Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Enhancing adoption through DeFi asset management: Velvet Capital partners with Cointelegraph Accelerator

The era when decentralized finance (DeFi) was solely the domain of crypto pioneers and centralized finance (CeFi) completely commanded user confidence is now behind us. In the wake of the downfall of prominent centralized entities like FTX, Prime Trust, and Celsius, among others, the user community — ranging from traders to asset managers — recognized the significance of self-custody and began to seek sophisticated services within the DeFi landscape.

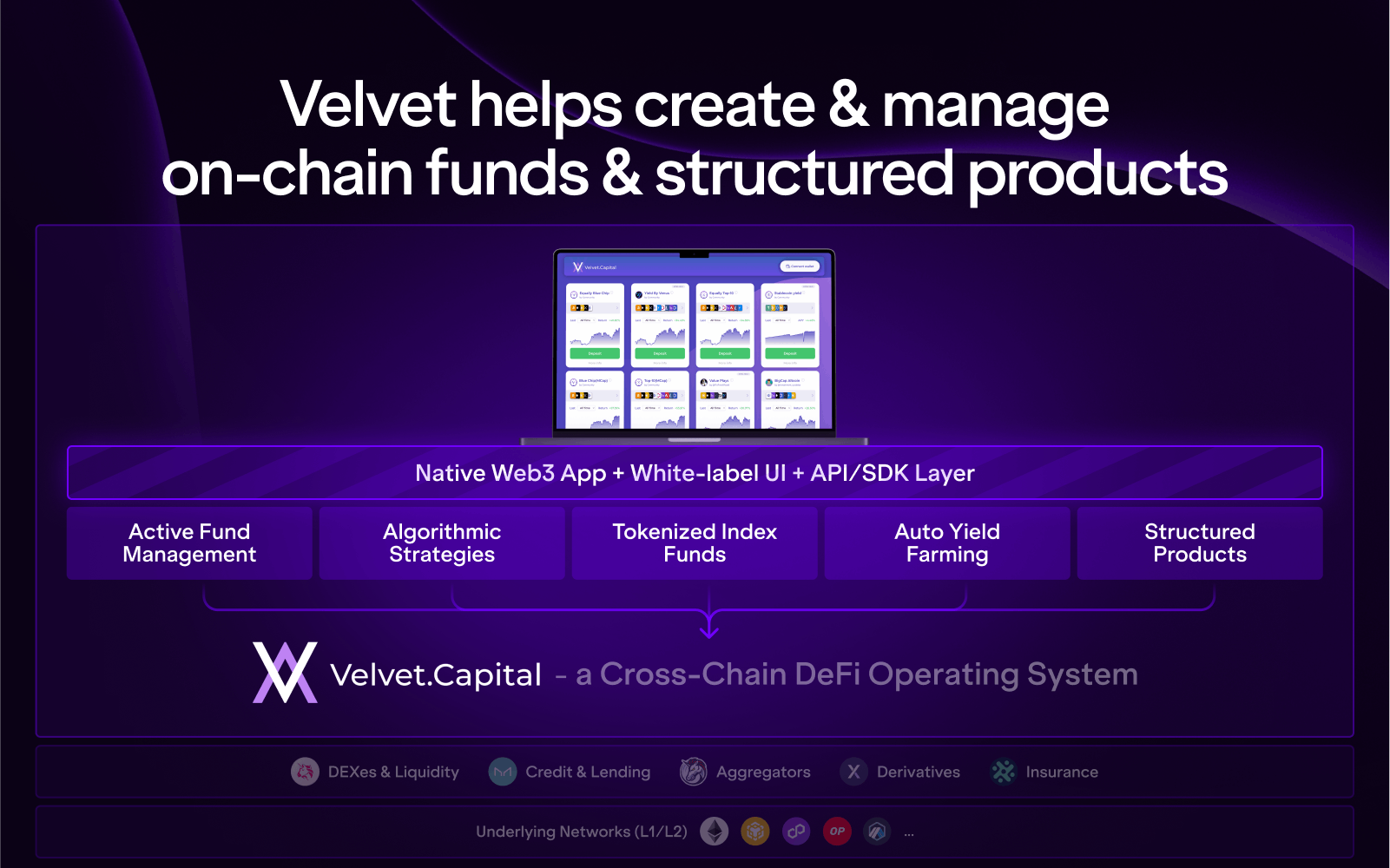

Supported by Binance Labs, Velvet Capital provides an infrastructure for managing digital assets entirely on-chain, reducing or removing obstacles for new fund managers and enabling individuals of all skill levels to establish and oversee on-chain funds and structured products with minimal difficulty.

