Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Private equity tokens seek to enhance liquidity, transparency, and accessibility.

As the emerging blockchain technology framework continues to progress, a variety of distinctive asset classes have begun to enter the mainstream. Private equity tokens represent one such innovation, acting as digital embodiments of ownership in private equity investments facilitated by a decentralized ledger.

These tokens facilitate fractional ownership, enhanced liquidity, and streamlined management of private equity assets. They are generated through a method known as tokenization, which entails converting physical assets into digital tokens that can be purchased, sold, or exchanged across different platforms.

Recent studies suggest that private equity and hedge fund assets are the most likely candidates for tokenization in the near term. The research involved fund managers from France, Spain, Germany, Switzerland, and the United Kingdom, who collectively oversee approximately $546.5 billion in assets under management. The findings revealed that 73% of the respondents viewed private equity assets as the most probable to experience significant tokenization first.

Additionally, the World Economic Forum has projected that as much as 10% of global GDP could be stored and transacted through distributed ledger technology by 2027, with crypto-asset custodian Finoa indicating that tokenized markets might reach a valuation of up to $24 trillion by the same year.

Consequently, a significant majority of fund managers (93%) strongly believe that alternative asset classes — including private equity — are highly likely to be targeted for tokenization due to their inherent limitations in liquidity, transparency, and accessibility compared to traditional asset classes.

The financial proposition of private equity tokens

One of the most appealing features of private equity tokens is the potential for increased liquidity.

Historically, private equity investments have been hindered by lengthy lock-up periods and restricted exit options, rendering them less attractive to certain investors. However, by tokenizing these assets and allowing them to be traded on secondary markets, private equity tokens can provide a significantly more liquid alternative.

This newfound liquidity not only enables investors to enter and exit positions with greater ease but also helps unlock the value of illiquid assets, making them more appealing to a wider array of investors.

Recent: Will Biden’s plan to tax crypto mining reduce emissions? Critics say no

Alongside enhanced liquidity, private equity tokens also provide greater transparency in an industry that has traditionally been opaque. The implementation of blockchain technology, which supports these tokens, allows for public tracking of ownership and transactions, offering investors a real-time, transparent perspective on the underlying assets. This degree of transparency can foster trust and confidence in the private equity sector while mitigating risks associated with fraud and mismanagement.

Moreover, these tokens democratize access to the private equity market, lowering barriers for retail investors. By enabling investors to acquire fractional ownership in private companies or funds, they create opportunities for smaller investments, thus allowing a broader range of individuals to engage in the growth of private companies. This democratization not only diversifies investment portfolios but also encourages innovation and economic growth as more capital flows into the private sector.

In a conversation with Cointelegraph, Nikolay Denisenko, co-founder of Swiss neo-digital bank Brighty and former lead backend engineer for Revolut, acknowledged the aforementioned advantages of tokenization for private equity. However, he pointed out that “there are factors that could potentially limit the growth and adoption of private equity tokens. One key factor is the regulatory environment, which is still evolving in many jurisdictions. Ensuring compliance with securities laws and Anti-Money Laundering regulations can be a challenge.”

Recent developments surrounding the space

While venture capitalists have enthusiastically funded blockchain technology to transform the banking industry, they have been more cautious in applying it to their own operations. Nevertheless, recent efforts to tokenize private funds appear to indicate a notable shift in this perspective.

For instance, Pierre Mauriès — who formerly held the position of private equity technology practice director at PwC and served as a mergers and acquisitions strategy executive for The Carlyle Group — has recently established Nemesis Technologies. The firm is in the process of tokenizing a $500 million fund that will be accessible on Securitize, a digital security issuance and compliance platform. This initiative will convert the fund stakes into digital tokens, enabling investors in the United States and Japan to trade them on Securitize’s brokerage platform, Securitize Markets.

