Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

USDT supply decreased by $1.5 billion, according to Artemis Analytics., 2026/02/21 10:08:02

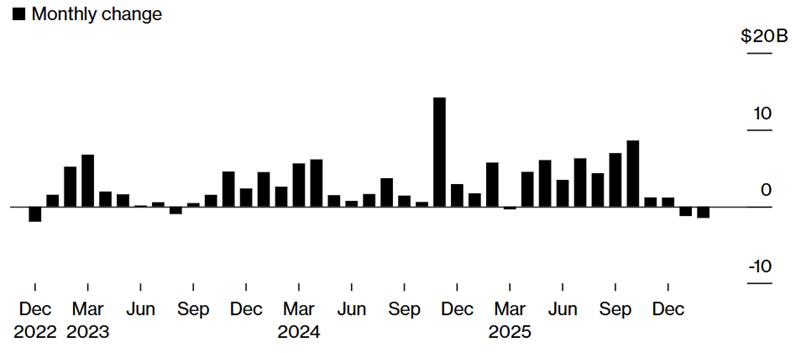

The stablecoin USDT, issued by Tether, has experienced a reduction in supply: since early February, the circulating volume of tokens has decreased by $1.5 billion, according to analysts at Artemis Analytics.

Their assessment suggests that this could represent the most significant monthly decline in supply since December 2022, when the cryptocurrency sector was recovering from the collapse of the FTX exchange.

The influx of capital into stablecoins increased after Donald Trump designated digital dollars as a national priority for the U.S. in 2025. However, in recent months, the trend has slowed down.

The weakening momentum coincided with a prolonged downturn in the cryptocurrency market that began in October. Since then, the total market capitalization of digital assets has fallen by $2 trillion.

Nevertheless, despite the pressures, the stablecoin segment shows resilience. In February, the total supply of this asset class rose to $304.6 billion, up from $302.9 billion the previous month. This growth was primarily driven by competitors of USDT.

Specifically, the market capitalization of the USDC stablecoin, issued by Circle, increased by nearly 5%, reaching $75.7 billion. Meanwhile, Tether’s metrics began to decline after a January peak of $187 billion: by February 18, the supply volume fell below $184 billion.

Analysts note that support for stablecoins from U.S. authorities has heightened interest from technology and financial firms. In particular, the USD1 stablecoin project by World Liberty Financial was launched in 2025.

Previously, experts from the auditing firm BDO reported that Tether generated over $10 billion in net profit last year.