Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

UAE dirham-backed stablecoin DRAM introduced on Uniswap and PancakeSwap

A former alumnus of the Massachusetts Institute of Technology (MIT) and a SoftBank executive has introduced a dirham-backed stablecoin designed to provide countries experiencing high inflation with access to assets tied to the United Arab Emirates’ (UAE) fiat currency.

Cointelegraph contacted Akshay Naheta, co-founder and CEO of Distributed Technologies Research (DTR), after the announcement of the DRAM stablecoin, which was listed on decentralized finance platforms Uniswap and PancakeSwap on October 3.

The Abu Dhabi-based firm has been working on the technology for a dirham-backed stablecoin since October 2022. Naheta has revitalized DTR in this jurisdiction, which he co-founded in Switzerland in 2019.

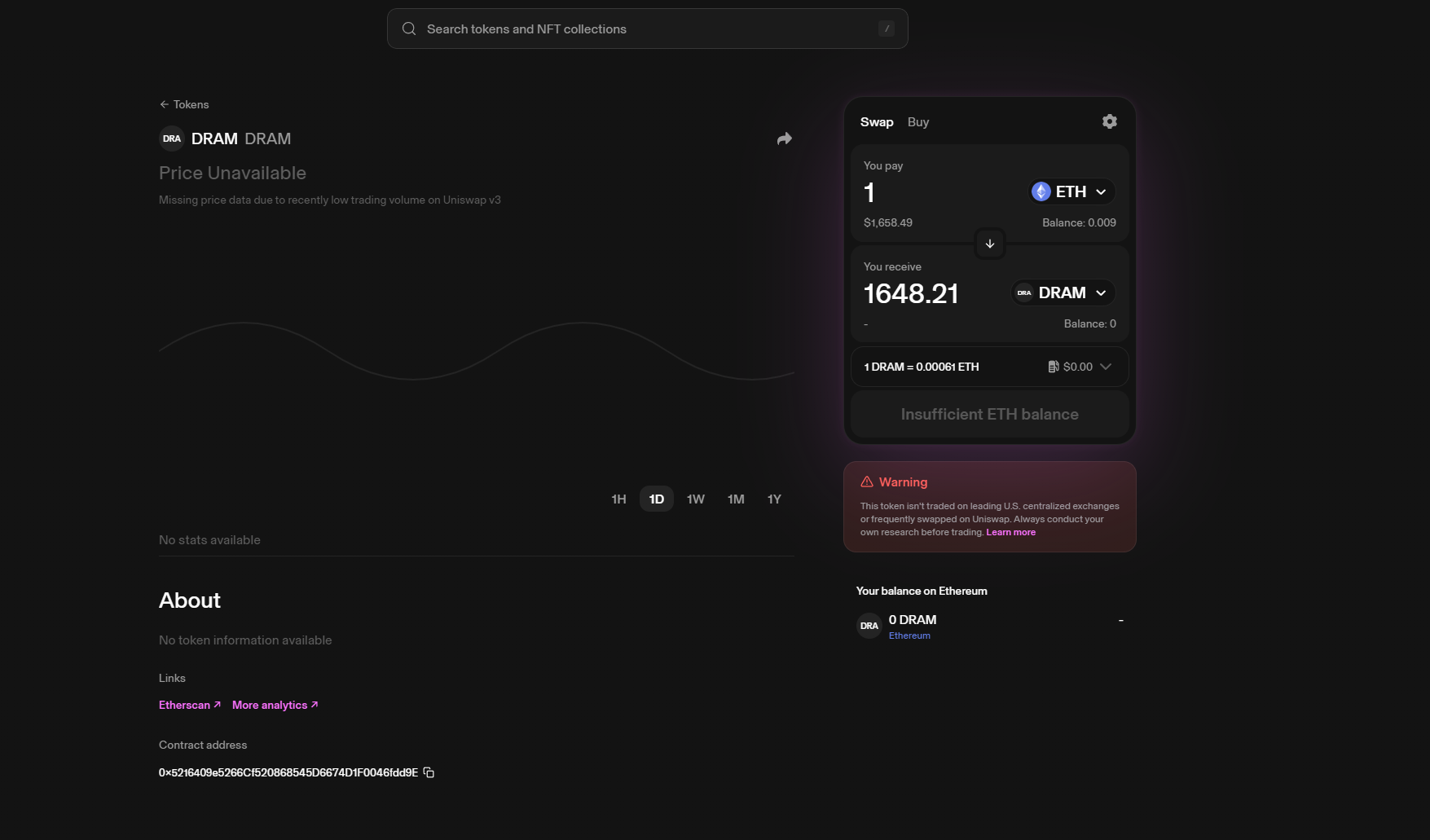

The DRAM contract was listed on Uniswap on October 3. Source: Uniswap

The DRAM contract was listed on Uniswap on October 3. Source: Uniswap

DRAM is an Ethereum ERC-20 token issued by Hong Kong-based Dram Trust, while an independent trustee, responsible for authorizing token mints and burns, is reportedly licensed and regulated by the Hong Kong Monetary Authority.