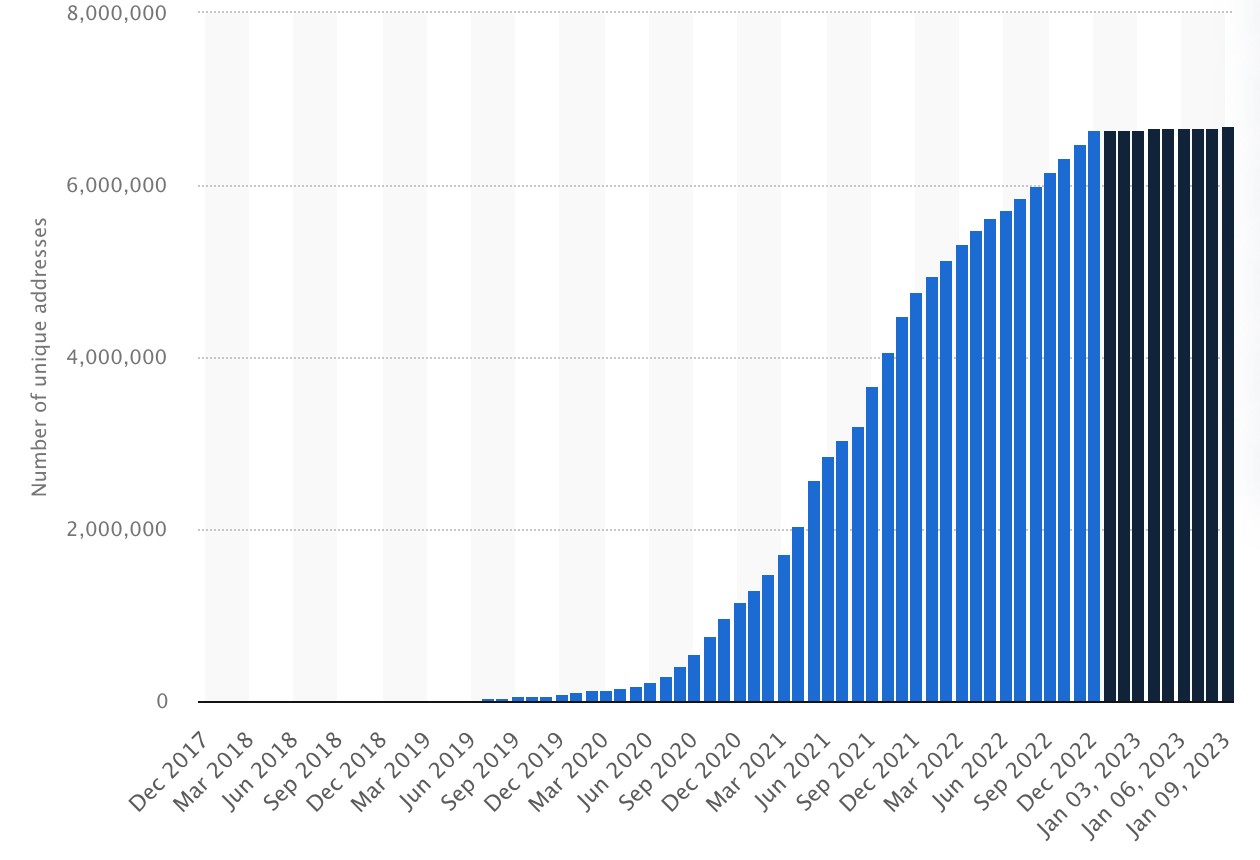

A report from Statista illustrates that the number of DeFi users surged from fewer than 1,000 in 2017 to over 6 million by January 2023, marking a substantial influx into the DeFi ecosystem.

The number of unique addresses that entered the DeFi space grew significantly between 2019 and 2023. Source: Statista

Operating as a cross-chain DeFi asset management platform, Velvet Capital integrates with major DeFi protocols such as Chainlink, Safe, 0x, 1inch, and PancakeSwap, empowering asset managers, banks, fintech firms, and traders to conduct on-chain trades while utilizing its DeFi-as-a-Service features. This model allows Velvet to offer tools for easily launching and managing DeFi funds.

Advanced DeFi tools for asset managers

Velvet’s DeFi-as-a-Service framework aids in launching a tokenized fund or strategy product while fully operating on-chain. Through the smart routing and yield farming integrations provided by Velvet Capital, users can enhance the capital efficiency of their portfolios.

In response to the increasing demand for decentralized options, Velvet Capital has recently joined the Cointelegraph Accelerator program. By participating in the program, Velvet seeks to facilitate straightforward access to digital asset management for all.

Velvet enables cross-chain DeFi operations for asset managers. Source: Velvet Capital

Functioning across various blockchain networks, Velvet facilitates intricate strategies spanning multiple ecosystems through omni-chain portfolio management, automated tokenization, smart yield farming, and seamless integration. Institutional funds and asset managers can access their portfolio data in real-time via Velvet’s white-label client portal.

Shaping the future of DeFi-as-a-Service

To realize genuine decentralization, Velvet Capital aspires to operate as a community-managed protocol under the auspices of a decentralized autonomous organization (DAO) known as Velvet DAO. Participants in Velvet DAO will be able to utilize VLVT, the forthcoming native governance token of the network, to participate in votes and decision-making processes after the token launch and airdrop. Native tokens will be allocated to users based on the total value locked in their accounts and the duration of their platform usage.

DeFi enthusiasts wishing to engage in the founding of Velvet DAO can secure a whitelist spot for a Velvet Founders NFT, granting them a position within the DAO and the opportunity to influence the future of the DeFi-as-a-Service protocol by using the exclusive invite code Cointelegraph23.

Cointelegraph introduced its Accelerator program in early 2023 to serve as a catalyst for the growth of Web3 startups and products. The Cointelegraph Accelerator utilizes the media giant’s extensive resources to provide partners with essential tools for the Web3 landscape, including advertising and media exposure, workshops with industry experts, networking opportunities, participation in major crypto events, and the development of marketing strategies.

Velvet has set its goals on attracting the next wave of users to DeFi through Cointelegraph Accelerator’s comprehensive media exposure toolkit specifically designed for the Web3 environment. This collaboration will enable Velvet to reach a significantly broader audience, drawing more attention to its DeFi asset management operating system that simplifies DeFi trading.