Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

Anniversary of Ethereum Merge: 99% Reduction in Energy Consumption, Yet Concerns Over Centralization Persist

One year following its groundbreaking shift to proof of stake, Ethereum has experienced a significant decrease in energy consumption and an enhanced ability to access the network; however, several technical challenges still lie ahead.

The Merge was carried out on Sept. 15, 2022 — a milestone that involved the Ethereum mainnet merging with a distinct proof-of-stake blockchain known as the Beacon Chain.

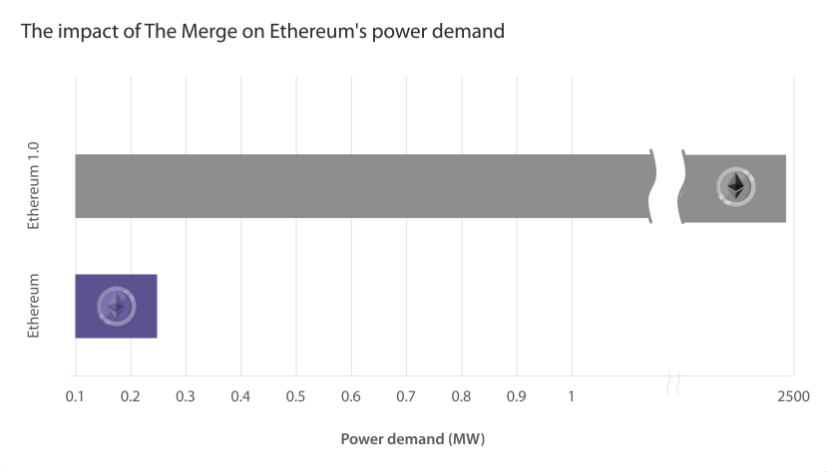

The most prominent enhancement to Ethereum after the merge was the dramatic transition from an energy-intensive proof-of-work (PoW) consensus mechanism to PoS, resulting in a substantial reduction in the network’s overall power usage.

As per data from The Cambridge Centre for Alternative Finance, the Ethereum network has witnessed its energy consumption decline by over 99.9% from the roughly 21 terawatt hours of electricity it utilized while operating under PoW.

The Merge has decreased Ethereum’s power consumption by more than 99%. Source: CCAF

The Merge has decreased Ethereum’s power consumption by more than 99%. Source: CCAF

Ethereum becomes deflationary

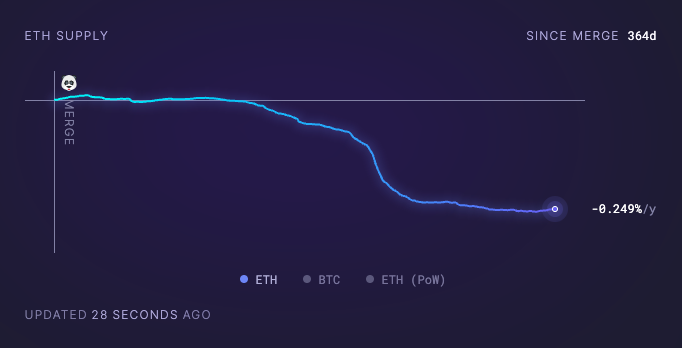

In addition to consuming less energy, The Merge also resulted in the Ethereum network becoming economically deflationary, indicating that the issuance of new Ether (ETH) to secure the network has been surpassed by the quantity of ETH permanently removed from circulation.

Data from the Ethereum data provider ultrasound.money reveals that just over 300,000 ETH (valued at $488 million at current prices) has been burned since The Merge. At the current burn rates, the total ETH supply is decreasing at an annual rate of 0.25%.

Change in ETH supply since the Merge. Source: ultrasound.money

Change in ETH supply since the Merge. Source: ultrasound.money

While numerous supporters anticipated that the price of Ethereum would rise in response to this new deflationary pressure, expectations for a significant increase in ETH’s price were tempered by various macroeconomic challenges, including the banking crisis and rising inflation.

Notably, the growth of ETH was overshadowed by the increase in Bitcoin (BTC) prices during the first quarter of this year, with the leading cryptocurrency appearing to benefit from much of the traditional financial instability caused by the banking crisis.

Regardless of price movements, the central focus of the proof-of-stake upgrade was the replacement of miners with stakers to secure the network.

