Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

UK legislators advocate for regulation of cryptocurrency retail trading as a form of gambling.

The trading of what are termed “unbacked cryptoassets,” including Bitcoin (BTC) and Ether (ETH), ought to be governed as gambling rather than as a financial service, according to a recent report from a group of British lawmakers.

The United Kingdom is in the process of developing a regulatory framework for cryptocurrencies that would integrate current financial asset regulations with new rules specific to crypto.

Nevertheless, in a report from the House of Commons Committee dated May 17, the U.K. Treasury Committee “strongly recommended” that retail crypto trading and investment activities be regulated as gambling, aligning with the principle of “same risk, same regulatory outcome.”

Published today

We’ve just released our report on cryptoassets, outlining our recommendations for the Government’s strategy in regulating this market.

Learn more and read the full report at https://t.co/CK7CVH2pQ1 pic.twitter.com/GvDQfiGhPU— Treasury Committee (@CommonsTreasury) May 16, 2023

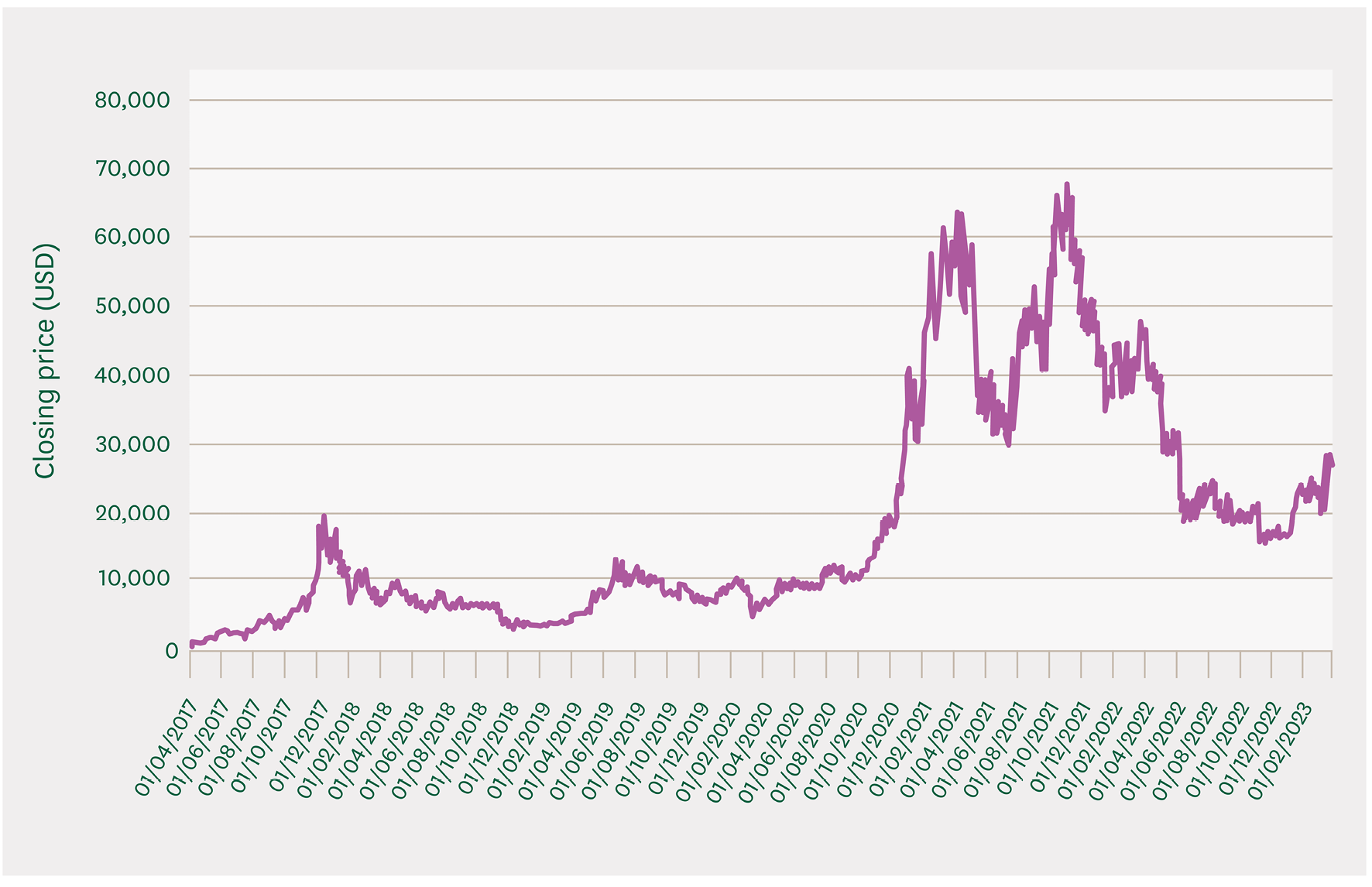

The report contended that the price fluctuations and absence of intrinsic value indicate that unbacked crypto assets will “inevitably pose significant risks to consumers.”

Treasury Committee Chair Harriett Baldwin noted that Bitcoin and Ether represent two-thirds of the overall market capitalization of crypto assets, both of which she asserted are “unbacked.”

“We are concerned that regulating retail trading and investment activity in unbacked cryptoassets as a financial service will create a ‘halo’ effect that leads consumers to believe that this activity is safer than it is, or protected when it is not.”

In the U.K., all forms of gambling—whether online or physical—are overseen by the Gambling Commission under the Gambling Act 2005. This oversight encompasses establishments such as bingo halls, lotteries, betting shops, online betting platforms, and casinos, aiming to prevent problem gambling and enforce Anti-Money Laundering measures.

