Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Swift states that blockchain incorporation is ‘more feasible’ than consolidating CBDCs.

The banking messaging network Swift has recently released a report emphasizing how Swift can engage with blockchains and address the challenge of interoperability among various blockchain networks.

In a document titled “Connecting blockchains: Overcoming fragmentation in tokenised assets,” Swift determined that a more gradual strategy that links current systems to blockchains is “more plausible” for market advancement in the short term, as opposed to consolidating central bank digital currencies (CBDCs), tokenized deposits, and assets into a single unified ledger.

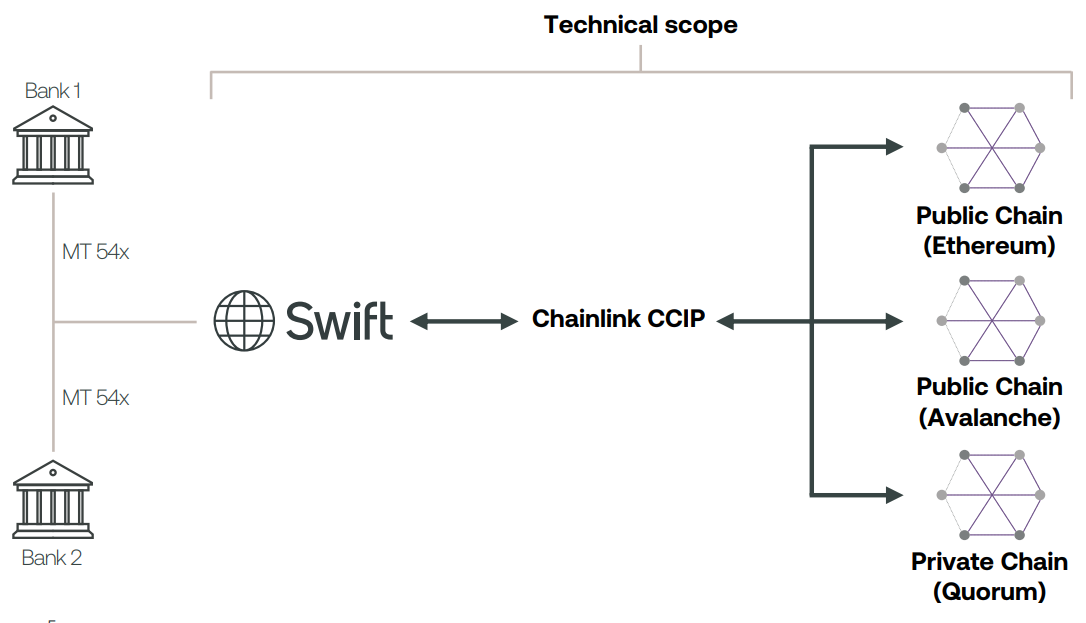

Diagram illustrating how Swift can connect financial institutions with various blockchains. Source: Swift

Diagram illustrating how Swift can connect financial institutions with various blockchains. Source: Swift

Swift pointed out in the report that there is a “lack of secure interoperability” among different blockchain networks. The financial entity stated that this results in various inefficiencies and a subpar user experience. Nevertheless, the institution is optimistic about its potential to address the interoperability challenge.

By collaborating with various financial institutions and the blockchain oracle network provider Chainlink, Swift indicated that it was able to demonstrate its capability to offer a single access point to multiple networks utilizing existing infrastructure. Swift claims that this significantly alleviates operational difficulties and expenses for institutions managing tokenized assets.

Related: Singapore central bank states three business days is ‘timely transfer’ for stablecoins

In a press release, Swift’s chief innovation officer Tom Zschach mentioned that tokenization can achieve its full potential once institutions can connect to the entire financial ecosystem. Zschach elaborated:

“Our experiments have demonstrated clearly that existing secure and trusted Swift infrastructure can provide that central point of connectivity, removing a huge hurdle in the development of tokenization and unlocking its potential.”

Within the report, Swift identified numerous potential advantages of tokenization, which encompass increased liquidity and automation, along with improved transparency and security.

In addition to these benefits, the banking infrastructure noted that while tokenization presents advantages, it also faces considerable obstacles, such as legal and regulatory frameworks that are still evolving. According to Swift, this continues to pose a challenge for institutions when engaging in tokenized asset transactions.

Magazine: SEC reviews Ripple ruling, US bill seeks control over DeFi, and more: Hodler’s Digest, July 16-22