Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

DeFi seeks to rebound from Curve breach, yet vulnerabilities persist: Finance Redefined

Welcome to Finance Redefined, your weekly source of crucial decentralized finance (DeFi) insights — a newsletter designed to deliver the most important updates from the previous week.

The DeFi ecosystem is still in the process of recovering from the turmoil caused by the Curve Finance hack, and although the situation appears to be under control, another series of exploits affected the DeFi landscape this past week.

Steadefi, a DeFi protocol, has become the latest target of an ongoing exploit while the ecosystem was still healing from the Curve incident.

Binance has stepped in to invest $5 million in the Curve token as the hacker has partially returned some of the funds to mitigate the risks associated with the Curve token’s value.

In other developments, Aptos has formed a partnership with Microsoft to work on various Web3 solutions, resulting in a significant increase in its token’s value. Coinbase has made history as the first publicly traded company to introduce a decentralized layer-2 platform named Base, which has already garnered considerable attention from the DeFi community.

Binance invests $5 million in Curve token as hacker partially returns funds

Binance Labs, the investment division of the cryptocurrency exchange Binance, has allocated $5 million to Curve Finance (CRV), the token associated with the decentralized stablecoin trading platform.

“Curve is the largest stableswap and the second-largest DEX [decentralized exchange], with around $2.4 billion in total value locked and $215 million in daily volume at the time of this announcement,” Binance Labs stated in their announcement on Aug. 10. Yi He, co-founder of Binance and head of Binance Labs, expressed the firm’s commitment to supporting the DEX “in light of recent events that have affected the protocol.”

Continue reading

Aptos token rises 11.6% after Microsoft deal to marry AI with blockchain

Aptos (APT), the cryptocurrency that powers the layer-1 Aptos Network, has increased by approximately 11.6% following the announcement of its collaboration with Microsoft to utilize the tech giant’s suite of artificial intelligence tools to promote Web3 adoption among banks and financial institutions.

This initiative will allow the Aptos Network to leverage Microsoft’s Azure OpenAI service to explore advancements in asset tokenization, on-chain payments, and central bank digital currencies, as stated by Aptos in an announcement on Aug. 9.

Continue reading

Base network has officially launched: Here’s how it can be used

Coinbase’s Base network has officially launched after a few weeks in an “open for builders only” phase. The network is now prepared to onboard users, as indicated in an announcement from the team on Aug. 9.

Multiple Web3 development teams have concurrently announced the release of applications for Base, and the network’s team has shared a schedule of upcoming events to commemorate its launch.

Continue reading

Breaking: ‘All funds are at risk’ — Steadefi exploited in ongoing attack

The DeFi application Steadefi was exploited for at least $334,000 on Aug. 7 during an ongoing attack. The development team of the app stated in a social media post that the attack currently “puts all funds at risk.” The app’s total value locked has significantly decreased due to the attack, according to data from DefiLlama.

The Steadefi team communicated via X (formerly Twitter): “NOTICE: Steadefi has been exploited and all funds are currently at risk.” They also confirmed that an on-chain message was sent to address 0x9cf71F2ff126B9743319B60d2D873F0E508810dc on Ethereum in an effort to negotiate with the attacker. Blockchain data indicates that several large inflows on the Avalanche chain were directed to this address, starting at 4:41 pm UTC on Aug. 7.

Continue reading

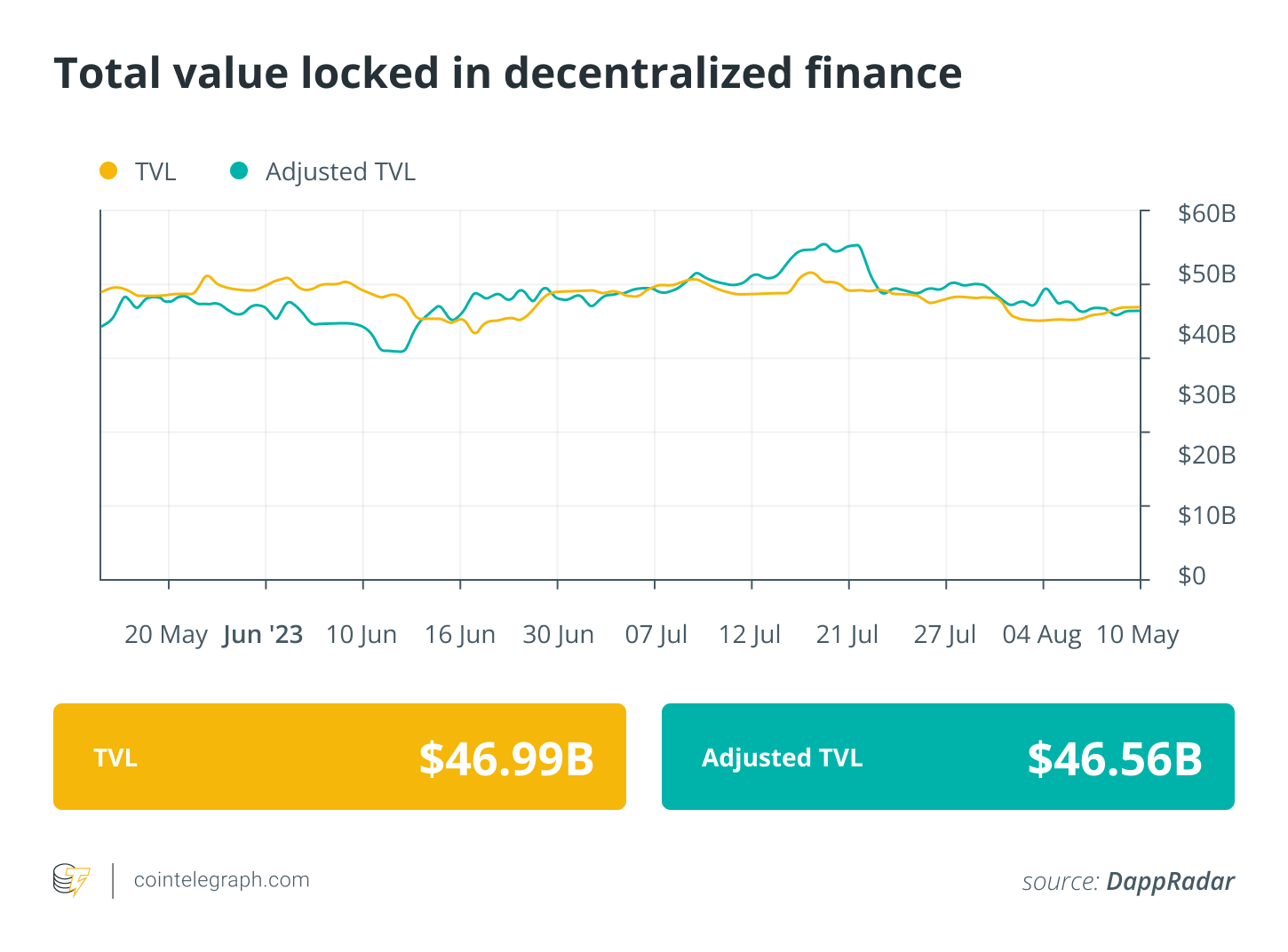

DeFi market overview

The total market value of DeFi experienced a bearish decline over the past week. Data from Cointelegraph Markets Pro and TradingView reveals that the top 100 DeFi tokens by market capitalization had a mixed performance, with the majority trading in the negative. The total value locked in DeFi protocols remained below $50 billion.

Thank you for reading our summary of this week’s most significant DeFi developments. Join us next Friday for more stories, insights, and educational content regarding this rapidly evolving space.