Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

BIS and Bank of England finalize pilot for DLT settlements

The Bank of England, in collaboration with the Bank for International Settlements (BIS) Innovation Hub London Center, has conducted a trial of a settlements system powered by distributed ledger technology between the two institutions. The findings from this initiative will inform the Bank of England’s real-time gross settlement (RTGS) system.

On April 19, BIS released a report detailing the collaborative pilot project with the Bank of England, referred to as Project Meridian. The 44-page document indicates that the banks have successfully acquired properties in Wales and England via the synchronization network utilizing distributed ledger technology (DLT).

The report highlights that the messages exchanged between the synchronization network and the RTGS system through APIs offer a generic interface that could be “relatively easily” adapted to other asset categories, such as foreign exchange. This adaptation could lead to reductions in transaction time, costs, and risks.

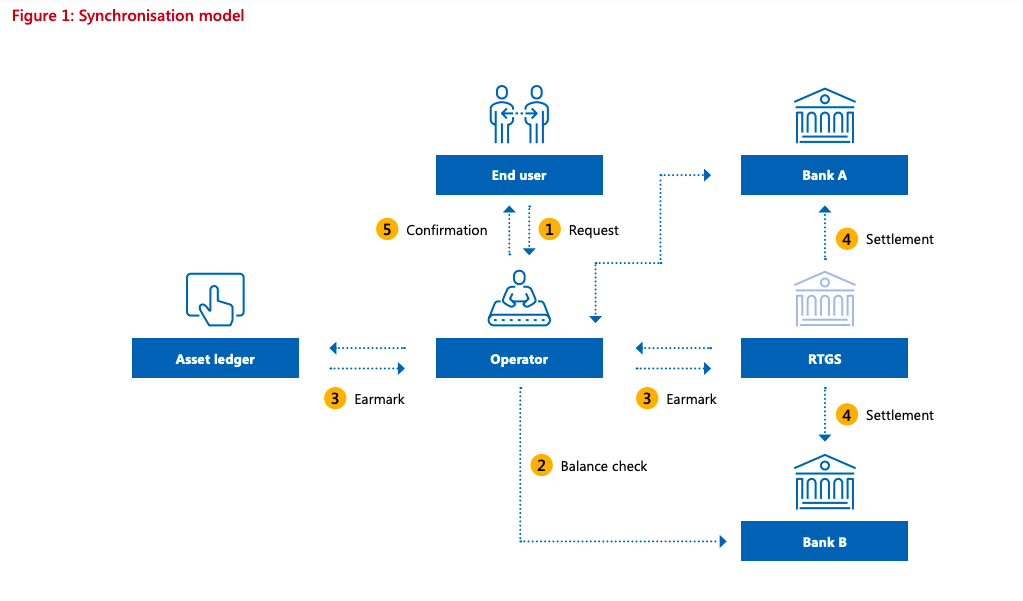

The Synchronization system of Project Meridian. Source: BIS

The Synchronization system of Project Meridian. Source: BIS

Project Meridian is clearly designed to establish a settlement framework for central bank digital currencies (CBDC). The report explicitly mentions the potential advantages for central banks:

“Synchronization can provide a catalyst for innovation in wholesale payments and support the emergence of new payments infrastructures that settle using central bank money.”

Nonetheless, the report concludes with several concerns regarding the prospective application of the system, as discussed in the “Political and operational considerations” section. For instance, future network operators will need to address the processes involved in identity verification. Additionally, the synchronization services would be limited by the current RTGS operating hours, especially as many jurisdictions are contemplating extending the operating hours of their national payment systems.

Related: CBDCs could provide smooth cross-border payments, says Bank of Israel official

Implementing the system would raise numerous legal issues, including the finality of settlement irrevocability, the digital representation of asset ownership, and the prevention of arbitrary use of clients’ funds by commercial banks prior to the transaction date.

In March, the BIS reported the conclusion of Project Icebreaker, which examined international retail and remittance payment use cases for CBDCs in collaboration with the central banks of Israel, Norway, and Sweden. In October 2022, the bank announced that a CBDC pilot involving the central banks of Hong Kong, Thailand, China, and the United Arab Emirates was deemed “successful” after a month-long trial that facilitated $22 million in cross-border transactions.

Magazine: Are CBDCs kryptonite for crypto?