Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Bitcoin earnings per terahash approach historic lows amid rising hashrate.

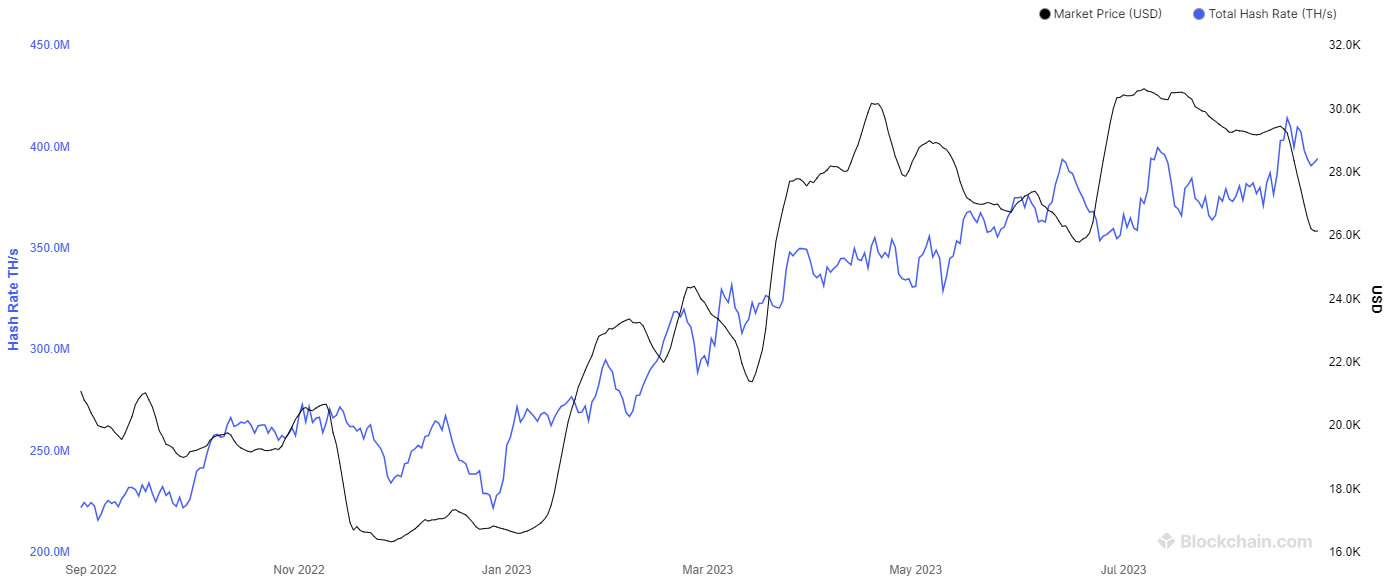

Bitcoin mining revenue, often referred to as “hash price” — an indicator of earnings in dollars per TH/s per day — has decreased to levels not observed since the FTX collapse in November 2022, while the hash rate has achieved new records.

In the last week, the Bitcoin network hash rate reached a peak of 414 exahashes per second (EH/s) on Aug. 18, setting a new high for this metric.

This peak reflects a 54% increase in the network hash rate compared to the start of 2023 and an 80% rise over the past year, as reported by Blockchain.com.

BTC hash rate and price 1 year. Source: Blockchain.com

BTC hash rate and price 1 year. Source: Blockchain.com

Nevertheless, while the network appears robust in terms of security, the situation for Bitcoin miners is less favorable as revenue has significantly declined, reaching levels last seen when BTC dropped to a market cycle low of approximately $16,500 in November 2022.

