Disclaimer: Information found on CryptoreNews is those of writers quoted. It does not represent the opinions of CryptoreNews on whether to sell, buy or hold any investments. You are advised to conduct your own research before making any investment decisions. Use provided information at your own risk.

CryptoreNews covers fintech, blockchain and Bitcoin bringing you the latest crypto news and analyses on the future of money.

The market for tokenized goods has increased by 50% over the past few weeks., 2026/02/11 13:01:46

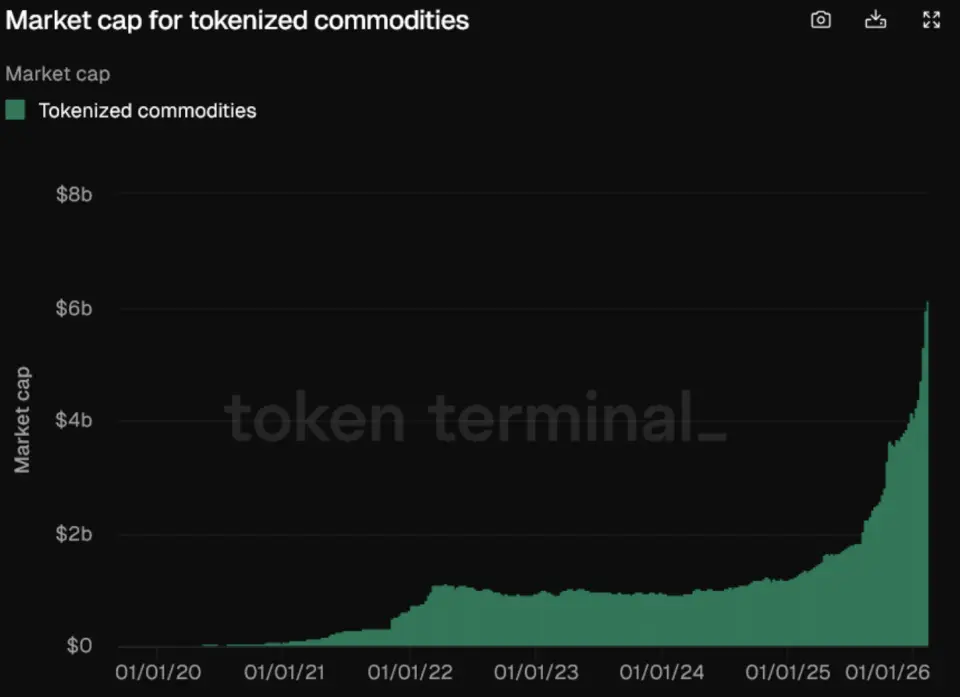

In less than six weeks, the global market for tokenized goods has expanded by 53%, surpassing $6.1 billion. This sector represents the most rapidly growing area within the tokenization of real-world assets. The primary factor driving this growth is the transition of gold onto the blockchain.

At the beginning of 2026, the market for tokenized goods was valued at just over $4 billion, according to analytics from the Token Terminal platform. By early February, the volume had increased by approximately $2 billion. Year-over-year, the market for tokenized goods has experienced a growth of 360%. In contrast, the growth rate since the start of the year significantly outpaces that of other tokenization segments: tokenized stocks have risen by 42%, while tokenized fund shares have only increased by 3.6%.

Currently, the market capitalization of tokenized goods accounts for just over one-third of the tokenized fund market, which is valued at $17.2 billion. In comparison, the market capitalization of tokenized stocks is considerably lower, at only $538 million.

A significant portion of the tokenized goods market is comprised of gold assets. The Tether Gold (XAUt) token has made the largest contribution, with its market capitalization increasing by 51.6% over the past month to reach $3.6 billion. The PAX Gold (PAXG) token from Paxos has risen by 33.2%, reaching $2.3 billion.

The increase in tokenized gold volumes coincided with a sharp rise in the spot price of the most expensive precious metal. Over the past year, the price has surged by more than 80%, hitting a historical peak of $5600 per troy ounce on January 29. Following a correction, the price fell to $4700. As of the morning of Wednesday, February 11, gold is trading at $5080.

Analysts from the financial holding JPMorgan believe that Bitcoin, which is currently in a bearish trend, will only surpass gold in terms of investor appeal in the long term. They noted that market compression will create conditions conducive to the asset’s price growth, as its volatility has decreased to a record low level.