Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto Update: Ripple’s costly legal struggle, Bittrex insolvency, and the launch of a new blockchain network.

A significant question in the cryptocurrency sector may be whether tokens qualify as securities in the United States, with several crypto firms investing heavily in this issue.

For the payment platform Ripple — which was sued by the U.S. Securities Exchange Commission (SEC) in 2020 — legal expenses have already exceeded $200 million, as reported by Cointelegraph. The SEC alleges that Ripple sold XRP (XRP) tokens as an unregistered security, similar to accusations made against numerous other crypto companies recently.

Despite the potential for costly legal battles with the regulator, companies and projects continue to explore the boundaries of what can be classified as a security. The Arbitrum Foundation — the organization behind the Arbitrum blockchain — intends to distribute Ether (ETH) tokens valued at over $6 million to holders of its native Arbitrum (ARB) token, according to a recent proposal in its DAO governance forum.

The tokens were created from base fees and excess revenue from network transactions. While the proposal has garnered support, some community members expressed concerns that the revenue distribution might be interpreted as a means to categorize ARB tokens as securities.

This week’s Crypto Biz examines Arbitrum’s recent contentious proposal, Ripple’s ongoing two-year struggle with the SEC, and a coalition of large corporations working to develop blockchain solutions aimed at institutional investors.

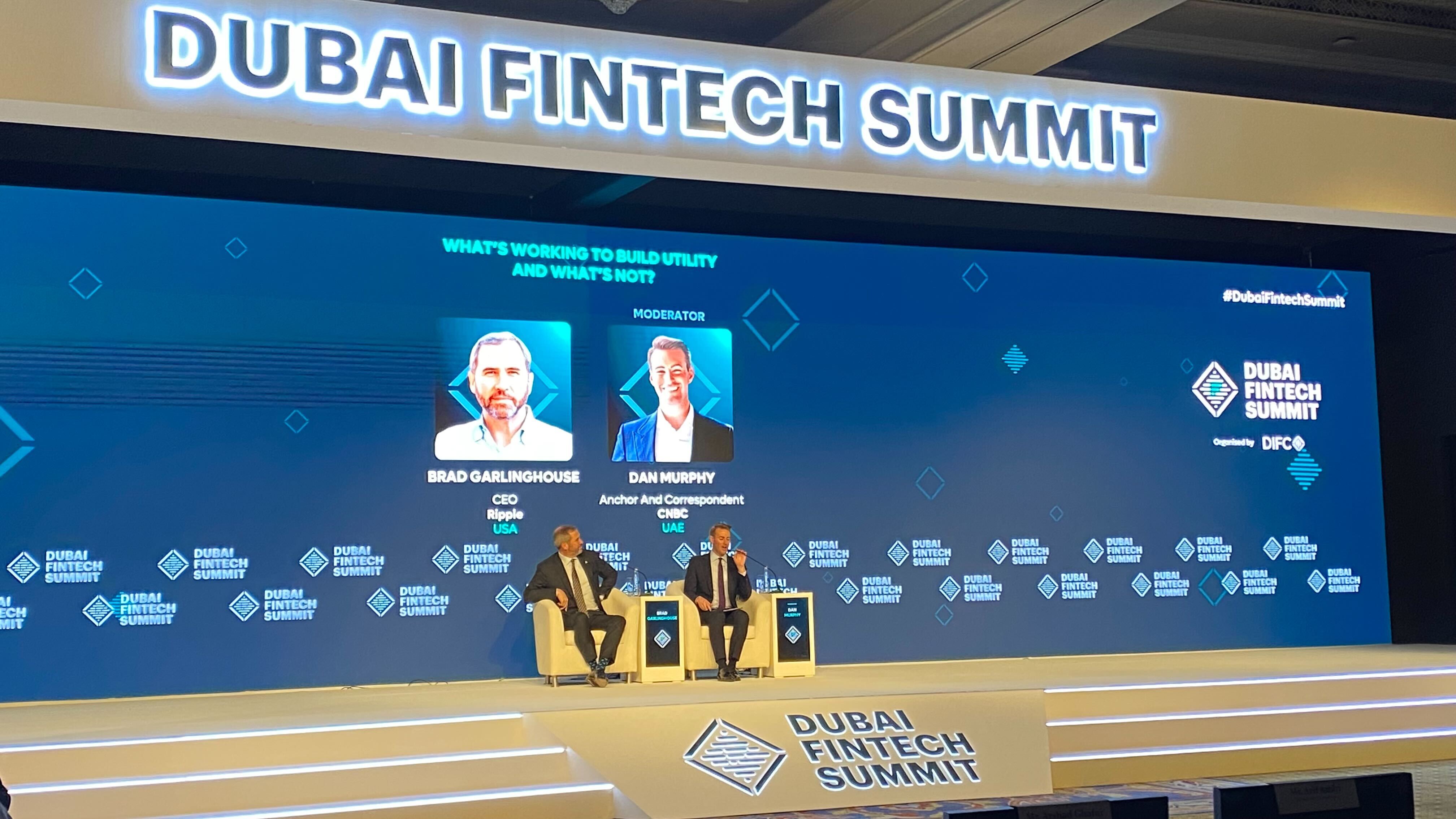

Ripple’s defense against the SEC to incur $200 million, says CEO Brad Garlinghouse

The lawsuit filed against Ripple by the SEC has cost the company $200 million, stated CEO Brad Garlinghouse during a fireside chat at the Dubai Fintech Summit. Garlinghouse also remarked that the U.S. is lagging behind in regulatory advancements compared to the United Arab Emirates and the recent Markets in Crypto-Assets legislation in the European Union. The SEC initiated legal action against the crypto payment platform in December 2020, asserting that Ripple unlawfully sold XRP tokens as an unregistered security.

