Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

The volume of money laundered through cryptocurrencies has set a record, 2026/01/28 15:54:48

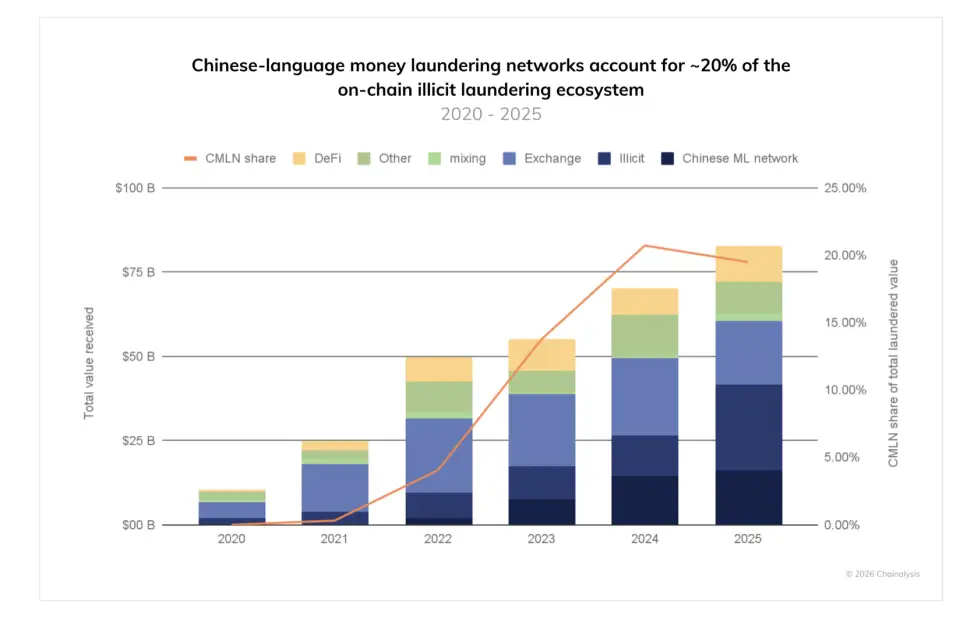

The volume of funds laundered by criminals using cryptocurrencies reached $82 billion last year, according to Chainalysis analysts. For comparison, in 2020, the volume of money laundered through cryptocurrency was $10 billion.

Criminals are increasingly using centralized crypto exchanges to launder money. Such sites, due to pressure from the authorities, have significantly strengthened customer verification and security measures and began to freeze suspicious assets more often, experts explained.

Chinese networks specializing in money laundering have come to the fore. $16 billion (about $44 million daily) of $82 billion came from Chinese-language platforms. The main driver of growth, according to analysts, is the increasing availability and prevalence of cryptocurrencies.

Chinese-language channels on Telegram and other platforms offer a wide range of illegal services: using droppers and organizing the work of unofficial over-the-counter trading platforms, and also using gambling platforms to mix and exchange cryptocurrencies, Chainalysis said.

Such schemes have been operating since the coronavirus pandemic, and over the past five years, about 20% of traced illegal crypto funds have passed through them. Since 2020, the influx of money into identified Chinese-language networks has grown 7,325 times faster than centralized exchanges, analysts said.

Earlier, the founder of the blockchain company Card1Ventures and Node40 co-investor Gary Cardone suggested that in the future, with the development of blockchain tracking systems, bitcoins that were once involved in illegal activities (“dirty bitcoins”) risk being excluded from the global financial system. “Clean” coins will cost more.