Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Pepe’s market valuation drops by $1 billion in five days, while certain large investors continue to purchase.

The market capitalization of the new memecoin Pepe (PEPE) has decreased by $1.1 billion from its peak on May 6, although on-chain data indicates that it continues to attract purchases from certain crypto whales.

In the past five days, the price of the memecoin has dropped over 56%, declining from a high of $0.00000431 to $0.00000193, as reported by CoinGecko.

This downward trend has resulted in the token’s total valuation falling from a high of $1.82 billion on May 6 to $820 million at the time of this report.

The market capitalization of Pepe since April 20. Source: CoinGecko.

The market capitalization of Pepe since April 20. Source: CoinGecko.

A report released on May 8 by researchers from the crypto fintech company Matrixport attributed the significant price drop of Pepe to traders liquidating substantial portions of their holdings to new retail investors after the memecoin’s listing on Binance, the largest crypto exchange by daily trading volume.

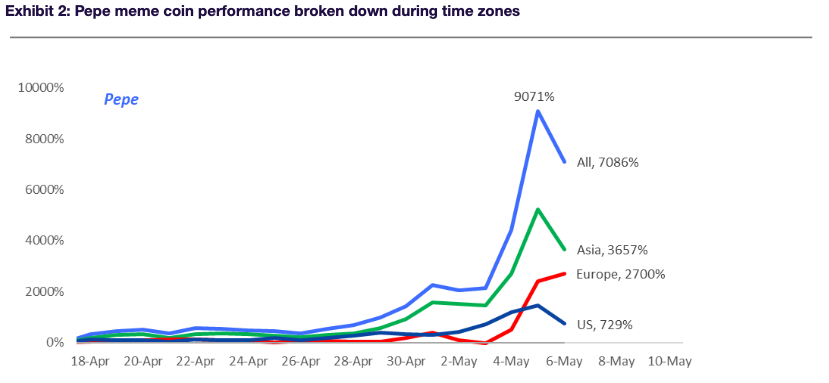

Furthermore, the report highlighted that the primary factor behind Pepe’s remarkable price movement since its launch on April 14 appears to be traders located in Asia. According to Matrixport, buying activity during Asian trading hours accounted for an impressive 3,657% of the total 9,071% increase observed in the memecoin as of May 8.

Pepe price performance categorized by trading hours in world time zones. Source: Matrixport.

Pepe price performance categorized by trading hours in world time zones. Source: Matrixport.

Another piece of data that may support this theory is that Ethereum deposits in the 24 hours following the memecoin’s listing on the exchange reached levels not seen since November 2021.

The crypto market intelligence firm Santiment suggested that this surge was largely due to early investors in Pepe taking profits by converting their holdings—primarily acquired through ETH swaps on decentralized exchanges like Uniswap and 1inch—back into Ether (ETH).

Updating our report on #Ethereum’s sky-high active deposits, exchange addresses interacting on the network is now at its highest level since November, 2021. As expected, $ETH is showing decoupling signs and on the cusp of breaking $2k once again. https://t.co/zYjY7669yj https://t.co/dQlKsTVyt2 pic.twitter.com/2nMXOUGgYC

— Santiment (@santimentfeed) May 5, 2023

Despite the significant price drop over the last week, some prominent and well-known whales in the crypto market continue to acquire Pepe at the lower price points.

Data from blockchain analytics firm Lookonchain reveals that “Machi Big Brother,” the online alias of former tech entrepreneur Jeffrey Huang, has bought a total of 73.4 ETH—approximately $137,000—of Pepe in the last four days, with an average purchase price of $0.000002082, which is about 3% below the current trading price.

Machi Big Brother bought 6B $PEPE again 30 mins ago.

He has bought a total of 66B $PEPE with 73.4 $ETH ($137K) in the past 3 days, with an average buying price of $0.000002082.https://t.co/8TP6j6unZw pic.twitter.com/Ubmg3ZC1rm— Lookonchain (@lookonchain) May 10, 2023

While other memecoins like Dogecoin (DOGE) and its similarly themed counterpart Shiba Inu (SHIB) have leveraged their success to develop additional applications and use cases for their tokens, Pepe appears to be a challenge to the notion of providing any value at all.

Related: PEPE’s sudden drop leaves whale 500K in the red

Essentially, Pepe’s anonymous development team has made it clear that the token is “entirely useless,” and the humor surrounding this fact is a sufficient reason for investors to “ape” into it. The official website of the frog-themed token includes a closing disclaimer that characterizes the token as follows:

“$PEPE is a meme coin with no intrinsic value or expectation of financial return. There is no formal team or roadmap. the coin is completely useless and for entertainment purposes only.”

Magazine: $3.4B of Bitcoin in a popcorn tin — The Silk Road hacker’s story