Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

$150 Billion in US Tax Refunds May Drive New Cryptocurrency Investments, Historical Data Indicates

A significant influx of new capital may soon enter the crypto market. Approximately $150 billion in tax refunds is expected to reach U.S. consumer accounts by the end of March.

Some analysts believe that a portion of these funds could flow directly into risk assets, including cryptocurrencies. Strategists at Wells Fargo suggest that this wave of refunds, enhanced by tax incentives for 2026, could subtly reignite retail engagement.

The timing is noteworthy. Markets are currently positioned at critical technical thresholds. If even a small fraction of this capital shifts into digital assets, retail demand could emerge precisely when it is most needed.

Key Takeaways

- $150B Liquidity Wave: Analysts at Wells Fargo estimate that around $150 billion in refunds will be issued by late March.

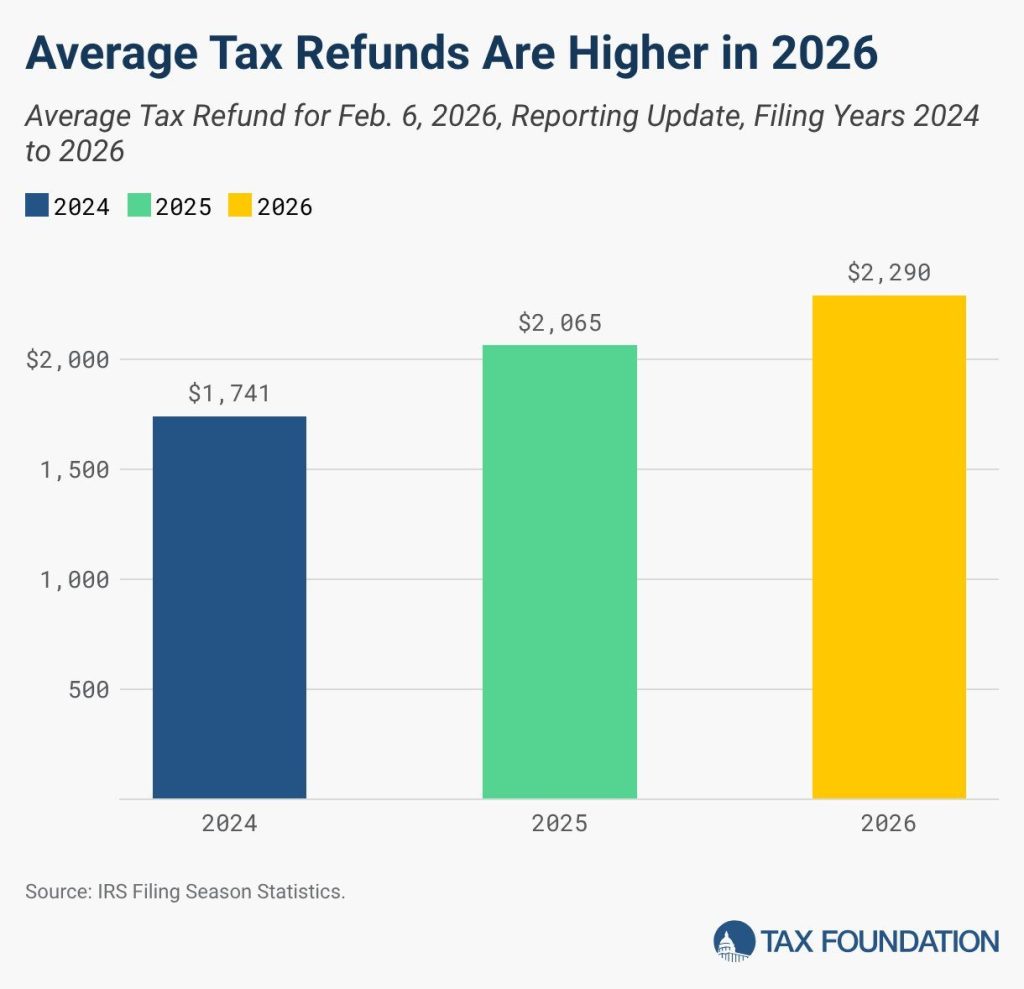

- Refunds Are Up 11%: Preliminary IRS data indicates that the average refund amount has risen to $2,290, enhancing retail purchasing capacity.

- Retail Catalyst: Historical trends suggest that the “refund effect” is linked to increased inflows into crypto assets favored by retail investors.

Why Does Refund Season Matter for Crypto?

Liquidity influences market dynamics. Currently, the U.S. Treasury is poised to introduce a significant amount of it. Following the passage of the One Big Beautiful Bill in July 2025, tax reductions have increased refund amounts for many Americans.

Treasury Secretary Scott Bessent has already indicated that refunds this season could be “very large,” implying more disposable income entering bank accounts.

Average tax refunds are expected to rise by $1,000 this year — returning $91 BILLION to the American populace.

The largest tax refund season in U.S. history is underway, thanks to @HouseGOP’s Working Families Tax Cuts.

More funds back in your pocket.pic.twitter.com/U3hktiKsq7

— Congressman Gabe Evans (@repgabeevans) February 7, 2026

Historically, lump sum payments like these are not solely allocated to expenses. A portion typically flows into investments, and in recent cycles, this has included digital assets. Retail participation tends to increase when individuals feel financially secure.

Average refunds generally peak around mid-February. This timing coincides with the current uptick in activity across various altcoins. When new capital intersects with technical breakout levels, the response can be more pronounced than anticipated.

The Data: Bigger Checks, Faster Deposits

Initial figures for the 2026 filing season are already showing strong results. By February 6, the IRS had processed over 20.6 million returns and issued nearly $16.954 billion in refunds.

The average refund is currently about $2,290, reflecting an increase of approximately 10.9% from the previous year.

Source: Tax Foundation

Source: Tax Foundation

Direct deposits are even higher, averaging around $2,388. The funds are transferred quickly, with most e-filers receiving their money within about 21 days, meaning that cash is available for use almost immediately.

Another influx is anticipated as well. Once PATH Act restrictions are lifted after February 15, refunds associated with the Earned Income Tax Credit will begin to be distributed. Historically, this second wave is larger and arrives later in February.

New liquidity entering an already concentrated exchange landscape can have a significant impact, especially if even a small portion is directed toward risk assets.

Will This Trigger the Next Leg Up?

The coincidence of tax refund season with a more favorable regulatory environment is not accidental. It establishes a robust context for risk assets. Funding rates are already indicating extremes, suggesting that short positions are heavily populated.

If even a small fraction of retail refund funds shifts into spot crypto, that buying pressure could initiate a rapid short squeeze.

Bitcoin (BTC)24h7d30d1yAll time

Bitcoin (BTC)24h7d30d1yAll time

The macroeconomic environment adds further support. Political signals regarding clearer crypto regulations are enhancing sentiment. When retail investors perceive a reduction in regulatory risk, confidence tends to rebound more swiftly.

Over the next six weeks, approximately $150 billion will flow into consumer accounts. While not all of it will enter the crypto market, it does not need to. Even a small fraction can alter momentum in a leveraged market.

Monitor the weekly IRS updates toward the end of February. This data will indicate whether the liquidity wave is gaining strength or already reaching its peak.

The post $150B in US Tax Refunds Could Fuel Fresh Crypto Inflows, Historical Data Suggests appeared first on Cryptonews.

pic.twitter.com/U3hktiKsq7

pic.twitter.com/U3hktiKsq7