Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Increasing M2 money supply will lead to cryptocurrency becoming a ‘Super Massive Black Hole’: Raoul Pal

The increasing total money supply (M2) may drive cryptocurrency into another bullish phase and enable it to surpass traditional markets, as stated by Raoul Pal, co-founder and CEO of the financial media platform Real Vision. Pal’s post on X emphasized the link between the growing fiat market supply and the initiation of the crypto bull market.

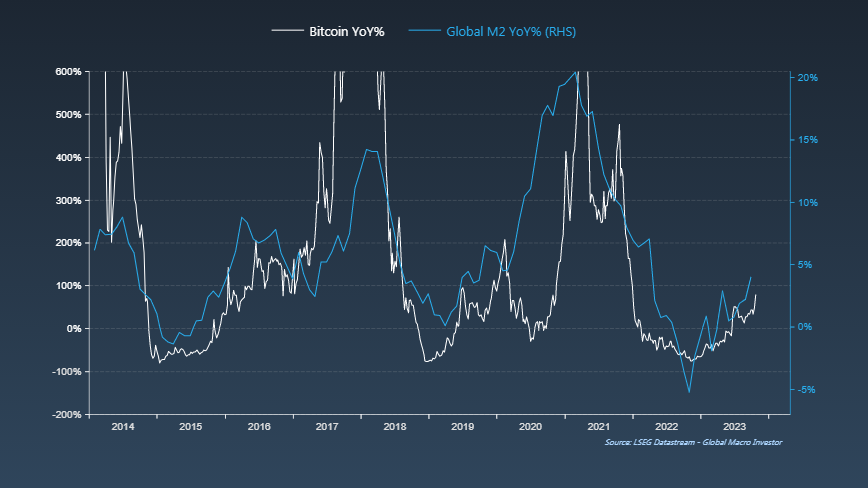

In an X (formerly Twitter) post, Pal presented a graph that compares Bitcoin’s (BTC) annual performance with the global M2 money supply, illustrating the concurrent rise of both Bitcoin and the global M2 supply. Historically, the Bitcoin and cryptocurrency sectors have begun to outperform traditional financial markets when there is an increase in global M2 supply.

Bitcoin vs. global M2 supply. Source: Global Macro Investor

Bitcoin vs. global M2 supply. Source: Global Macro Investor

The chart above indicates that Bitcoin’s price is nearing a decoupling from the traditional market amid a rising M2 supply, a trend that has been historically observed, particularly during the spikes in BTC’s performance in 2021, 2017, and 2014.

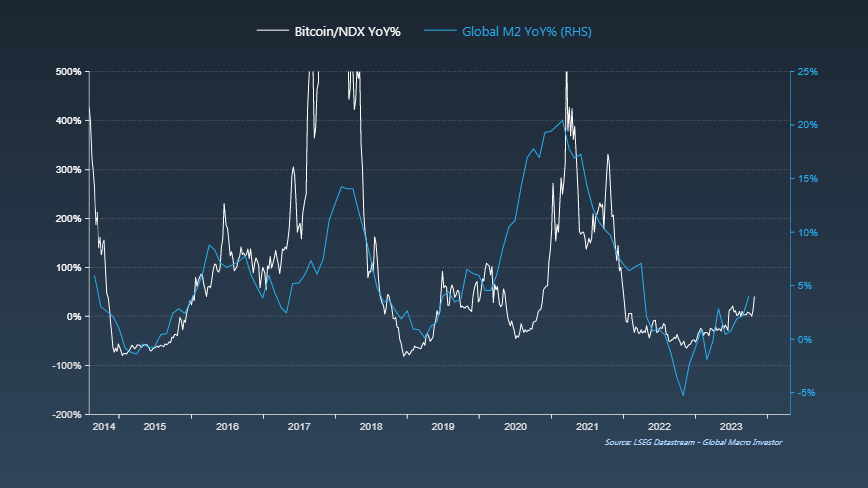

Bitcoin/NDX vs. global M2 supply. Source: Global Macro Investor

Bitcoin/NDX vs. global M2 supply. Source: Global Macro Investor

Pal remarked that he “loves Global M2… this is when BTC outperforms the NDX and crypto becomes the Super Massive Black Hole.”

The M2 represents the quantity that the United States Federal Reserve estimates to be in circulation; it includes all cash held by individuals and all funds deposited in savings accounts, checking accounts, and other short-term savings vehicles such as certificates of deposit.

Related: First Bitcoin ETF trades $1.5B as GBTC ‘discount’ echoes $69K BTC price

A Bitcoin bull market is frequently associated with the block reward halving that occurs every four years, with the next event set for April 2024, as it diminishes the market supply of BTC in the face of rising demand. However, the halving is not the only determinant of the price surge, as various macroeconomic factors also significantly influence the market.

Throughout the last decade, Bitcoin’s price has experienced substantial increases during periods of rapid M2 growth, driven by lower interest rates, quantitative easing, and fiscal stimulus. Conversely, during phases of monetary tightening by central banks, the cryptocurrency market has found it challenging to maintain bullish momentum. The 2021 bull market coincided with an aggregate M2 growth of 6% or more at the Fed, European Central Bank, Bank of Japan, and People’s Bank of China.

Magazine: Beyond crypto — Zero-knowledge proofs show potential from voting to finance