Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Linking DeFi: The potential of multichain token frameworks to enhance liquidity

Digital assets are generally confined to their original blockchain networks, and current techniques for transferring tokens between different blockchain networks are often susceptible to hacking or necessitate the involvement of a trusted intermediary.

In contrast, multichain tokens allow users to move their assets to another blockchain directly while retaining control over their tokens.

Professionals in the blockchain sector assert that cross-chain tokens can have a beneficial effect on the industry by fostering increased user engagement across various networks.

Marius Ciortan, the director of product engineering at Bitpanda and Pantos, a European cryptocurrency exchange, informed Cointelegraph, “Multichain tokens can create a more fluid and interconnected environment within decentralized finance.”

Ciortan elaborated, “For instance, multichain tokens can facilitate the development of more efficient decentralized exchanges by enabling users to trade assets across multiple blockchain networks. This can enhance liquidity and reduce fragmentation within the DeFi ecosystem.”

Multichain tokens can also aid in linking blockchain networks, helping developers deploy their applications across various blockchains. Hoon Kim, chief technology officer at Astar Foundation, a layer-1 smart contract platform, concurred, stating to Cointelegraph, “Increased asset and liquidity interoperability leads to greater interdependence among ecosystems. This can broaden the network, fostering more innovation while also heightening the risk of failure if one asset depreciates.”

“However, if an asset seeks to boost its demand, we may witness a future where an increasing number of projects aim to integrate their assets into multiple networks to enhance their utility,” Kim remarked.

Challenges with interoperability

Enabling communication and interoperability among diverse blockchain networks heavily depends on interoperability protocols. Nevertheless, these protocols within the blockchain realm face numerous challenges that must be addressed to ensure the smooth functioning of the blockchain ecosystem.

The lack of standardization presents a significant barrier to interoperability protocols. Numerous exchange protocols exist, each with its unique design and framework, resulting in an environment filled with disparate networks that do not collaborate.

Due to this lack of cohesion, developers encounter difficulties in creating applications that can operate across different blockchain networks effectively. Consequently, software developers must familiarize themselves with various exchange standards, which can be time-consuming.

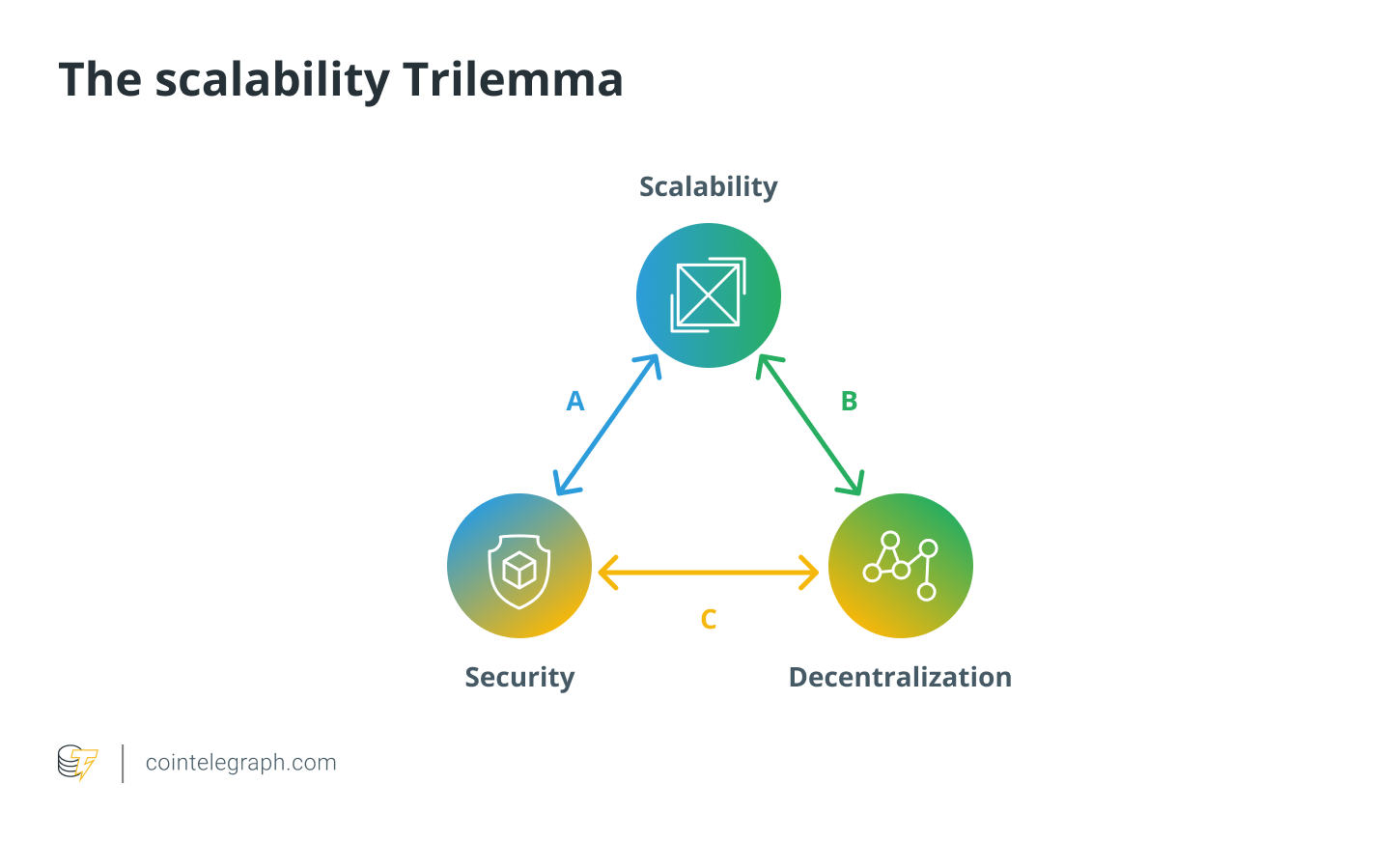

Scalability represents another challenge for interoperability protocols. Most of these protocols are specifically designed to handle a limited number of transactions, which can hinder data flow in networks experiencing high traffic volumes.

