Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Maintaining the integrity of blockchain transactions: Assurance via audits

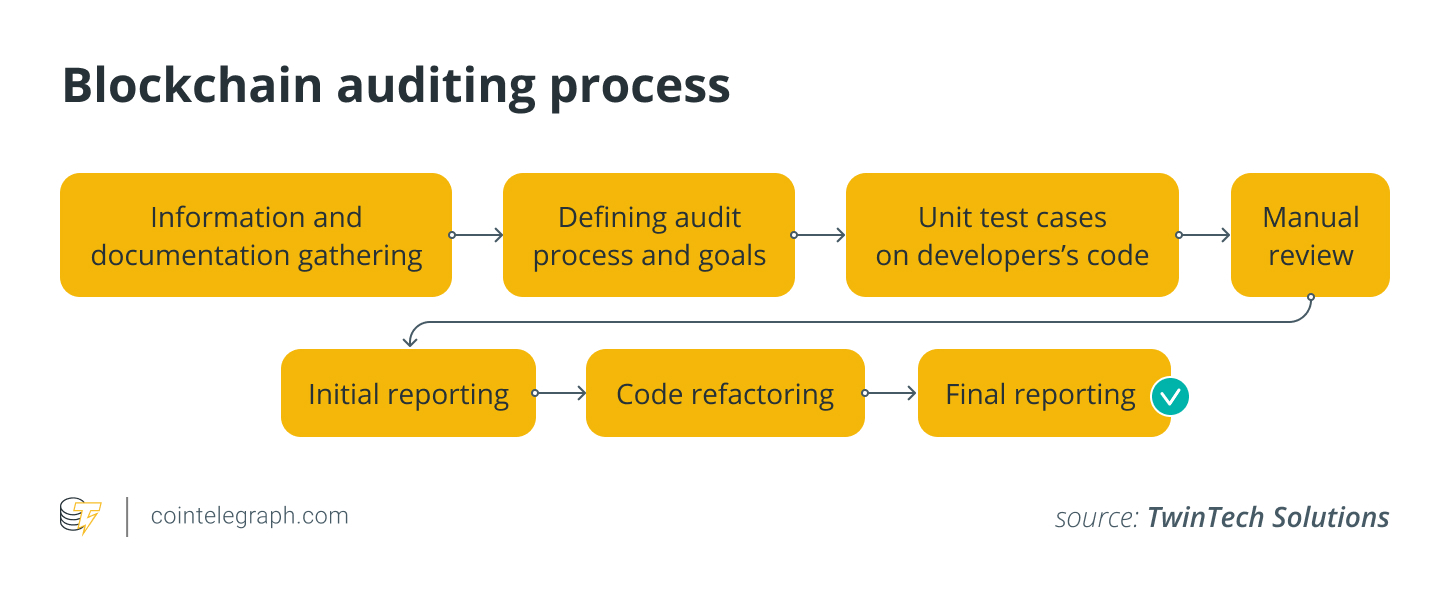

Blockchain auditing involves the examination and verification of the data and transactions recorded within a blockchain network. It aims to evaluate the integrity and precision of the information documented on the blockchain to ensure it adheres to the established rules, protocols, and regulations.

During the auditing process, smart contract code is meticulously analyzed to uncover vulnerabilities at various levels, from minor flaws to significant weaknesses that could potentially put millions at risk.

Auditors assess and identify centralization concerns, confirm that the project code operates as intended by the developer, and enhance the code’s efficiency. They focus on critical areas such as mathematical operations, logical inconsistencies, control flow, access control, and compiler errors. This thorough examination significantly lowers the likelihood of smart contract vulnerabilities, serving as a vital safeguard in the Web3 landscape.

Sheldon Xia, founder and CEO of the cryptocurrency exchange Bitmart, stated to Cointelegraph, “Auditing significantly reduces risks associated with smart contract vulnerabilities.”

Nonetheless, auditing is not a cure-all. Numerous projects often do not undergo a complete code audit due to constraints related to time and budget, leaving portions of the code unchecked and potentially vulnerable to issues.

Moreover, audits need to be ongoing, as code is regularly updated or forked, making singular audits inadequate for long-term security.

Additionally, there is the challenge of confirming that the deployed code is indeed the one that was audited and not a different version. This highlights the necessity for both transparency and traceability in the deployment process, emphasizing the need for a more comprehensive approach to security that extends beyond simple code auditing.

Auditing blockchain systems is essential for several reasons.

First, auditing guarantees the verification of transactions documented on the blockchain. This process involves examining the transaction history, validating inputs and outputs, and ensuring that the transactions conform to established rules and smart contracts. By doing so, auditing helps avert fraudulent or erroneous transactions and preserves the integrity of the blockchain network.

Second, blockchain auditing is crucial for security and fraud detection. Auditors conduct thorough reviews of transactions, access controls, and cryptographic mechanisms to uncover unauthorized or suspicious activities within the blockchain network. This aspect is particularly vital in financial systems, supply chains, and sensitive data management that carry high potential risks.