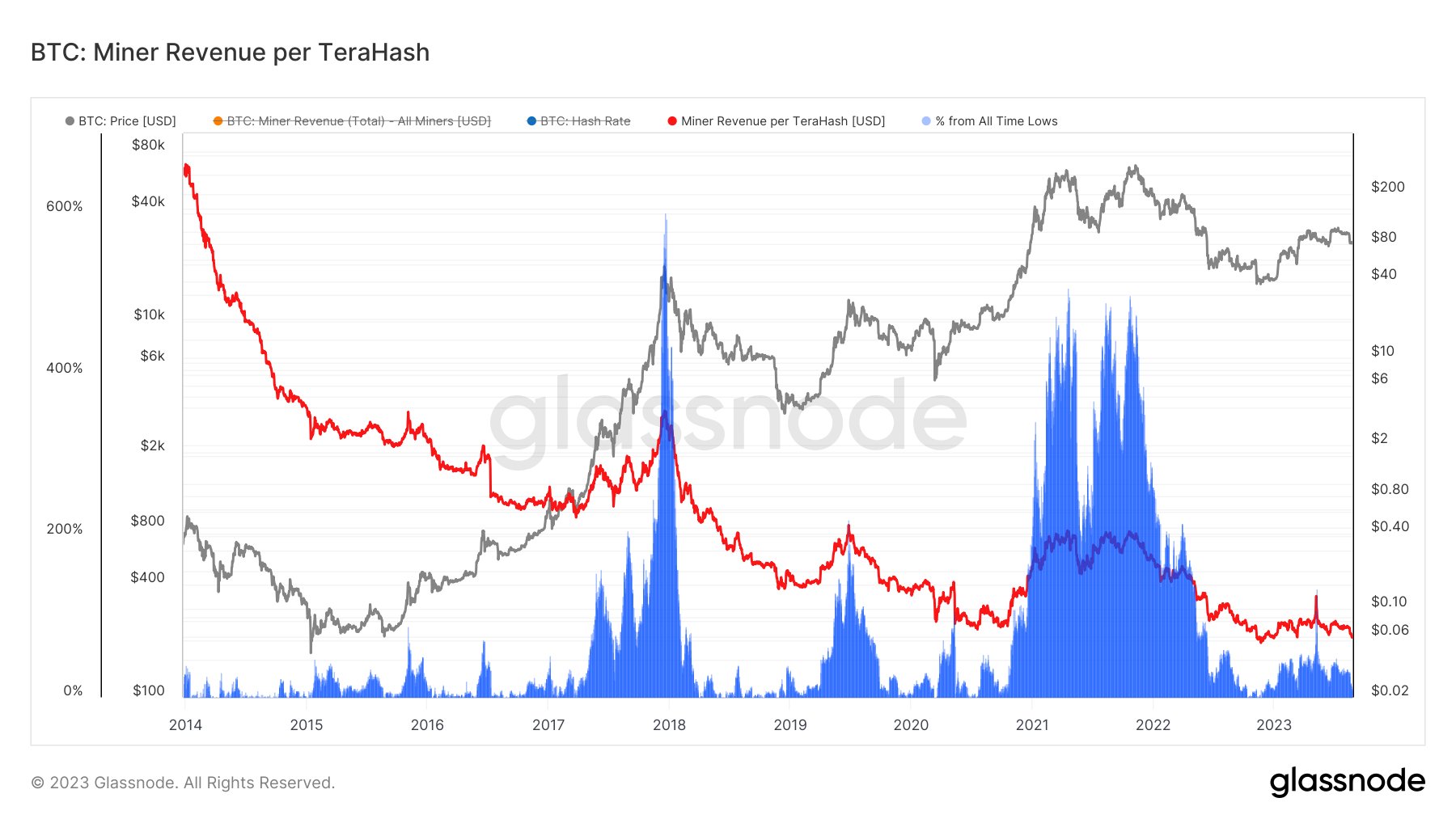

As per HashPriceIndex, revenue currently stands at just $0.060 per terahash per second per day, roughly half of what it was in early May when the Bitcoin Ordinals inscription surge led to a substantial demand for block space.

Market analyst Dylan LeClair remarked on the declining revenue and the peak in hash rate, indicating that more efficient new rigs will continue to be developed, “but it’s almost time for the price to outpace,” suggesting that prices need to rise to maintain mining profitability at such elevated hash rates.

Miner revenue per terahash. Source: Glassnode

Miner revenue per terahash. Source: Glassnode

Related: Bitcoin miners need BTC price over $98K by the halving

Reports indicate that Bitcoin miners have been depending on funds from stock sales in the second quarter to sustain operations during the bear market.

On Aug. 24, Bloomberg disclosed that the 12 major publicly traded miners raised approximately $440 million through stock sales in Q2.

Major $BTC miners are in BIG trouble heading to the halving

To avoid selling the ~$900M BTC they’re hoarding, miners relied on debt and diluting shareholders

Now those lifelines are drying up. Soon their only option is dumping into the market https://t.co/I27tvV4kxu— Rho Rider (@RhoRider) August 26, 2023

Mark Jeftovic, who oversees the Bitcoin Capitalist newsletter, stated, “Some mining companies are diluting shareholders at an excessive rate,” adding that “if they are diluting you faster than Bitcoin is going up, then you are going the wrong way on a treadmill.”

Magazine: Recursive inscriptions: Bitcoin ‘supercomputer’ and BTC DeFi coming soon