Graph utilized by the Committee as evidence of crypto’s volatility. Source: Yahoo Finance, U.K. Parliament

Graph utilized by the Committee as evidence of crypto’s volatility. Source: Yahoo Finance, U.K. Parliament

In their discussions, the lawmakers referenced written statements from Dr. Larisa Yarovaya, an associate professor at the University of Southampton, who indicated that crypto exchanges, online trading platforms, and other crypto-asset enterprises should be regulated with the same rigor as crypto speculation “can be addictive.”

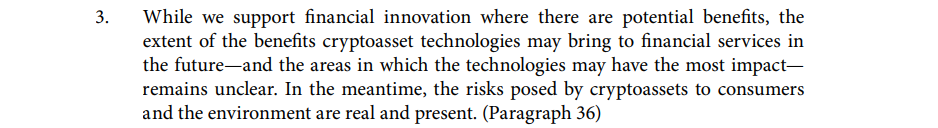

In a minor victory for the crypto sector, the committee acknowledged the potential for certain crypto assets and their underlying technology to provide advantages to financial services and markets—such as lowering the costs of cross-border payments and enhancing financial inclusion.

It stated that an effective regulatory framework should be established to foster these advancements in the U.K. while addressing some of the risks linked to crypto assets.

Excerpt from the Fifteenth Report of Session 2022–23. Source: U.K. Parliament

Excerpt from the Fifteenth Report of Session 2022–23. Source: U.K. Parliament

“We therefore welcome the Government publishing proposals for how it plans to regulate cryptoassets used in financial services,” the Committee remarked.

Related: UK Treasury drops plans for Royal Mint NFT

Including Baldwin, who previously held the position of economic secretary to the Treasury, the committee comprises a total of 11 members of Parliament from the Labor and Conservative parties, along with representatives from the Scottish National Party.

The committee initiated its inquiry into the crypto sector in July 2022 to investigate the role of cryptoassets within the U.K.

Research conducted by His Majesty’s Revenue and Customs (HMRC)—the country’s tax authority—last year indicated that 10% of U.K. citizens possess or have possessed crypto, with over 55% having never sold any.

Chainalysis positioned the United Kingdom as 17th in its 2022 crypto adoption index.

Magazine: Unstablecoins: Depegging, bank runs and other risks loom