Brad Garlinghouse during the fireside chat at the Dubai Fintech Summit.

Brad Garlinghouse during the fireside chat at the Dubai Fintech Summit.

Microsoft, Goldman Sachs, and others collaborate on new blockchain network

A new blockchain network tailored for financial institutions is being developed by a consortium of participants from the finance and technology sectors, including Microsoft and Goldman Sachs. The Canton Network will serve as an interoperable blockchain network for organizations dealing with institutional assets. The platform utilizes Daml, the smart contract language from Digital Asset, which facilitates an interoperable system where “assets, data, and cash” can align across interconnected applications.

Bittrex seeks Chapter 11 bankruptcy just weeks after SEC allegations

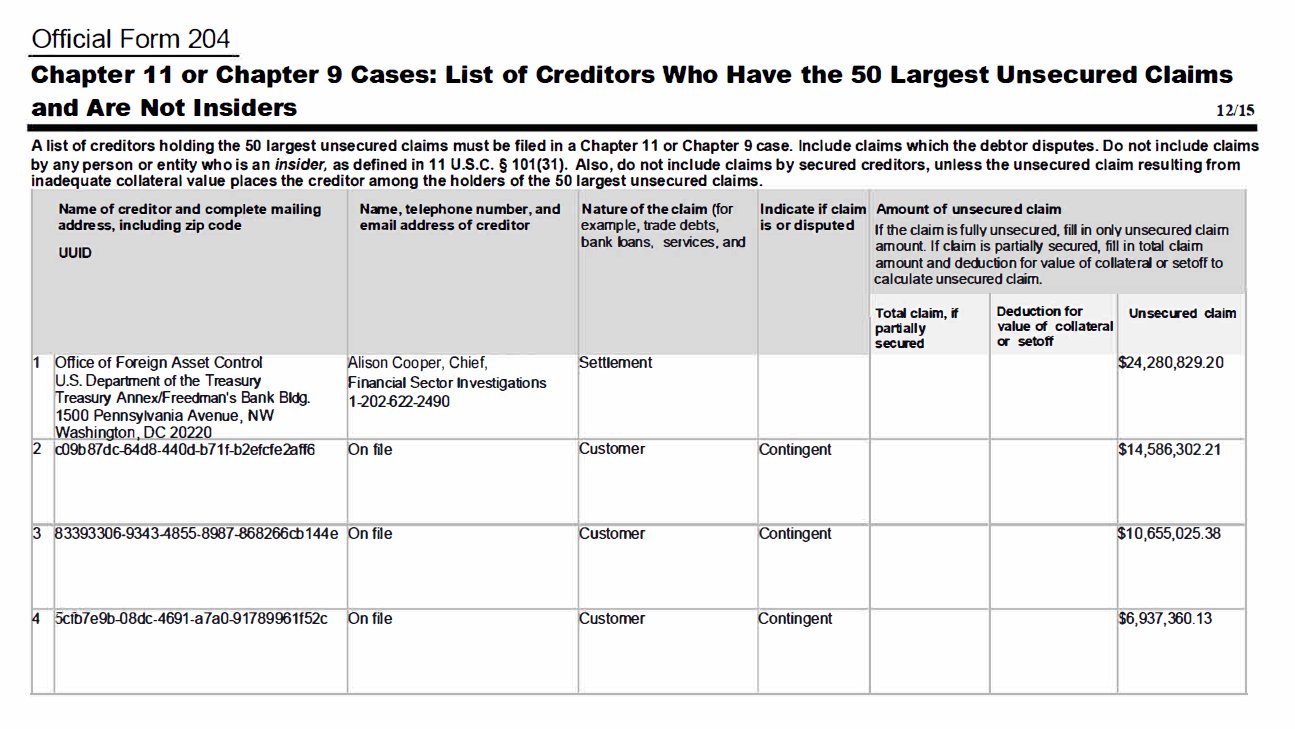

The cryptocurrency trading platform Bittrex has sought Chapter 11 bankruptcy protection in the United States. Bittrex Global CEO Oliver Linch informed Cointelegraph that the bankruptcy is part of the exchange’s process of winding down operations in the U.S., assuring that funds are secure and will be transferred to the court. This action follows the SEC’s charges against the company and its co-founder William Shihara for securities violations in April. In October 2022, the exchange faced charges from the U.S. Treasury’s Office of Foreign Assets Control. This agency is the largest creditor listed in Bittrex’s bankruptcy filing, which includes a claim of $24.2 million.

OFAC takes the top creditor spot for Bittrex with claims of $24.2 million. Source: PACER

OFAC takes the top creditor spot for Bittrex with claims of $24.2 million. Source: PACER

Arbitrum’s DAO to receive over 3,350 ETH from transaction fees

The Layer-2 blockchain Arbitrum plans to allocate Ether tokens valued at nearly $6.2 million to its community. As per a recent proposal on its governance forum, approximately 3,352 ETH will be gathered by Arbitrum’s decentralized autonomous organization. The funds collected originate from base fees and excess revenue generated from network transactions. Data from Crypto Fees indicates that Arbitrum’s users incurred $387,423 in fees over the past week. The proposal seems to have widespread support, but some community members cautioned that the revenue distribution could lead to the classification of the ARB token as a security.

Crypto Biz is your weekly pulse of the business behind blockchain and crypto, delivered directly to your inbox every Thursday.