Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Crypto exchanges establish timeline for Ether staking withdrawals.

The Ethereum mainnet successfully executed the Shapella upgrade on April 12. This successful implementation allows Ethereum validators to finally withdraw their staked Ether from the Beacon chain.

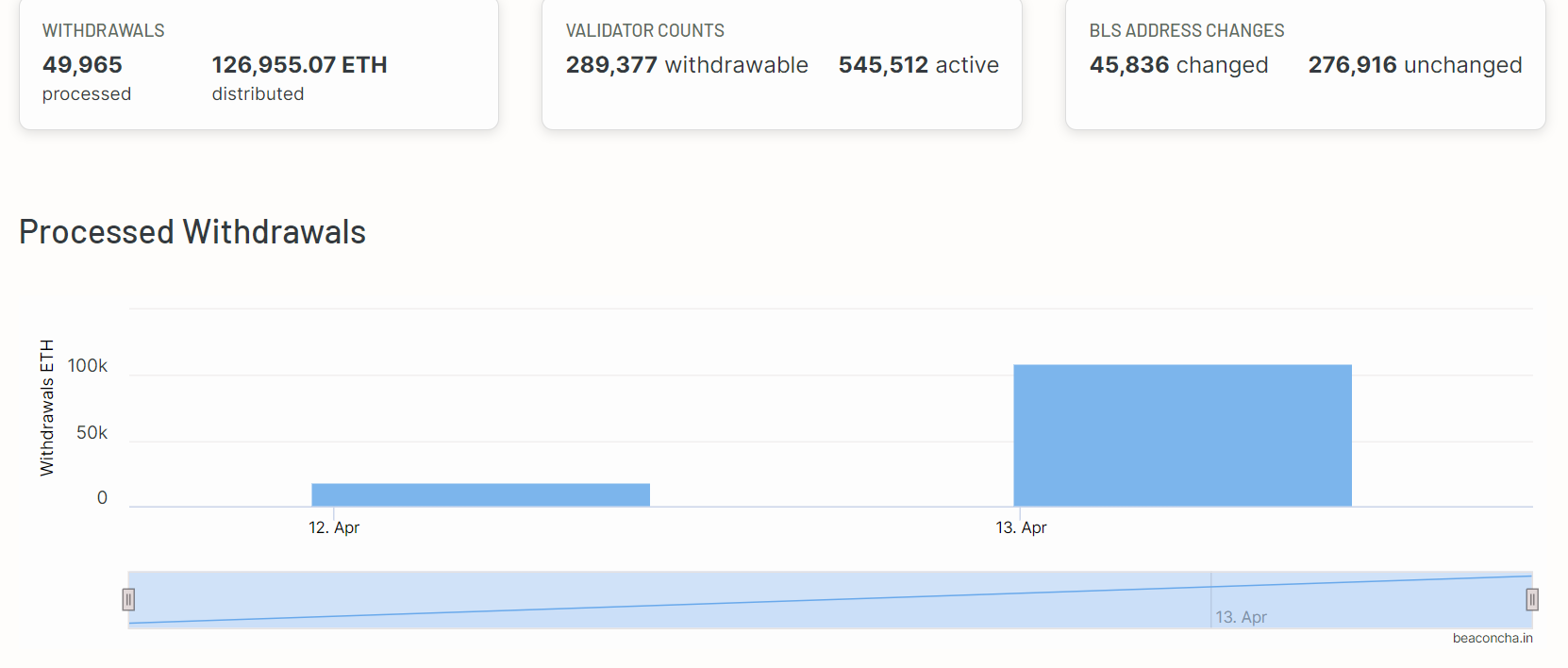

At the time of this report, validators had withdrawn a total of 126,955.07 ETH. Currently, 248,043 out of 559,549 active validators, approximately 44%, have the option to request either a partial or full withdrawal. The majority of these withdrawals are between 2.8 and 3.2 ETH, suggesting that most validators are primarily withdrawing their staking rewards.