Auditing promotes accountability by holding participants responsible for their actions within the blockchain network. It aids in identifying discrepancies or inconsistencies, ensuring that all stakeholders are accountable for their activities.

Furthermore, auditing fosters trust and confidence among stakeholders in blockchain-based systems. By optimizing the blockchain network based on audit findings, organizations can ensure it is capable of handling increasing transaction volumes and achieving desired performance goals.

The significance of reliable auditing processes

While auditors are integral to the security of blockchain networks, founders must choose reputable organizations. One drawback associated with dubious auditing firms is the potential for conflicts of interest. These entities may have undisclosed conflicts that compromise their independence and objectivity.

They might be financially linked to the projects they audit or maintain undisclosed partnerships or investments that introduce bias into their assessments. Such conflicts undermine the integrity of the audit process and raise questions about the impartiality of their findings.

Magazine: 6 Questions for Simon Davis of Mighty Bear Games

Transparency is vital in auditing to ensure accountability and build trust. However, questionable auditing firms often lack transparency in their operations. They provide limited or ambiguous information regarding their methodologies, processes, and auditors’ qualifications.

In March 2023, Cointelegraph reported that banks connected to the now-defunct crypto exchange FTX may have relied on misleading and faulty financial information provided by proof-of-reserve examinations conducted by auditors associated with the Public Company Accounting Oversight Board.

In another report by Cointelegraph in December 2022, the SEC’s acting chief accountant Paul Munter emphasized that investors should not place excessive confidence in a company’s proof-of-reserve audits. Munter noted that these proof-of-reserve reports lack sufficient information for stakeholders to ascertain whether the company possesses enough assets to meet its liabilities. This lack of transparency complicates the evaluation of the reliability and credibility of their findings, raising concerns about the validity of their audits.

Although audits should be conducted by a third party, the absence of true independence among many auditors means that the results can sometimes be unreliable. In other words, they may have an incentive to avoid disappointing clients.

Insufficient due diligence is another drawback associated with questionable auditing firms. Effective audits necessitate thorough analysis, including a comprehensive review of project documentation, source code, financial records, and security measures.

Some firms may perform inadequate due diligence or rely on incomplete or inaccurate information from their audit projects. As a result, their reports can be misleading or incorrect, failing to identify significant risks or vulnerabilities.

An incomplete or misleading audit can have serious repercussions for the reputation and trustworthiness of a blockchain project. If investors, users, or regulators discover that an audit report is unreliable or conducted by an untrustworthy firm, it undermines confidence in the project.

This erosion of trust can lead to reduced adoption, loss of investments, and potential legal consequences.

Best practices for effective auditing in blockchain systems

In examining best practices for conducting audits in blockchain environments, auditors must possess a deep understanding of how blockchain systems operate. This includes knowledge of the underlying architecture, consensus mechanisms, and transaction validation processes.

This expertise enables auditors to identify potential vulnerabilities and assess the overall security and integrity of the system. Comprehensive documentation is critical to the auditing process, ensuring that all pertinent information about the blockchain system is thoroughly recorded.

Technical specifications, smart contracts, cryptographic algorithms, and other essential components must be documented to gain insights into the system’s functionality and identify potential risks and vulnerabilities.

Moreover, auditors should conduct a thorough review of the codebase of the blockchain system and perform a detailed analysis of smart contracts. This process involves evaluating the code for vulnerabilities, logical flaws, and potential attack vectors that could be exploited by malicious actors.

Specialized tools and techniques may be utilized to ensure the accuracy and security of the system during the code review and smart contract analysis.

End-to-end security is key

The reality is that auditing alone is insufficient. A more comprehensive, holistic approach is necessary. While auditing addresses code-based risks, Know Your Customer procedures address the human risk factor, thereby providing a more complete security overview. However, achieving the right balance between the anonymity offered by Web3 and the trust established through KYC can be a delicate task.

Of course, KYC is not infallible either, with instances of bad actors misrepresenting themselves and passing KYC checks, creating a false sense of trust around a project. This necessitates rigorous screening processes conducted by experienced professionals. KYC verification is only as meaningful as the thoroughness of the process behind it.

Alpen Sheth, partner at Borderless Capital, a crypto venture capital firm, remarked to Cointelegraph, “It’s important to remember that auditing should be an ongoing process to keep up with code changes and the evolution of the ecosystem. We acknowledge that security is an integral part of sustainable growth and development in the blockchain space.”

Chinese police vs. Web3, blockchain centralization continues: Asia Express

In this intricate landscape, investors should also exercise due diligence. Alongside reading and understanding audit reports, they should seek projects audited by reputable firms, monitor project code updates and their corresponding audits, familiarize themselves with the team behind the project and their track record, and consider the proportion of audited code within the project.

As the Web3 ecosystem continues to expand, a multifaceted approach that combines comprehensive auditing, robust KYC processes, and investor due diligence is essential to ensure optimal security. This, along with a concerted effort to tackle the challenges of centralization risks, can provide a more secure foundation for the ongoing growth and success of Web3 projects.