Currently, DTR is unable to offer DRAM in Hong Kong or the United Arab Emirates, but Naheta suggests that discussions are underway to facilitate token liquidity for listings on centralized exchanges outside these two regions.

Regulatory requirements stipulate that dirham fiat reserves must be deposited prior to the minting of any DRAM tokens, with reserves reportedly held by regulated financial entities.

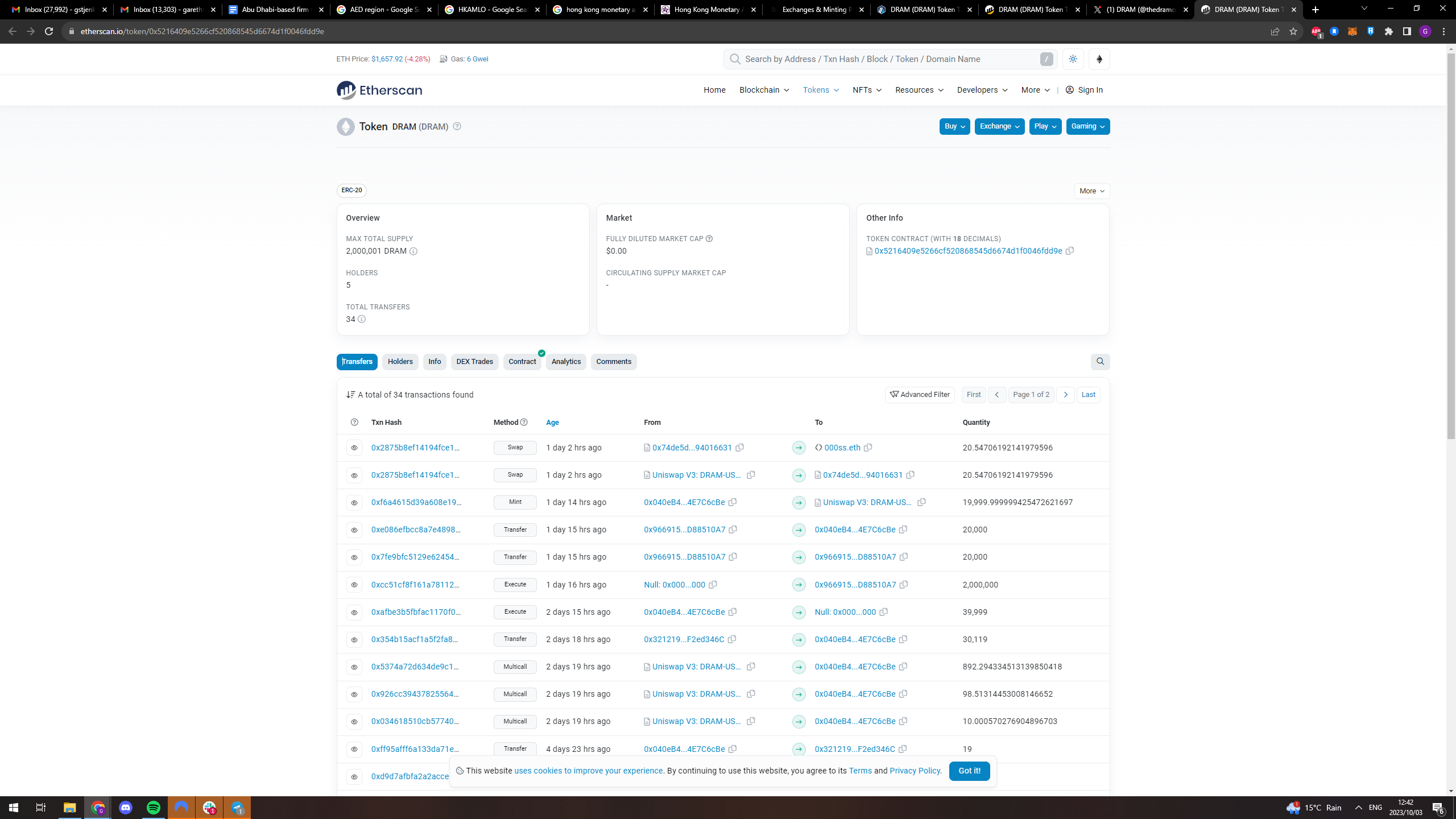

The DRAM website also provides links to the stablecoin’s smart contract addresses for Ethereum, BNB Smart Chain, and Arbitrum. At the time of publication, the Ethereum token contract indicates a maximum total supply of 2 million DRAM, while the Arbitrum contract shows 499,999 DRAM, and the BNB Smart Chain contract contains 2.5 million DRAM.

DRAM’s Ethereum smart contract address. Source: Etherscan

DRAM’s Ethereum smart contract address. Source: Etherscan

A background investigation by Cointelegraph revealed the earlier establishment of Distributed Technologies Research in Switzerland four years prior.

The company subsequently developed a decentralized payment system named Unit-e, which was designed and constructed by a group of academics and developers through collaborations and grants with prominent academic institutions, including Stanford University, MIT, and the University of Illinois.

