Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Distributed ledger technology has the potential to save traditional finance $100 billion annually, according to a lobbying organization.

According to a recent report from the Global Financial Markets Association (GFMA), the adoption of distributed ledger technology (DLT) in conventional markets could result in annual savings of approximately $100 billion or more.

In a report released on May 16, the GFMA, in collaboration with the international consulting firm Boston Consulting Group and other entities, urged regulators and traditional financial institutions to seriously consider the benefits of this technology.

A distributed ledger refers to a broad category of systems that document transactions and digital data. A blockchain is a specific instance of a distributed ledger.

“Distributed ledger technology has the potential to foster growth and innovation,” stated GFMA CEO Adam Farkas. “This opportunity should not be overlooked or restricted where regulatory oversight and resilience measures are already in place.”

The report indicates that employing distributed ledgers to enhance collateral processes in derivatives and lending markets could yield an additional $100 billion in savings.

Moreover, the implementation of smart contracts to automate and strengthen clearing and settlement processes could lead to a reduction in overhead costs by $20 billion annually.

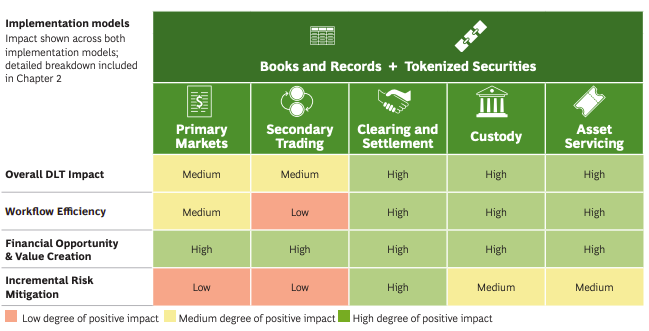

Impact of DLT on various market elements. Source: GFMA

Impact of DLT on various market elements. Source: GFMA

In general, the areas that are likely to benefit the most from the integration of DLT include clearing and settlements, with custody and asset servicing following closely behind.

As per BCG’s analysis, primary markets and secondary trading are expected to experience less significant effects from the technology; however, tokenization in these markets may enhance risk management and increase liquidity.

DLT is starting to see increased adoption on a global scale. On March 23, Euroclear, a European securities clearing firm that claims to manage over 37.6 trillion euros ($40.9 trillion) in custodied assets, announced its intention to incorporate DLT into its settlement processes.

Related: China launches national blockchain center to train half a million specialists

Nonetheless, there remains considerable scope for advancement in the integration of DLT within existing financial frameworks.

Last November, the Australian Securities Exchange halted its efforts to modernize its 25-year-old clearing and settlement system with DLT, resulting in a $170 million deficit.

The GFMA report follows a statement from Citi investment bank made just two months prior, which projected that the global market for blockchain-based tokenized assets could reach an impressive $5 trillion by 2030.

Magazine: How to control the AIs and incentivize the humans with crypto