In a recent discussion, Mauriès underscored the significance of tokenization for the future of alternative investments, highlighting various advantages for limited partnerships. For example, investors in the Nemesis fund will be able to trade tokens after four years, providing earlier liquidity than traditional models. Additionally, the digital nature of the tokens simplifies fractionalization and resale to other investors compared to the conventional secondary market.

Other notable firms such as KKR, Apollo, Hamilton Lane, Backed, and Partners Group are also taking the lead in the private equity tokenization movement. Backed, in particular, has recently launched its ERC-1400 security standard-based private equity token, BACD.

The firm asserts that the token’s features include expedited settlement speeds, automated compliance through smart contracts, 24/7 trading, and enhanced transparency. BACD tokens represent ownership in private equity and serve as utility tokens for exchanges and payments.

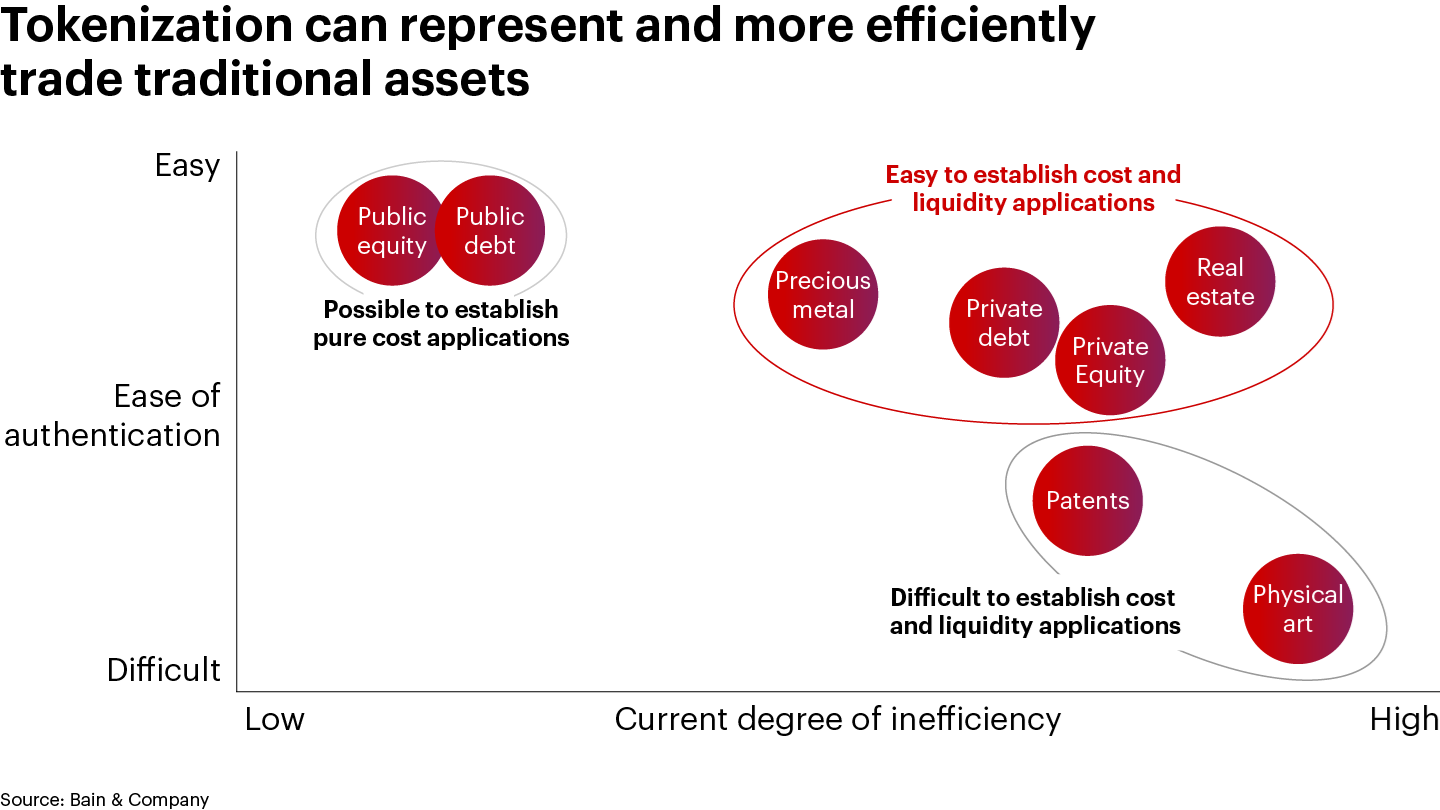

Tokenization of traditional assets. Source: Bain and Company

Tokenization of traditional assets. Source: Bain and Company

Ultimately, the early adoption of tokenization in private equity appears to be primarily motivated by the aim to broaden investor bases, as tokens provide retail investors with easier access to private equity. By offering digital tokens, private equity firms can potentially connect with 13.6 million accredited investors managing $75 trillion in the United States alone, according to Securitize CEO Carlos Domingo.

Potential drawbacks

As the legal and regulatory frameworks surrounding tokenized assets continue to develop, the prevailing uncertainty can complicate the navigation of the tokenization process for private equity firms and investors, as well as adherence to local and international regulations.

Moreover, the market for trading tokenized private equity assets remains relatively immature, which can lead to limited trading volumes and diminished liquidity for these tokens in comparison to more established, liquid asset classes.

Technological security, particularly the reliability of the underlying blockchain technology, is essential for the successful implementation of tokenized private equity. Blockchain networks can be susceptible to hacks, system failures, or other technical vulnerabilities, which could jeopardize the integrity and value of the tokenized assets.

Furthermore, widespread market acceptance is crucial for tokenized private equity to realize its full potential, but this necessitates significant buy-in from private equity firms, investors, and other stakeholders, which may be challenging due to entrenched industry practices and resistance to change.