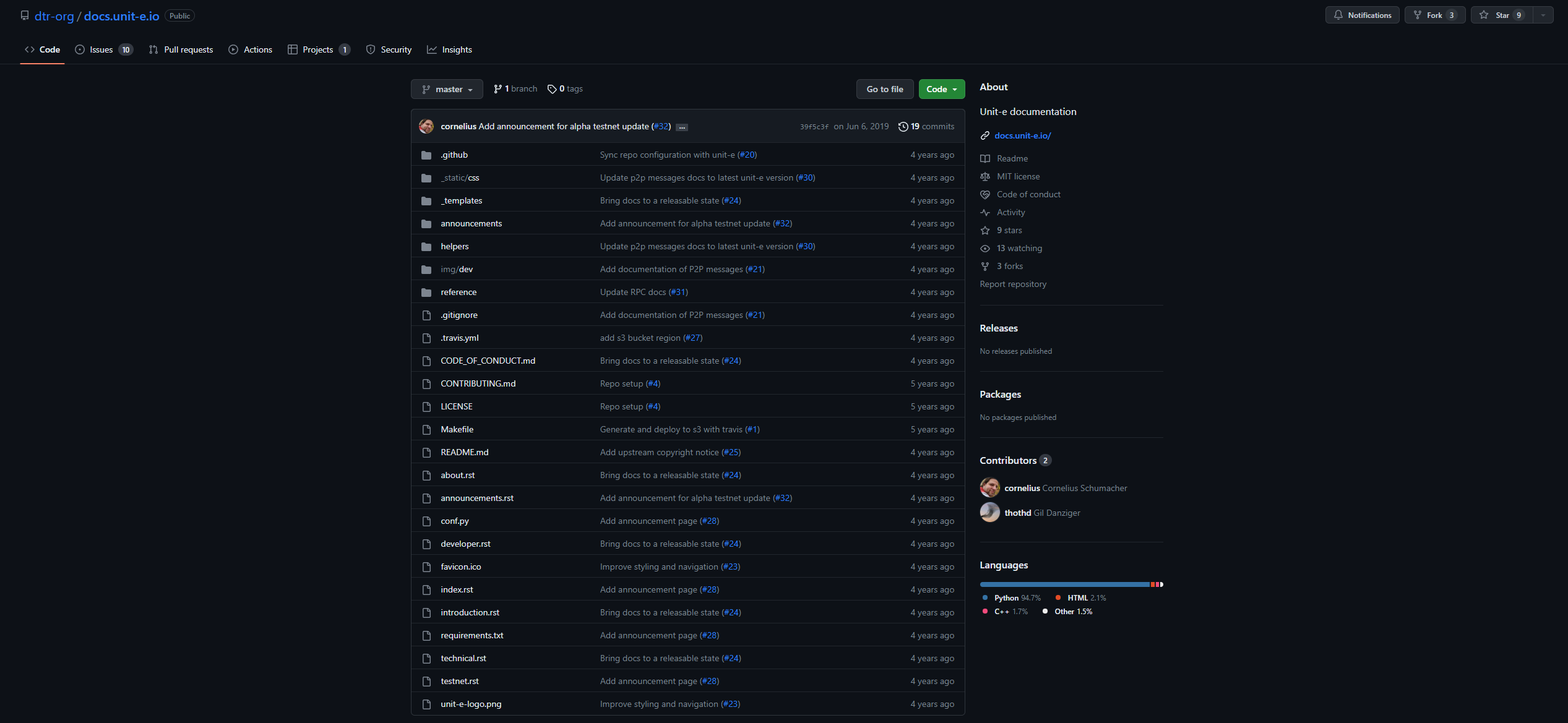

The code repository for Unit-e last showed commits in 2019. Source: GitHub

The code repository for Unit-e last showed commits in 2019. Source: GitHub

Cointelegraph has confirmed that Naheta established DTR during his time at SoftBank. DTR’s Unit-e initiative was a scalable decentralized payment network developed by a Berlin-based team.

“The original ambition back in 2019 was also to disrupt payments and to create a protocol that would have very high throughput with significant cost efficiency.”

Naheta provided insights into the company’s endeavors in “its previous incarnation” in a comprehensive summary of the Unit-e protocol reviewed by researchers from the University of Illinois. The team currently working on the DRAM stablecoin comprises approximately 30 permanent staff and contractors.

Naheta mentioned that while DTR would not be able to promote DRAM in the UAE, the firm anticipates interest from businesses in the region facing high inflation and currency challenges:

“The link to AED [dirham] was driven by the strong performance and attractiveness of the UAE economy and the desire for stable, digital asset investment options around this region.”

The UAE is emerging as a center for the developing cryptocurrency and broader Web3 landscape due to favorable regulatory frameworks that seek to encourage financial innovation and the adoption of digital assets.

Major exchanges, including Coinbase, have openly discussed future operations within the jurisdiction, while industry leader Binance is already active in Dubai.

Magazine: Blockchain detectives: Mt. Gox collapse saw birth of Chainalysis