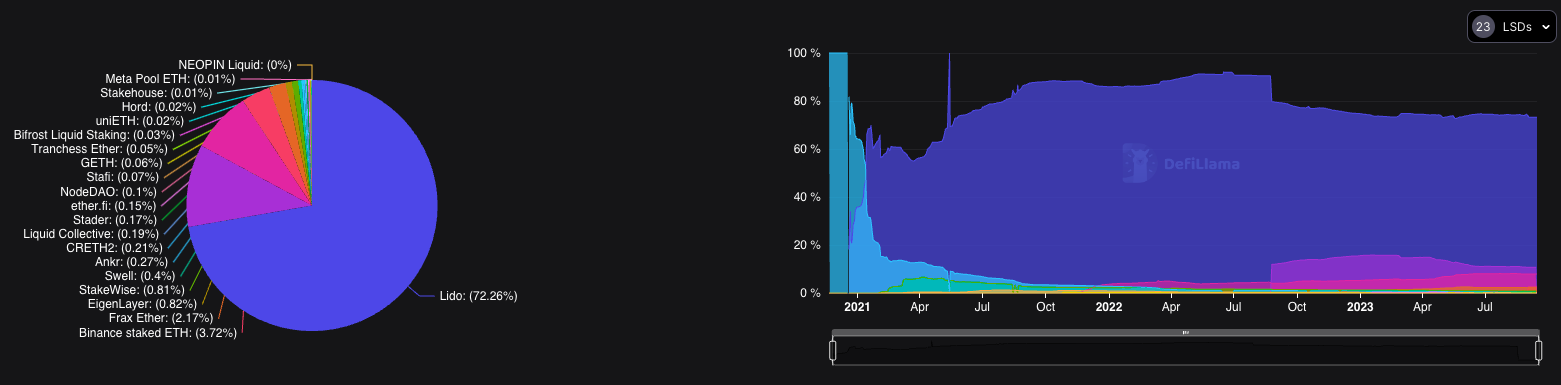

The subsequent Shapella upgrade in April 2023 prompted a substantial influx of ETH into staking. The primary beneficiaries of this transition were liquid staking providers like Lido and Rocket Pool.

Liquid staking dominates

Since the Merge, liquid staking providers have come to dominate the Ethereum ecosystem, with over $19.5 billion worth of ETH currently staked through liquid staking protocols, according to data from DeFiLlama.

At the time of publication, Lido stands out as the largest staking provider, representing 72% of all staked ETH.

Lido currently accounts for 72% of all staking on Ethereum. Source: DeFiLlama

Lido currently accounts for 72% of all staking on Ethereum. Source: DeFiLlama

However, while many Ethereum supporters, including Labry CEO Lachlan Feeny, have commended the transition to staking for eliminating the barriers posed by costly, complex mining hardware, a primary concern regarding the rise of liquid staking has been the level of control afforded to staking providers, particularly Lido Finance.

“Liquid staking is ultimately beneficial for the network as it ensures that governance is not limited to the affluent. However, it has also given rise to its own set of challenges,” Feeny stated to Cointelegraph.

At least five Ethereum liquid staking providers are working towards implementing a 22% limit rule to ensure the decentralization of the Ethereum network — although Lido opted not to participate.

Related: Ethereum’s active addresses second-highest in history: Analysts

Notably, Lido voted against self-limiting by a 99.81% majority in June, prompting Ethereum advocate Superphiz to assert that the staking providers had “expressed an intention to control the majority of validators on the beacon chain.”

Lido voted by a 99.81% majority not to self-limit. They have expressed an intention to control the majority of validators on the beacon chain.https://t.co/T16rTdM3gm

— superphiz.eth ️ (@superphiz) August 31, 2023

This decision has raised widespread concerns regarding the potential centralization of validation on Ethereum.

“Lido currently controls 32.26% of all staked Ether on the network, valued at over $14 billion. In the long term, I am confident that Ethereum is better off with liquid staking than without it; however, numerous challenges still need to be addressed,” Feeny concluded.

Feeny also highlighted that the most urgent concern for Ethereum in the near future is the increasing regulatory pressure against crypto and blockchain in the United States at large.

“Regulatory bodies, particularly in the U.S., seem determined at present to eliminate the U.S.-based blockchain industry,” he remarked.

It would be devastating for Ethereum and the global blockchain community if it becomes too difficult for blockchain companies to operate in the U.S.”

In addition to staking, client diversity remains a critical issue. On Sept. 5, Vitalik Buterin addressed the audience at Korea Blockchain Week to discuss the six key challenges that must be tackled to mitigate centralization.

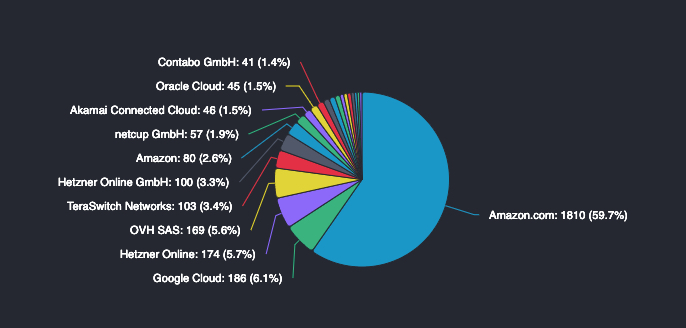

Currently, the majority of the 5,901 active Ethereum nodes are operated through centralized web providers like Amazon Web Services, which many experts argue leaves the Ethereum blockchain vulnerable to a centralized point of failure.

Distribution of Ethereum nodes from web service providers. Source: Ethernodes

Distribution of Ethereum nodes from web service providers. Source: Ethernodes

In Buterin’s perspective, for Ethereum to maintain adequate decentralization in the long run, it must become easier for everyday individuals to operate nodes, which necessitates significantly lowering costs and hardware requirements for node operators.

Buterin’s primary solution was the idea of statelessness, which diminishes reliance on centralized servers by reducing data requirements for node operators to nearly zero.

“Today, it takes hundreds of gigabytes of data to run a node. With stateless clients, you can run a node on basically zero.”

While this was Buterin’s most significant concern regarding centralization, he indicated that these issues may not be resolved for another 10 to 20 years.

Magazine: NFT collapse and monster egos feature in new Murakami exhibition