Total staked ETH withdrawal. Source: beaconcha.in

Total staked ETH withdrawal. Source: beaconcha.in

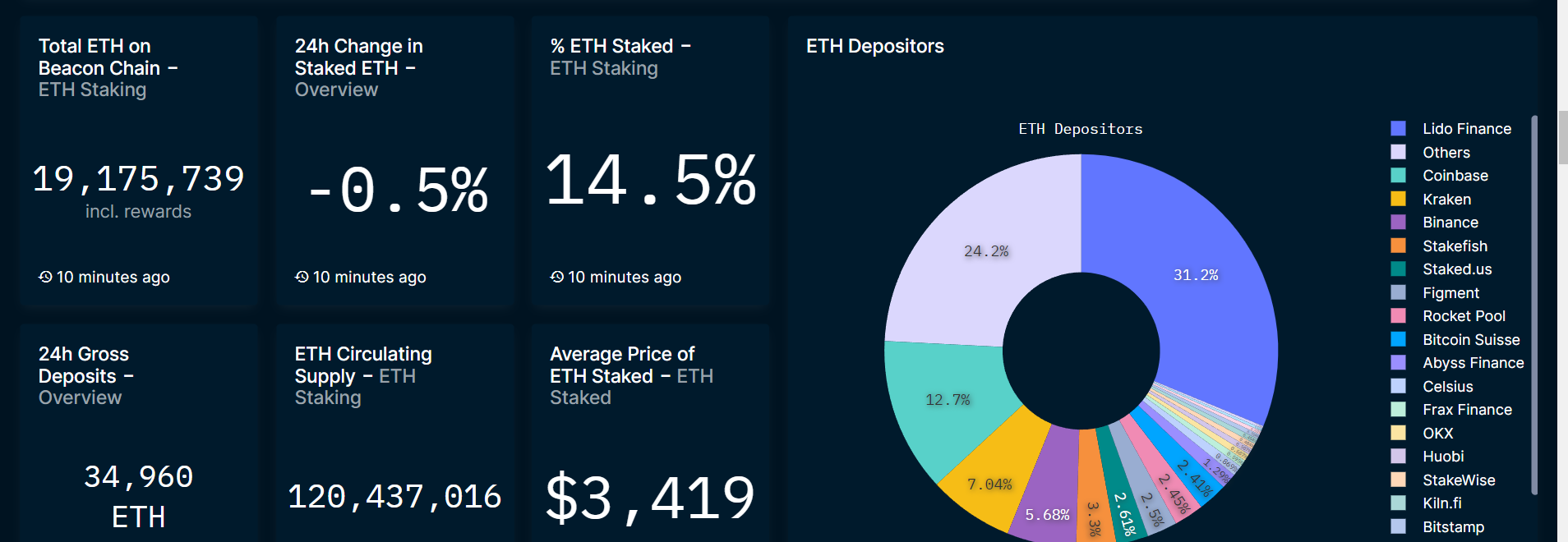

The average value of staked ETH is $3,149, which may contribute to the decision of validators not to withdraw the entire amount. The current trading price of ETH is just below $2,000, with this price acting as a significant resistance level.

Staked ETH data and exchange holdings. Source: Nansen

Staked ETH data and exchange holdings. Source: Nansen

Major cryptocurrency exchanges have declared their support for ETH unstaking, with several already processing withdrawal requests. Coinbase, the first publicly listed crypto exchange, announced that ETH unstaking is now operational on their platform.

The Shapella Upgrade is complete. Congratulations to the @Ethereum community! ETH unstaking is now enabled on https://t.co/bCG11KNnW0. https://t.co/JcTxAVphGZ

— Coinbase (@coinbase) April 12, 2023

Chen Fang, the chief operating officer of BitGo, took to Twitter to confirm that the exchange has successfully upgraded to Shapella and that ETH withdrawals are now available on their platform.

In contrast, Kraken began withdrawing validators for their U.S. customers on April 11 and started processing ETH withdrawals following the completion of the Shapella upgrade. The early withdrawal of validators by the exchange was prompted by the U.S. Securities and Exchange Commission’s action against Kraken’s Ethereum staking product in February.

For clarity:

Validators are currently able to exit but the associated 32 ETH stake and consensus layer rewards are not able to be withdrawn (aka moved around) until Shapella goes live in around 12 hours.

What Kraken is doing right now is exiting their validators.— sassal.eth (@sassal0x) April 12, 2023

Related: Upcoming Shapella upgrade fuels liquid staking growth — AMA with Swell

Jonathon Miller, Managing Director of Kraken Australia, informed Cointelegraph that while a significant amount of ETH unstaking might lead to some price fluctuations, it will ultimately attract users to the ecosystem over time. He elaborated:

“Whilst this unlocking event may create conditions for an exodus from the staking protocol, the ability to freely stake and unstake (in accordance with bonding periods specified by the protocol) could equally attract many ETH holders. The move to unstaking could see a massive movement of assets into Ethereum staking pools.”

Binance, the top crypto exchange by trading volume, stated it will support the Shapella upgrade and begin processing withdrawal requests starting April 19. The exchange also noted that withdrawal requests may take up to 15 days to process due to processing constraints.

#Binance will support $ETH 2.0 Staking withdrawals starting from April 19, 08:00 UTC.

Due to the processing limitations on the $ETH network, ETH withdrawal requests may take up to 15 days to several weeks to be fully processed.

More details here ⤵️https://t.co/L3iyon58lo— Binance (@binance) April 13, 2023

Bitfinex, a prominent crypto exchange, congratulated the Ethereum community on the successful upgrade and mentioned that details regarding ETH withdrawals will be provided soon.

Magazine: 2023 is a make-or-break year for blockchain gaming: Play-to-own