fees and spreads associated with converting between USD and two prominent stablecoins, USDT and USDC, enabling its 65 million users worldwide to exchange up to €500,000 every 30 rolling days at precise 1:1 rates.

This initiative eliminates conventional barriers in transitioning between fiat and cryptocurrency, mirroring the company’s long-standing strategy in foreign exchange that established clear currency conversion as a standard expectation for digital banking clients.

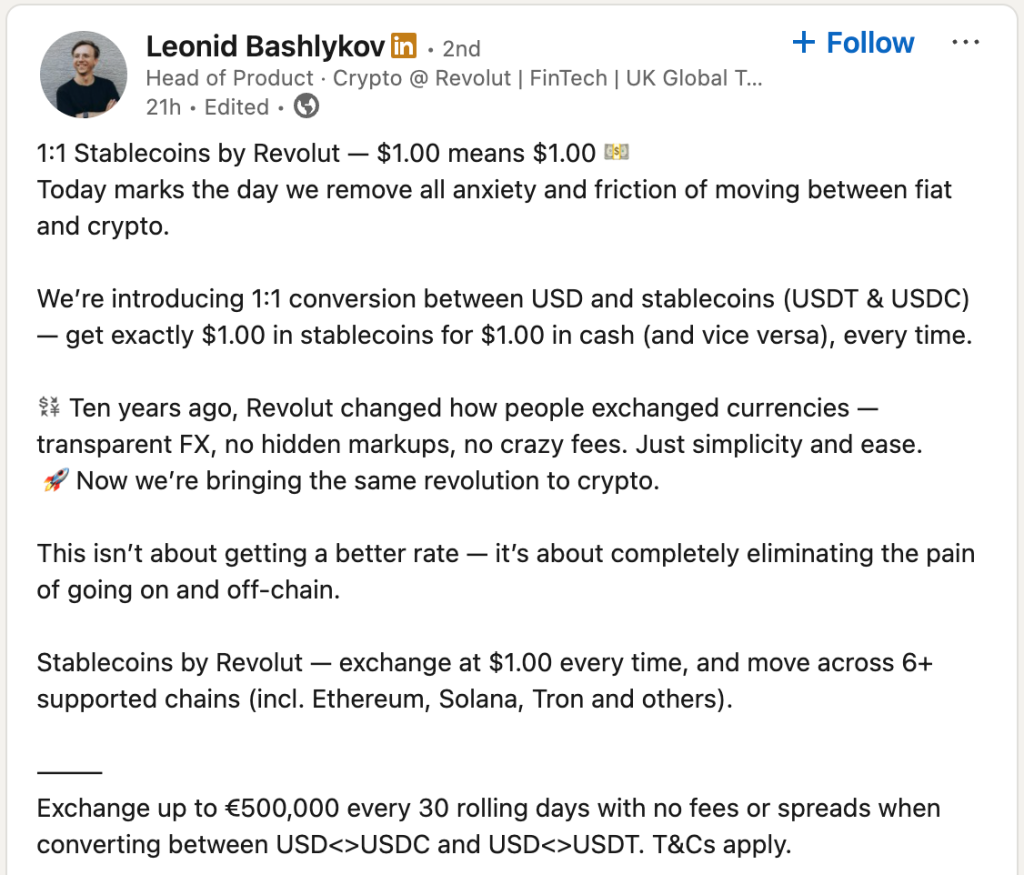

Leonid Bashlykov, Head of Product Crypto at Revolut, shared the announcement on LinkedIn, highlighting that users will receive exactly $1.00 in stablecoins for every $1.00 in cash and vice versa.

The service facilitates transfers across six blockchain networks, including Ethereum, Solana, and Tron, offering fee-free on-ramp and off-ramp functionalities that remove the markup generally imposed by exchanges and trading platforms.

Source: LinkedIn

Source: LinkedIn

Crypto Trading Fuels 298% Revenue Increase

Revolut’s wealth division, which includes cryptocurrency, commodities, trading, and savings products, achieved £506 million in 2024, reflecting a 298% year-over-year revenue increase.

Source: 2024 Annual Report

Source: 2024 Annual Report

This growth was largely driven by heightened crypto trading activity across the sector, along with the successful launch of Revolut X in May 2024, the company’s independent desktop trading platform aimed at professional traders.

Revolut X provides trading options for over 100 tokens with fixed fees of 0% for makers and 0.09% for takers, irrespective of volume, positioning it as a direct rival to established crypto exchanges.

The platform was extended to 30 more European countries in November 2024, offering real-time trading tools, advanced analytics, and TradingView chart integration for users throughout the European Economic Area.

The fintech reported unprecedented financial outcomes for 2024, exceeding $1 billion in annual profit for the first time, with net earnings reaching £1.1 billion, a 149% rise compared to the previous year.

Total revenue grew by 72% to £3.1 billion, with subscription services increasing by 74% to £423 million and the loan book expanding by 86% to £979 million as the company prepared to initiate full banking operations in the UK following the approval of a restricted banking license in July 2024.

Platform Growth and Strategic Collaborations

The company introduced Revolut Ramp in March 2024, collaborating with MetaMask developer Consensys to allow users to buy crypto directly within their Web3 wallets.

In August, Revolut formed a partnership with Ledger, enabling customers in several EEA nations to purchase cryptocurrencies using their Revolut accounts or cards via Ledger Live.

The majority of customer funds are kept in cold storage with 24/7 encrypted chat support, while advanced risk monitoring systems help prevent account takeovers.

The platform incorporates a Crypto Learn tool to enhance crypto knowledge for retail users, particularly focusing on first-time crypto buyers with educational resources alongside trading functionalities.

Regulatory Advancements and Global Expansion Initiatives

Revolut Digital Assets Europe Ltd obtained Crypto Asset Service Provider registration from Spain’s Bank of Spain and De Nederlandsche Bank in 2024 as the company aims for full MiCA authorization across the European Union.

This regulatory progress coincides with Revolut’s pursuit of banking licenses in 10 additional countries while planning over €1 billion in investments in France through 2028, which includes the establishment of a Western European headquarters in Paris.

The company is considering acquiring a US nationally chartered bank to expedite its entry into the American market, circumventing the lengthy charter application process that can take years.

@RevolutApp may acquire a US bank with a national charter to accelerate its American expansion and bypass the lengthy process of obtaining its own license.#Revolut #Fintechhttps://t.co/xeDYK3miuI

— Cryptonews.com (@cryptonews) July 30, 2025

Revolut currently serves 60 million customers worldwide, with 12 million located in the UK, although crypto services have been suspended in the United States since October 2023 due to regulatory uncertainties.

Founder and CEO Nik Storonsky secured new funding in 2024 through a secondary share sale at a $45 billion implied valuation.

Recent reports also indicate that the company is in discussions for a $1 billion fundraising round that would value the fintech at approximately $65 billion.

The company is also reportedly contemplating a dual listing in London and New York, which could place it among the top 15 most valuable firms on the London Stock Exchange and make it the first company to simultaneously join the FTSE 100 and list in New York.

The post 65 Million Revolut Users Can Now Swap Stablecoins at Zero Cost appeared first on Cryptonews.