As a result, scalability issues may lead to slow transaction processing, increased fees, and network congestion.

Recent: Crypto regulation: Does SEC Chair Gary Gensler have the final say?

To address this issue, it is crucial to develop interoperability protocols capable of handling large volumes of transactions and scaling proportionately with the growing adoption of blockchain technology.

Security is another significant concern for interoperability protocols. The interconnectedness of blockchain networks increases the risk of security breaches and hacks. If security considerations are overlooked during the design of an interoperability protocol, it may lead to vulnerabilities that malicious actors can exploit.

Developers have emphasized the necessity of creating interoperability protocols with robust security features that can protect against potential attacks and maintain the integrity of the blockchain ecosystem.

Ciortan stated, “One of the most significant challenges we have observed across all interoperability projects in recent years is ensuring the security of the system. Validating events across multiple chains is a complex task, requiring substantial effort and research to develop a system that is sufficiently robust to achieve this goal reliably and withstand the test of time.”

The complexity of interoperability protocols is a critical issue that requires attention. The intricacy of these protocols demands a deep understanding of cryptography, networking, and distributed systems.

To overcome these challenges, the blockchain community must collaborate to establish standards and best practices for interoperability protocols.

Kim also considers security to be one of the primary challenges regarding interoperability in the blockchain sector. Kim remarked:

“Most bridge protocols are operated through a centralized server that facilitates a burn-and-mint function where the account is managed via a multi-sig. However, we have recently observed a rise in ‘layer 0′ protocols featuring node validators and virtual machines to connect one blockchain to another.”

Centralized bridge protocols can be susceptible to hacking, data breaches, or other cyber threats. If the central intermediary or other elements of the bridge infrastructure are compromised, it can lead to asset loss, data leaks, or other security incidents that may have serious repercussions for users.

Since multichain token systems operate by allowing users to swap their tokens directly, without intermediaries or bridges, this can help mitigate some of the issues associated with traditional interoperability protocols.

Operating principles of a multichain token system

The Pantos group has developed a new standard known as the Pantos Digital Asset Standard (PANDAS). This standard serves as the primary facilitator for tokens functioning across multiple blockchain networks. Based on extensive research, the Pantos team has created a framework that enables tokens to interact seamlessly with various blockchains.

As Pantos functions more as an infrastructure layer than a bridge, the PANDAS standard allows developers to deploy both existing and newly created tokens across multiple blockchains without requiring maintenance work. This means that their tokens can exist on several chains and be freely transferred from one chain to another.

PANDAS achieves this through smart contracts, which are self-executing agreements that activate when specific conditions are met. In this case, the cross-chain transfer is facilitated by smart contracts and a network of nodes.

For example, if an individual possesses an Ethereum-based token and wishes to trade it on a BNB Chain DEX, they do not need to rely on a bridge to transfer a wrapped token to another chain, as they can utilize Pantos technology to natively transfer their token to a new chain.

How does the multichain verification process work?

Pantos has been working on various validation methods for an extended period. The ultimate validation technique is not yet available to the public; however, it will represent an improved version of the oracle-derived approach.

This method enhances scalability and reduces gas fees while upholding the system’s security standards. Oracles are primarily used as tools for inquiries. For instance, any Pantos client can query the oracle on a blockchain to verify a transaction on a different blockchain.

The oracle verification process is based on a combination of threshold signature schemes and distributed key generation (DKG) protocols developed by Dan Boneh, Ben Lynn, and Hovav Shacham — computer scientists at Stanford University. These cryptographic methods enable users to authenticate the legitimacy of signatories.

The Boneh-Lynn-Shacham threshold signature allows users to confirm that a signer is genuine, while DKG enables multiple parties to contribute to the computation of a shared public and private key set.

The process is executed with a dual emphasis on economic and logistical efficiency, achieved by consolidating multiple signatures into a single signature. Additionally, the verification of a single signature can serve as proof that the required minimum number of signatories supports the signed correspondence.

Pantos generates a decentralized private key, where the oracle nodes hold distinct private key shares, despite not owning the distributed private key. A public key can essentially be viewed as analogous to a decentralized private key. By utilizing the private key shares held by the oracle nodes, the network can effectively aggregate their findings and produce an encoded message that can later be decrypted using the public key.

Related: Building communities and ensuring NFT success: Insights for artists

If the oracle nodes are modified, all components, including the private key shares, the distributed private key, and the public key, may also change. Typically, generating new keys requires oversight from a trusted authority. In contrast, Pantos employs DKG protocols to eliminate the need for a reliable authority.

Multichain token systems have the potential to transform the blockchain industry and enhance the fluidity and connectivity of DeFi. By enabling users to transfer assets directly between blockchains without relying on intermediaries or bridges, multichain token systems offer an additional and efficient means for users to engage across multiple blockchain networks.