Tokenized private equity assets may also encounter skepticism from potential investors who associate blockchain technology and tokenization with the volatility and unpredictability of cryptocurrencies like Bitcoin (BTC). Overcoming this reputational risk may necessitate extensive educational and marketing initiatives.

Tokenizing private equity can also introduce additional complexity, especially for investors who are not well-versed in digital assets, blockchain technology, or the processes involved in trading and managing tokenized assets.

Finally, while blockchain technology can provide enhanced security, the storage and management of digital assets require stringent security protocols to guard against hacking, phishing, and other cyber threats, which can introduce new risks and challenges for private equity firms and investors.

According to Brighty’s Denisenko, these tokens could significantly influence liquidity and market volatility. While increased liquidity may benefit some investors, it could also lead to heightened volatility in the market.

This could impact both retail and institutional investors, who may not be prepared for abrupt price changes. To mitigate this risk, it is vital to establish robust secondary markets with appropriate risk management strategies and to educate investors about the potential risks and rewards associated with private equity tokens.

“The issue is that having an uncontrolled secondary market is not the ideal scenario for the company because it complicates efforts to reduce volatility. Therefore, total decentralization is not a feasible option, only through oracles and the DAO’s approval,” Denisenko concluded.

Recent: AI’s black box problem: Challenges and solutions for a transparent future

Despite these challenges, the potential advantages of tokenizing private equity are considerable. As the technology and regulatory landscape continues to evolve, these obstacles may be alleviated or resolved entirely.

Looking ahead

While the fundamental concept underlying tokenization may not necessarily expand the pool of potential market participants for investors, the primary appeal of tokenized private equity lies in the streamlined experience it provides to smaller investors with limited resources.

Furthermore, as tokenization gains momentum in the private equity sector, more established financial institutions are likely to embrace this innovative approach. With the backing of industry leaders such as KKR, Apollo, Hamilton Lane, and Partners Group, the tokenization movement is well-positioned to transform how private equity investments are managed and traded. Therefore, it will be intriguing to observe how this relatively new market niche continues to develop in the future.